Lido DAO price failing the critical support level could trigger losses worth over $75 million

- Lido DAO price is currently trading at $1.53, inching closer to testing the $1.45 support line.

- Losing this line would push 48.9 million LDO into losses days after 73 million LDO lost their profitability.

- A further decline in LDO would, however, give a clear trend as the MVRV suggests a bounce back from the opportunity zone is likely.

Lido DAO price has been moving sideways for the past month or so, with minor increases and decreases noted every now and then. However, the lack of a clear trend has left the investors uncertain as to whether their holdings will ever become profitable or not. This clarity would come only when LDO manages to bounce back from a key support level.

Lido DAO price could fall to January 2023 level

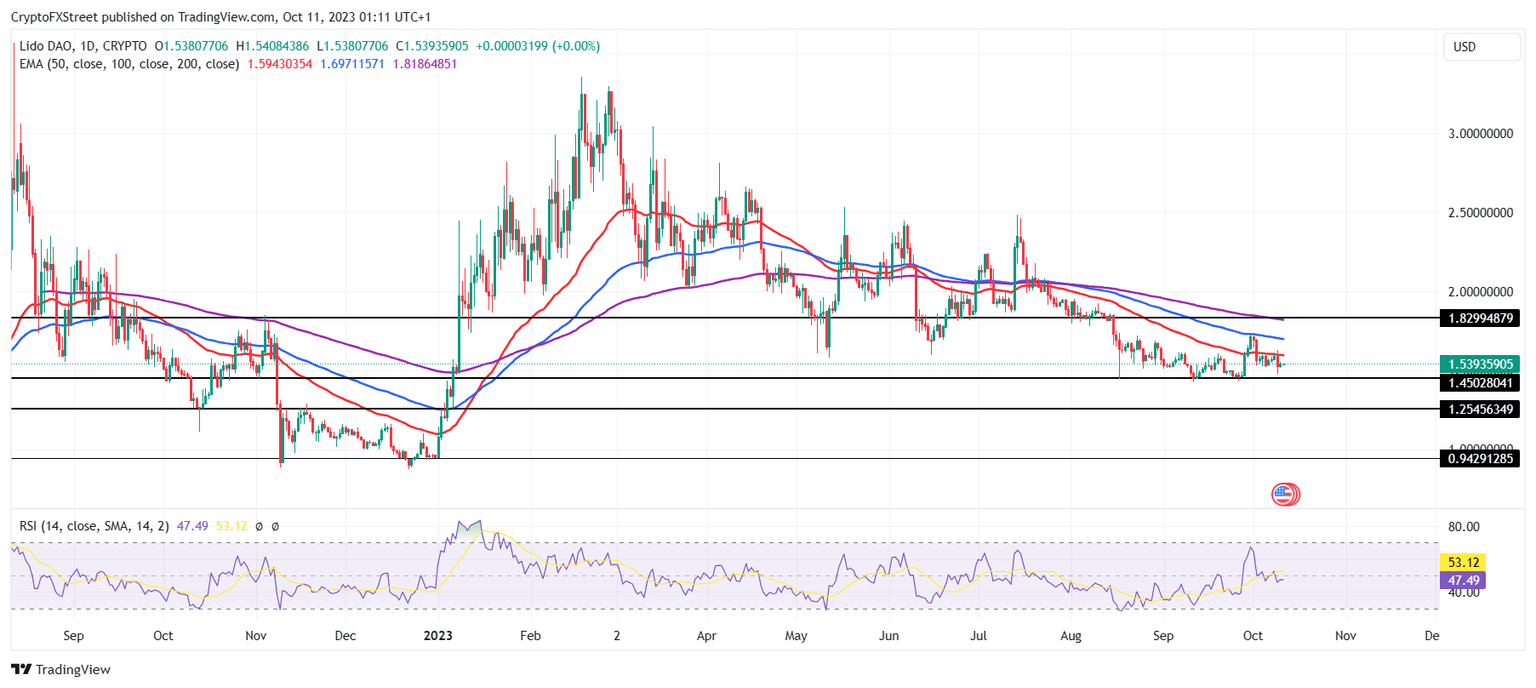

Lido DAO price trading at $1.53 failed the breach of the 50-day Exponential Moving Average (EMA) this past week and is now looking to test the critical support level marked at $1.45. This level has been holding strong for nearly a month now, and losing this could result in the altcoin falling to a nine-month low.

However, the certainty of a decline is very low, given the price action has mostly been restricted to sideways. The Relative Strength Index (RSI) is also presently hovering just below the neutral line at 50.0. If Lido DAO price loses the $1.45 support level, it would have a chance at a bounce back from $1.25, beyond which lies the 2023 low of $0.94.

LDO/USD 1-day chart

Nevertheless, the lack of bearishness also suggests that bullishness is not too unlikely either. If the 50-day EMA is breached and the neutral line of the RSI is flipped into a support floor, a recovery would be afoot. This would send Lido DAO price toward flipping the 100-day EMA into support, setting eyes on breaching the $1.82 level coinciding with the 200-day EMA.

The fate of millions of LDO

Since Lido DAO price has not recovered or crashed yet, LDO supply has been dangling somewhere in between that uncertainty. According to the Global In/Out of the Money (GIOM) indicator, which measures the profitability of the tokens by comparing the purchase price with the last moved price, about 48.89 million LDO is facing potential losses.

Purchased at an average price of $1.52, the lower band of the range stands at $1.47, above the critical support line. Thus, losing the support line would also translate to $75 million worth of LDO facing losses. As is in the past month, 73.99 million LDO worth over $113 million lost their profitability.

Lido DAO GIOM

However, a decline in price would also provide a clear trend, even if it turns out to be a downtrend. The reason why it would be good news is because it would provide an idea as to when Lido DAO price could see recovery again.

This can be achieved using the Market Value to Realized Value (MVRV) ratio. This indicator is used to assess the average profit/loss of investors who purchased an asset. The 7-day variant measures data for the past week.

In the case of LDO, the 7-day MVRV stands at -1.78%, suggesting those who bought their tokens in the past week are currently facing 1.78% losses. While the lack of profit might make it seem like the investors would sell to offset their losses, they are most likely to hold on to their LDO until the price recovers.

In fact, if the indicator hits between -5.43% and -13.19%, it would suggest that LDO is in the opportunity zone. This zone is ideal for accumulation as price historically has recovered after hitting this zone.

Lido DAO MVRV ratio

Thus, investors looking to invest in LDO should watch this development.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.41.46%2C%252011%2520Oct%2C%25202023%5D-638325824613299091.png&w=1536&q=95)