Leveraged MicroStrategy markets showcase risk-on like never before as Bitcoin aims for six-digit price

-

Options tied to Defiance's 2X long MicroStrategy ETF (MSTX) exhibit extreme bullish positioning.

-

The leveraged ETF is designed to two times or 200% of the daily performance of MSTR's share price.

The crypto market right now is like a roller coaster racing ahead and then adding a few extra loops for good measure, pushing the thrill and risk to new heights.

With Bitcoin (BTC) on the run toward the $100,000 mark, traders are using options tied to an already leveraged 2x long exchange-traded fund (ETF) tied to bitcoin holder MicroStrategy's share price to amplify gains.

The Defiance Daily Target 2X Long MSTR ETF, trading under the ticker MSTX on Nasdaq, seeks to deliver two times or 200% of the daily performance of MSTR's share price. The ETF surged 20%, briefly topping $180 on Tuesday, as MSTR jumped 10% to $473.

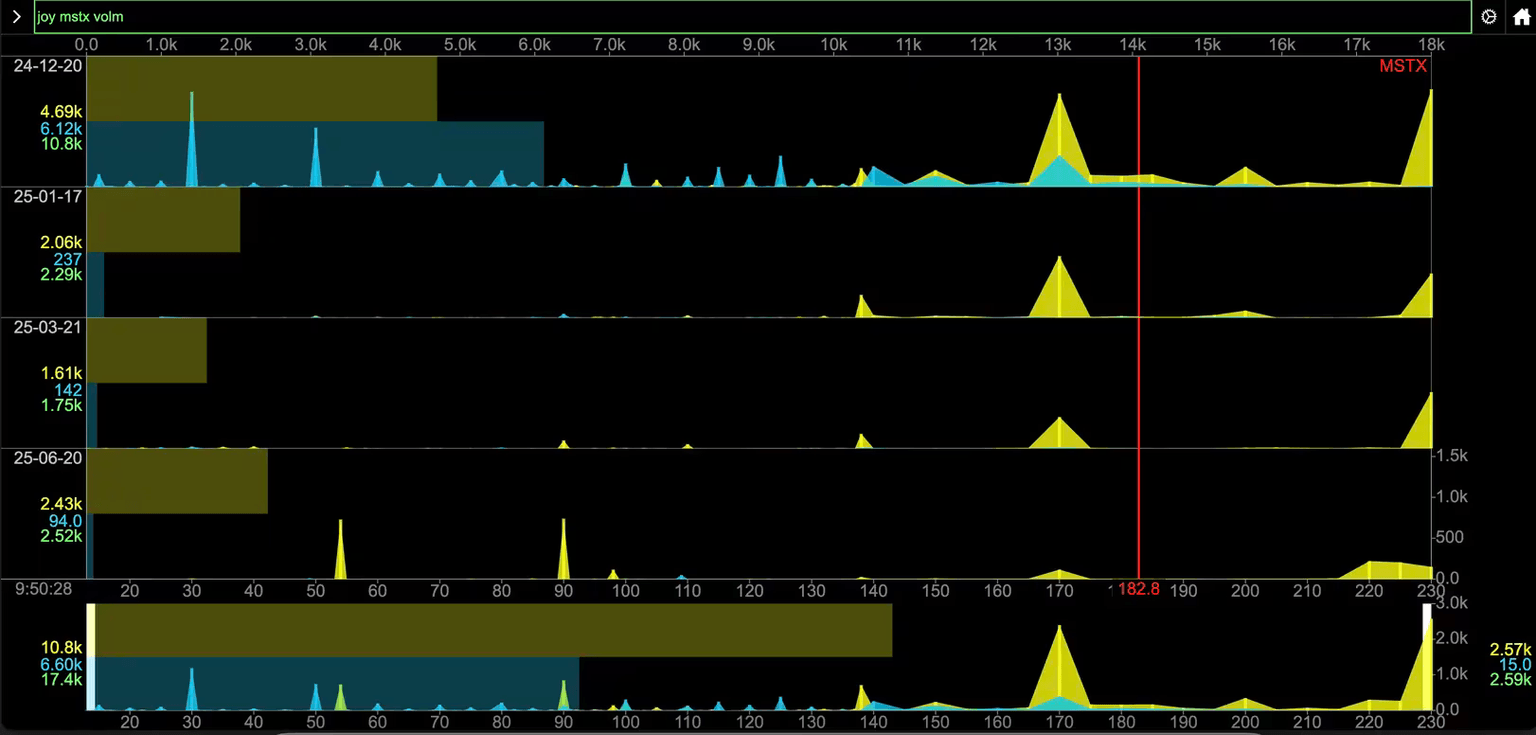

Meanwhile, trading volumes in options tied to the ETF blew up, with market participants piling into the deep out-of-the-money (OTM) higher strike call option at $230, according to data tracked by analytics platform ConvexValue. Deep OTM calls are cheaper than those near the going market rate of the underlying asset, offering an asymmetric payout potential.

MSTX's options volume profile . (ConvexValue) (Convex Value)

The demand for the $230 strike call was spread across multiple expiries, including contracts set to settle on June 20, 2025. A call option gives the purchaser the right but not obligation to buy the underlying asset at a predetermined price on or before a specific date. The option allows the buyer to control a large position in the underlying asset while paying a small premium upfront, thereby amplifying potential gains.

The extreme bullish sentiment is consistent with the MSTR options market, where calls recently traded at a record premium relative to puts usually used to protect against price slides, according to data source Market Chameleon. Similar uber bullish flows have been crossing the tape on the CME, Deribit and the nascent options tied to BlackRock's spot bitcoin ETF, hinting at retail investor mania and build up of speculative excesses that often lead to market corrections.

The frenzied action comes as expectations for friendlier regulatory approach under President-elect Donald Trump and Fed rate cuts drive BTC higher. The leading cryptocurrency by market value set new lifetime highs above $97,000 early Thursday, taking the month-to-date gain to 38%, CoinDesk data show.

MSTR is the world's largest public-listed BTC holder with a coin stash of 331,200 ($3.04 billion) steadily accumulated since 2020.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.