Lido DAO Price Forecast: LDO could rise 30% ahead of the Shanghai Upgrade

- Lido DAO price is trading with a bullish bias ahead of the Shanghai Upgrade.

- LDO could rise 30% amid the upgrade’s ‘sell the news’ event.

- A decisive break below the 50-day EMA at $2.42 could invalidate the bullish thesis.

Lido DAO price (LDO) hints at a continued uptrend as investors await the Shanghai Upgrade slated for April 12. The altcoin has been consolidating along an uptrend line that could deliver more gains for investors if maintained. Lido is a decentralized autonomous organization (DAO) that provides a liquid staking service for Ethereum 2.0. This allows users to earn staking rewards without maintaining staking infrastructure.

Lido DAO price eyes 30% gains

Given that LDO is an Ethereum layer 2 token, it is bound to benefit from the Shanghai/Capella upgrade, whose objective is to help bypass high-entry barriers such as the 32 ETH threshold, the need for technical node-operating knowledge, and the withdrawal queue. As the countdown to the upgrade continues, we expect Lido DAO price to increase courtesy of the ‘sell the news’ event.

Also Read: Ethereum Shanghai Upgrade is nearing, what to expect from ETH and LSD tokens

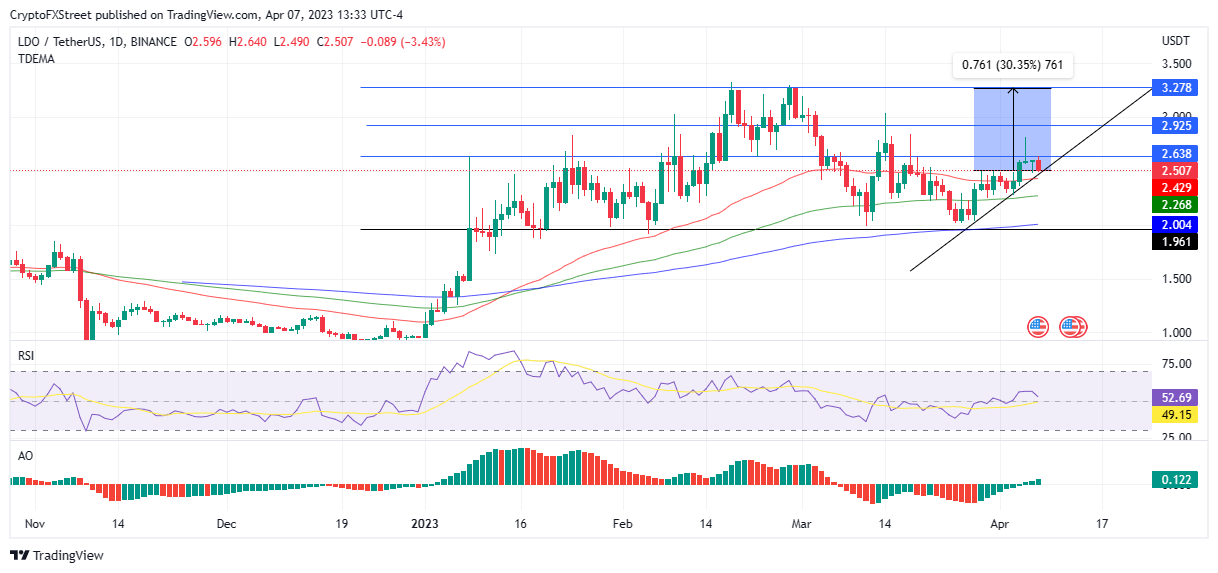

With bulls buying the rumor, the LDO market experienced increased buyer momentum. This could see Lido DAO price shatter the immediate barricade at $2.63. Further north, the altcoin could confront the next roadblock at $2.92 or tag the $3.27 resistance level in highly bullish cases. Such a move would denote a 30% ascent from the current price of $2.50.

The 50-, 100-, and 200-day Exponential Moving Averages (EMAs) at $2.42, $2.26, and $2.00 were below Lido DAO price, offering more downward support. Moreover, the Relative Strength Index (RSI) and the Awesome Oscillator were both positive, suggesting buyers were leading the market.

LDO/USDT 1-day chart

Daily active addresses increasing, Santiment shows

A giant spike in daily active addresses at the beginning of April coincided with the Lido DAO price rally, indicating growing investor interest in LDO. If the increased network activity proves sustainable over the coming days, it will deliver more gains for investors.

Conversely, if profit-taking begins, Lido DAO price could drop, losing the support due to the uptrend line before breaking below the 50-day EMA at $2.42. A daily candlestick close below this level would invalidate the bullish thesis.

An increase in selling pressure below the EMAs could deliver Lido DAO price to the February lows around $1.96, denoting a 20% decline from the current price of $2.50.

If the increased network activity proves unstainabe after the Shanghain Upgrade, it could signal an impending downward trend.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B21.28.33%2C%252007%2520Apr%2C%25202023%5D-638165003838639817.png&w=1536&q=95)