Lido DAO price could lose its 27% rally as whales sell a third of their 60 million LDO accumulation

- Lido DAO price has gained significantly in the past seven days, reaching a two-month high of $1.86.

- Lido is also improving on the DeFi front, with the total value locked on the protocol hitting a 17-month high.

- LDO whales have sold more than 20 million LDO in the last eight days to book profits, which could translate to a decline for the altcoin.

Lido DAO price has capitalized on the Bitcoin rally to bring significant gains to its investors. However, one particular cohort might have enjoyed the profits a bit too much as they are making a move in the direction that could undo the increase witnessed by LDO in the past few days.

Lido DAO price under threat

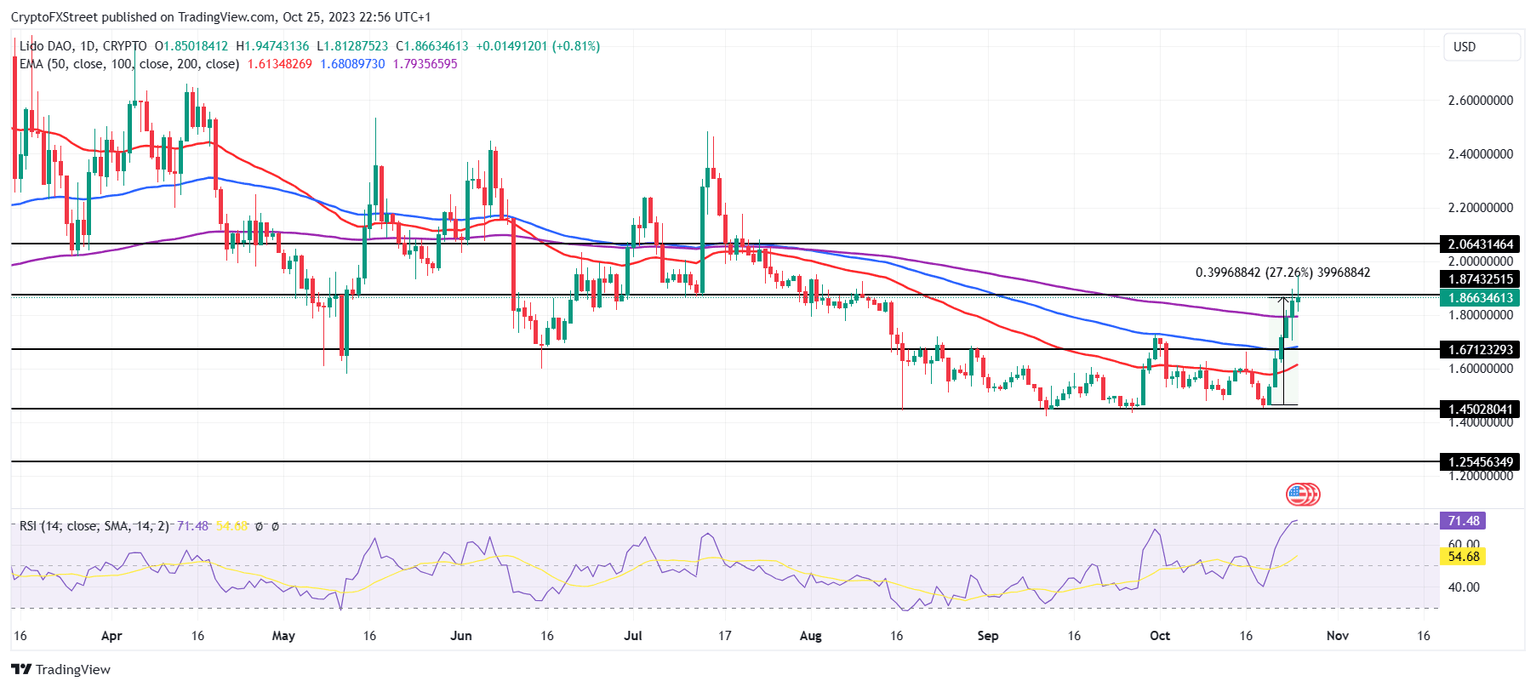

Lido DAO price, at the time of writing, could be seen hovering under the $1.87 barrier, changing hands at $1.86. The altcoin has risen by more than 27.26% in the last seven days, which has been significant enough to push the cryptocurrency to a two-month high. However, LDO still needs a little more push in order to flip the aforementioned barrier into a support floor.

However, the chances of this happening are unlikely. Lido DAO price is more prone to failing the breach and falling back down towards $1.67. It has already failed to sustain the rise witnessed during the intra-day high successfully. Adding to this is the observation on the Relative Strength Index (RSI), which shows that LDO is presently overbought.

Although there are instances when assets continue to rally despite being overbought, other on-chain factors suggest that Lido DAO may not be one of those assets. But there is a chance that it might bounce back from $1.67 as losing it could send it toward September lows of $1.45.

LDO/USD 1-day chart

Nevertheless, given that the Bitcoin price is trading above the $34,500 mark, LDO might be able to breach the barrier of $1.87 and defeat the possibility of a bearish outcome. It has the support of the 200-day Exponential Moving Average (EMA), flipping $1.87 into a support floor would invalidate the bearish thesis and push Lido DAO price beyond $2.00.

Whales may hinder LDO’s rise

While the attitude of never say never certainly is the mantra to success in the crypto space, it doesn't necessarily connote a likely bearish outcome wouldn't betide. The reason behind this is the on-chain performance of a key group of investors - the whales.

LDO whales comprise the addresses holding between 1 million and 10 million LDO, which have been a significant contributor to the recent rally. Lido DAO price has exhibited a tendency to react according to these addresses' actions in the past - rising when whales accumulate and falling when they sell.

This behavior is verified by the fact that the Lido DAO price rallied not much later after this cohort purchased 60 million LDO in the span of 20 days. Their holding increased from 264 million LDO to 323 million LDO, but as price rallied, this supply began declining.

In the span of eight days, these addresses have dumped about a third of the total LDO they accumulated. These 20 million LDO valued at about $37.5 million have been sold for profit, and this selling could undo the rise noted by Lido DAO price.

Lido DAO whale accumulation

Not only this, the selling and eventual probable price fall would also impact Lido DAO on the DeFi front. Consequently, the protocol could lose a chunk of the total value locked (TVL) on the platform, which recently hit a 17-month high of $15.84 billion.

Lido DAO TVL

Thus, despite being the native token of the biggest Decentralized Finance (DeFi) protocol in the world, even the Lido DAO price is not safe from the actions of the whales.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B03.35.14%2C%252026%2520Oct%2C%25202023%5D-638338714804325168.png&w=1536&q=95)