Lido could use ARB airdrop to incentivize liquidity providers in wstETH pools on Arbitrum via DAO vote

- Lido is considering a new proposal to use its ARB airdrop to enhance activity on Arbitrum.

- The proposal would see Lido accept its $1.2 million in ARB tokens and reward them to liquidity providers in wstETH pools.

- It could go to a vote later this week, and the result will have a bearing on LDO and ARB prices.

The Lido DAO community is set to vote on operational and strategic topics concerning how to claim and make valuable use of ARB tokens. More specifically, the vote will determine whether to accept Arbitrum’s airdrop and if the claimed ARB tokens could serve as emission rewards for incentivizing the adoption of wrapped staked Ether (wstETH) across the Arbitrum network.

In response to this airdrop, the Lido DAO rewards committee puts forward the following proposal. This proposal covers operational and strategic topics related to claiming and making productive use of the potential ARB tokens. This proposal will enable the rewards committee to pursue the continued growth of staking and the wstETH DeFi ecosystem on Arbitrum One (and beyond).

Lido’s Operational and strategic topics

Justin David Reyes, Lido’s head of decentralized finance (DeFi) business development and partnerships, submitted the proposal that precedes the vote on April 12. In his submission, Reyes suggested that liquidity providers (LPs) for the wstETH pools on Arbitrum be rewarded with ARB tokens.

According to marketing lead Kasper Rasmussen, the incentives program would operate similarly to how liquidity pools currently earn extra LDO rewards in addition to staking rewards, adding that the vote could take place within the week.

Lido to claim hundreds of thousands of ARB tokens

The deliberation comes almost a month after Arbitrum’s airdrop for its governance token, ARB, went live. The launch saw early adopters of the layer 2 (L2) scaling solution enjoy lucrative rewards, including some decentralized autonomous organizations (DAO) such as Lido, which played an enabling role in the growth and success of Arbitrum.

As a component of that airdrop, the Arbitrum Foundation has expressed that they are allocating a portion of the governance, via the ARB governance token, to communities that have played a role in the growth and health of the Arbitrum ecosystem.

A Google doc within Arbitrum Foundation’s governance documents reveals that Lido is entitled to claim up to 772,621 ARB tokens, translating to over $1.2 million at prevailing rates. Further, the proposal notes that 33,400 wrapped staked Ether has already been bridged to the Arbitrum ecosystem, with the cumulative number of wstETH transactions on Arbitrum now reaching over one million.

Based on the governance documentation, there are no specific conditions on the distribution of the said tokens, which leaves it in the hands of the Lido DAO network to determine how best to use the tokens in participating in the governance and growth of the Arbitrum ecosystem.

Possible impact of vote outcome on LDO and ARB prices

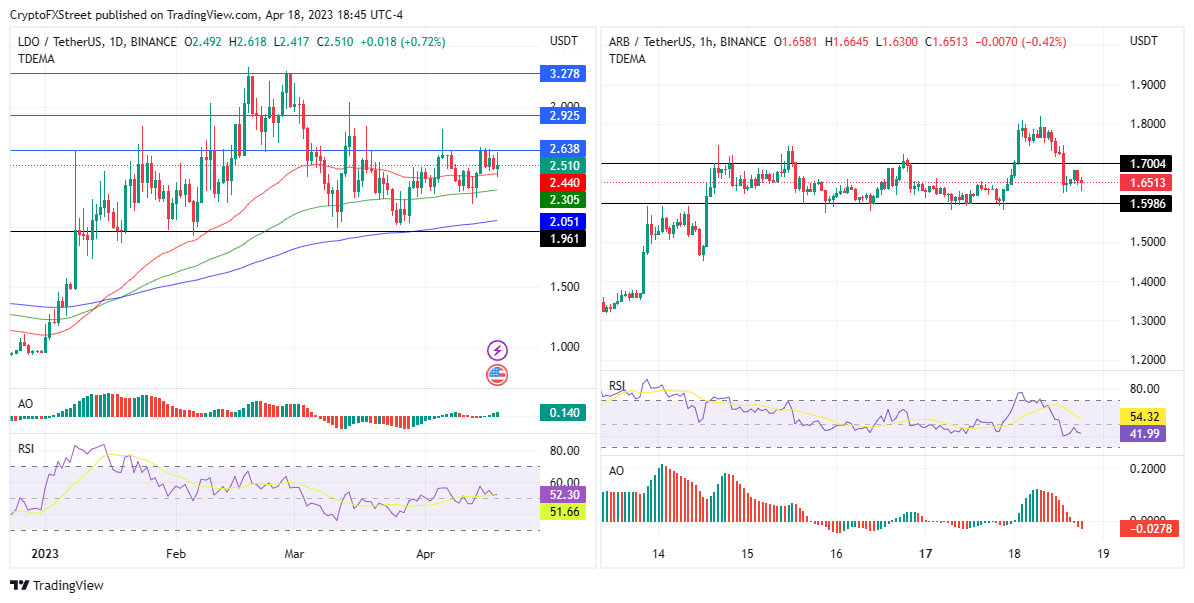

Meanwhile, Lido price (LDO) and Arbitrum price (ARB) are still experiencing a lack of directional bias and have been consolidating under formidable zones for weeks.

The outcome of the vote could catalyze a possible breakout for both Layer 2 tokens. For Lido price, a positive outcome could see LDO breach the immediate barricade at $2.63 and clear the path for a potential climb of around 15% to the next roadblock of around $2.92. The L2 token could tag the $3.27 hurdle in a highly bullish case, denoting a 30% upswing.

Regarding Arbitrum price, passing the proposal could restore ARBabove the $1.70 resistance level, paving the way for the altcoin to reclaim its local high of around $1.80. Such a move would constitute an uptick of about 10% from current levels.

LDO/USDT 1-day chart, ARB/USDT 1-day chart

Conversely, failure to pass the proposal could see Lido price drop toward the $1.96 swing low before a possible pullback. On the other hand, Arbitrum price could lose the critical support at $1.59, exposing the L2 token to a cliff that could send ARB down around 10% to $1.50.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.