Layer-2 scaling platform Optimism to upgrade its main network in June

- Optimism network is planning a Mainnet Bedrock upgrade on June 6.

- The upgrade will improve the security and resilience of the OP Mainnet Bridge while significantly cutting fees.

- While the work requires 2-4 hours of downtime, it could serve as a bullish catalyst for OP in the near term.

Optimism, one of the Layer-2 (L2) scaling solutions for the Ethereum blockchain, has started the countdown to June 6, when the major upgrade to its mainnet, christened Bedrock, will occur.

The official date of OP Mainnet’s upgrade to Bedrock has been set: June 6, 2023 at 16:00 UTC!

— Optimism (✨_✨) (@optimismFND) May 15, 2023

The upgrade will require 2-4 hours of downtime for OP Mainnet.

Visit Mission Control for full details on what to expect:https://t.co/o6UjKZaVKy

The upgrade is expected to make it easy to contribute toward client diversity. Among the early proofs of these include a16zcrypto, Magi, and testinprod_io.

Optimism Bedrock upgrade

The news about Optimism's scheduled upgrade was first revealed earlier in the year. The initial date was March, touting the development would "improve the network performance and Ethereum compatibility."

The Bedrock upgrade will introduce a new two-step withdrawal process to the Optimism Mainnet bridge that will improve its security & make exploits much more difficult

— OP Labs (@OPLabsPBC) March 22, 2023

One of the architects of two-step withdrawals, @vex_0x, explains how⬇️https://t.co/qs6Dtsz2nO

From the report, the upgrade will cause some downtime spanning two to four hours. During this time, transactions, including deposits and withdrawals, will be unavailable.

On upgrade day, transactions, deposits, and withdrawals will be unavailable for the duration of the downtime, and the OP Mainnet chain will not be progressing.

— Optimism (✨_✨) (@optimismFND) May 15, 2023

The news comes as the network plans to "improve the security and resilience of the OP Mainnet bridge" while at the same time reducing fees by a significant margin. The upgrade is designed with the most minimal diff on Ethereum possible. In summary, the announcement concludes:

Ethereum equivalence + minimized complexity = less room for bugs, easier for ecosystem developers to contribute.

According to the foundation, more information will be communicated through the mission control website, with one of the main design goals for the upgrade being backward compatibility.

Optimism Foundation doubles down on rollups

The Optimism Foundation has invited node operators to "spin up a brand new node deployment for Bedrock." The network leverages optimistic rollups, a technology that enables bundling multiple transactions. These transactions are then recorded on the Ethereum blockchain within a single transaction.

Based on DeFiLlama data, the Optimism network boasts around $863 million of locked assets on the platform.

Optimism price could rally on this news

Optimism (OP) prices could rally around this network development, playing the "buy the rumor, sell the news" tune. Further, amid a burgeoning FUD across the crypto sphere, such bullish fundamentals have proven to have a bearing in driving crypto prices in the past.

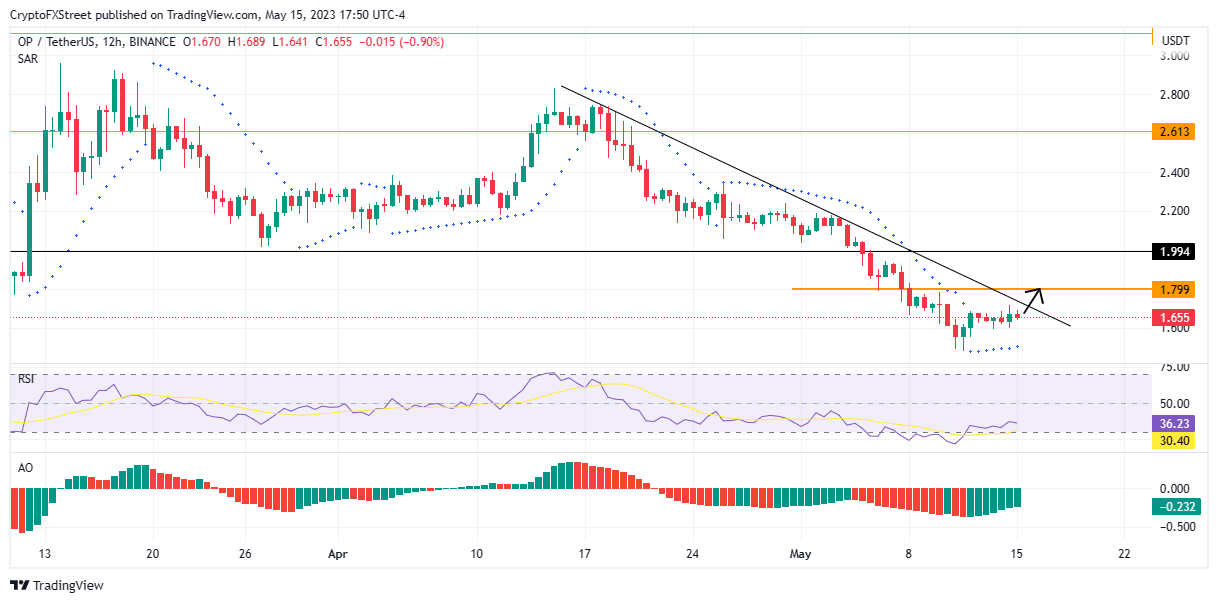

At the time of writing, OP is exchanging hands at $1.645, a daily rise of 1.6%. Similarly, the token recorded a 24-hour trading volume increase of 30%, indicating investor interest in the L2 token. Increasing buyer momentum could push Optimism price above the downtrend line to escape the descending trajectory. A decisive candlestick close above the $1.79 resistance level would invalidate the rally south.

The position of the Parabolic SAR below the Optimism price added credence to the bullish thesis after it flipped bullish when it turned below the OP price on May 12. As long as this trend-following indicator remains below Optimism price, the price should increase.

Also, note that the Awesome Oscillator (AO) had flipped green and moved toward the midline. The upward trajectory for the Optimism price will gain momentum once the OA crosses the neutral line into the positive region.

OP/USDT 12-hour chart

Conversely, the token could drop further by consolidating below the downtrend line. Such a move could see investors lose more money as Optimism price retraces to lower lows.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.