Lido DAO could begin its recovery as staking yield of stETH hits historical high

- The recent surge of meme coins has pushed the staking yield of stETH to a record high.

- The current Annual Percentage Rate (APR) of staked Ether is at 8%.

- LDO price nosedived 15% over the past week, but a bullish catalyst could fuel a recovery.

Lido Finance, a liquid staking solution for Ethereum, currently offers the highest staking yield on stETH, a record high of 8%. The spike in the staking yield of Ether tokens is attributable to the recent surge in popularity of meme coins, according to a data panel.

Yield of staked Ether climbs to 8%

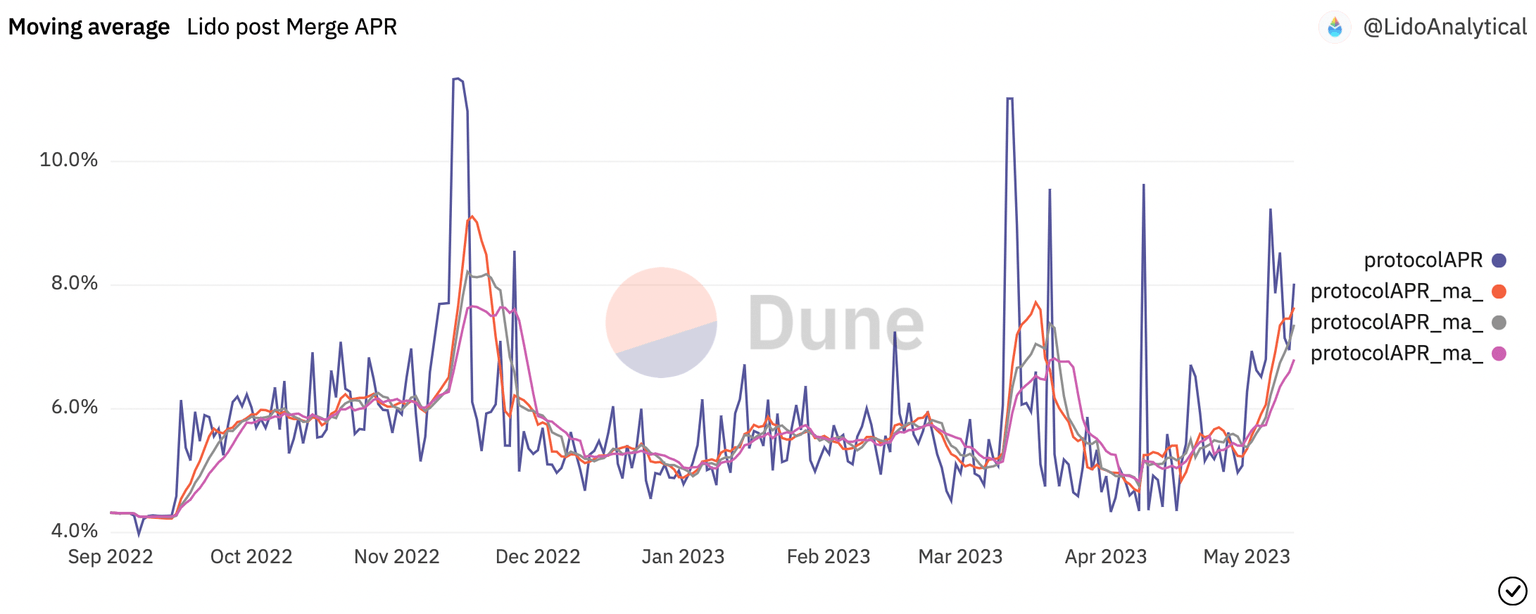

Based on data from Lido Finance’s analytics on Dune.com, the spike in meme coins has fueled a surge in activity on the blockchain. This rise in on-chain activity has caused an increase of the staking yield of stETH, which reached a record high of 8%.

Moving average of Lido post Merge APR from Dune Analytics

Staking yield is considered key to Lido’s utility and relevance in the crypto ecosystem as it involves traders staking their ETH for stETH, the staked Ether token, on Lido Finance.

Lido’s native token LDO experienced a 15% price decline between May 5 and May 12. This record high staking yield, however, could be a bullish catalyst for LDO.

LDO price gears up for recovery

Lido DAO (LDO) price is in an upward trend that started in July 2022. LDO price is below the three long-term Exponential Moving Averages (EMAs), 10, 50 and 200-day at $1.82, $2.13 and $2.03, respectively.

The Fibonacci extension from July 2022 to mid-Fed 2023 has laid out key support and resistance levels for LDO price. LDO needs to hold above support at 61.8% Fibonacci level at $1.57 to sustain its uptrend. A decline below this level could invalidate the bullish thesis.

LDO/USD one-day price chart

Immediate resistances for LDO in its recovery are the 50% Fibonacci level at $1.92, three EMAs at $1.82, $2.13 and $2.03, as well as the $2.09 level that acted as support throughout 2023.

In the event that LDO price deteriorates further, the 78.6% Fibonacci level at $1.07 could act as key support for the token.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.