LDO sees lowest cumulative volume in ten months as Lido DAO price struggles to breach key barrier

- Lido DAO price noted an 8.78% hike in the past 24 hours, making it the highest single-day rise in over two months.

- LDO transaction volume hit the lowest point in nine months this past week, making the month’s cumulative volume the worst since December 2022.

- The altcoin’s correlation with Bitcoin on a monthly basis is positive, which might hold a positive impact on the price action.

Lido DAO price is up over the past day as the market shifted its stance despite the SEC announcing a delay in the spot Bitcoin ETF applications of BlackRock among other applicants. However, this one-day rise is not enough for the likes of LDO that have been failing in recovering for a few weeks now.

Lido DAO price needs support

Lido DAO price is presently at $1.59 after observing a nearly 9% increase in the last 24 hours. The altcoin bounced off the critical support line at $1.46 but stopped rising after hitting the 50-day Exponential Moving Average (EMA). Breaching this barrier is important for the altcoin to establish a rally going forward.

The Moving Average Convergence Divergence (MACD) indicator suggests that a bullish play might be on the cards for LDO. The indicator nearly avoided a bearish crossover, and the rising green bars on the histogram hint at Lido DAO price having an opportunity to post further gains.

LDO/USD 1-day chart

The key resistance level for LDO is marked at $1.82, and breaching it would help investors recover nearly two months' worth of losses and reignite a bullish momentum. However, losing the critical support level of $1.46 could invalidate the bullish thesis, resulting in a potential decline to $0.94.

Investors are not exhibiting optimism

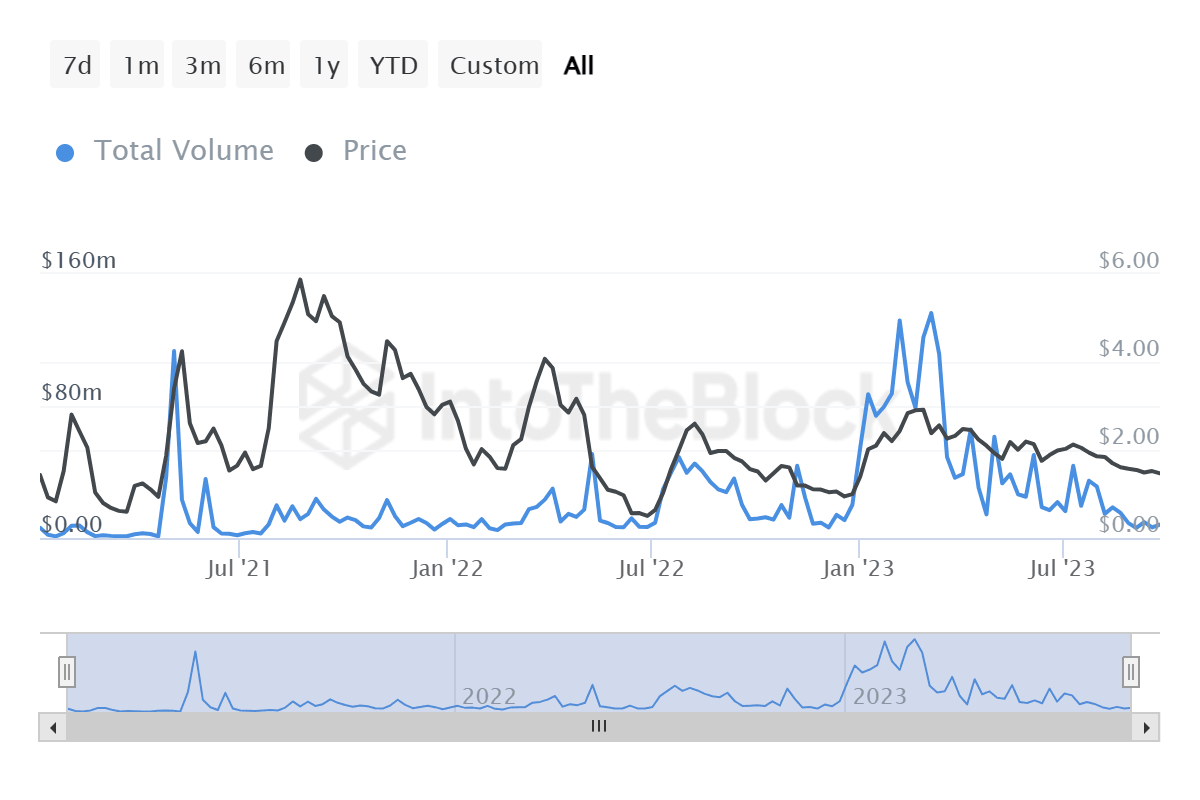

LDO holders have toned down their bullishness for the cryptocurrency rather evidently. The transaction volume conducted over the last couple of weeks has been the lowest witnessed in a while. The transaction volume hit a low of about $6 million in this month. This added to the entire month’s cumulative volume, which is the most disappointing figure since December 2022.

Lido Transaction volume

A lack of transaction volume signifies waning optimism, which can lead to the investors pulling back and sitting idle, waiting on profits. This impacts the flow of tokens, resulting in price fluctuation that can even wipe away any recovery noted.

However, Lido DAO price does have some support from the market as it shares a positive correlation with Bitcoin. Albeit not too high, at 0.42, LDO might benefit from a positive move by BTC as it did in the last 24 hours.

Lido DAO correlation with Bitcoin

This correlation might drive Lido DAO price higher, provided it also finds support from its investors.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.