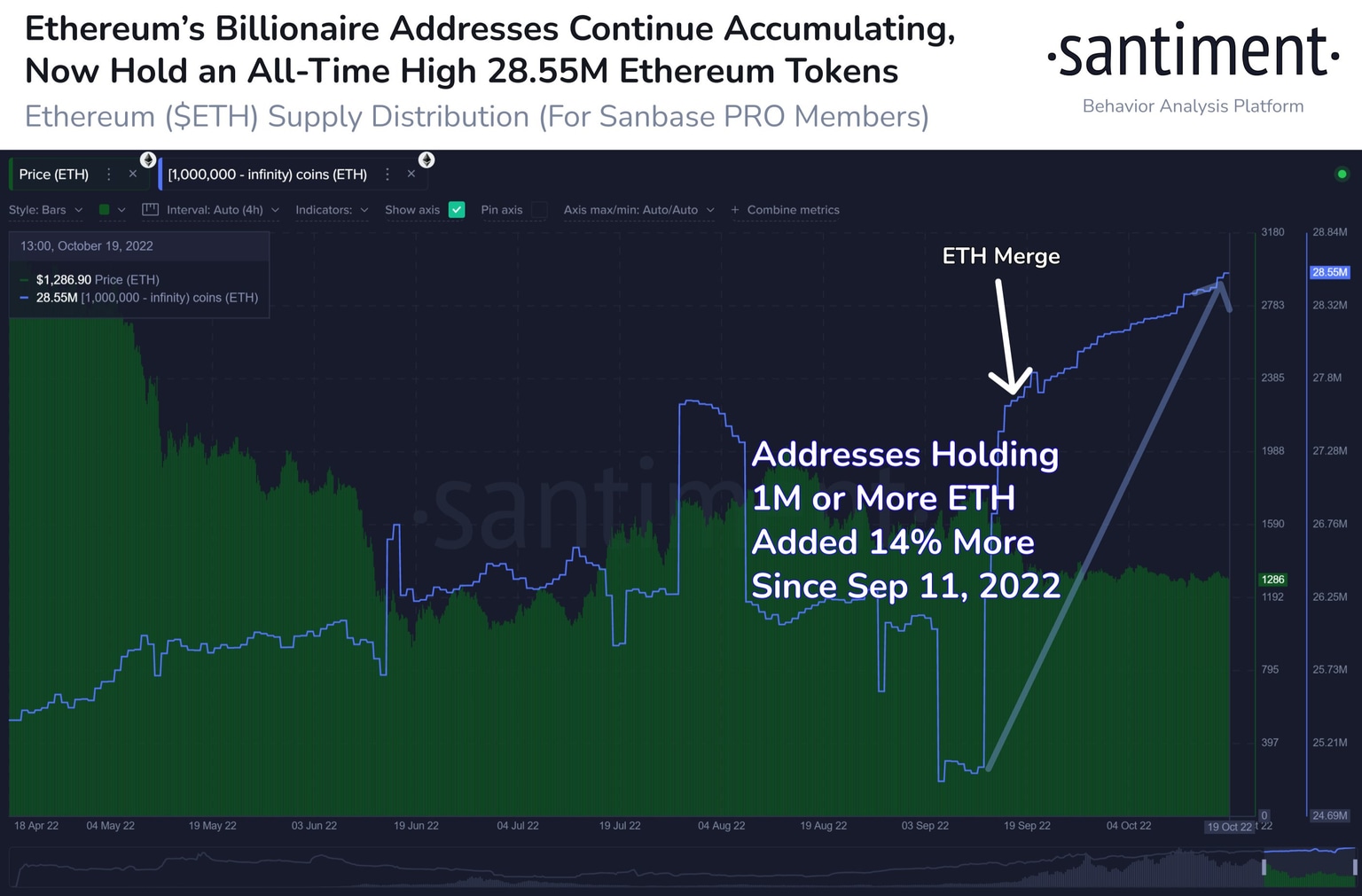

Large Ethereum whales gobble 3.5 million ETH, holdings hit new all-time high

- Large wallet investors in the Ethereum blockchain have scooped up 3.5 million ETH to add to their holdings of 28.55 million.

- Whales have continued their accumulation of the second largest cryptocurrency by market capitalization based on data from Santiment.

- Analysts believe Ethereum price is in the buying zone close to the $1,300 level.

Large wallet investors on the Ethereum network have scooped up large quantities of the altcoin. Over the past month, whales holding one million or more ETH collectively accumulated 3.5 million more Ethereum.

Also read: Bitcoin, Binance Coin, XRP and Cardano prepare for November rally, traders in euphoria

Ethereum whales accumulate ETH in frenzy

Based on data from crypto intelligence tracker Santiment, Ethereum whale addresses have started accumulating ETH since September 11. Large wallet addresses that hold one million or more Ethereum have collectively added 3.5 million more ETH to their portfolio. There are currently 132 such addresses.

The latest round of Ethereum accumulation marks a 14% increase in Ethereum holdings of whales with a billion dollar portfolio. The cumulative holdings of whale wallets has hit an all-time high balance of 28.55 million ETH, approximately $36 billion at the time of writing.

Ethereum whales are accumulating ETH

Santiment previously reported that Ethereum sharks and whales, addresses that hold between 100 and 1 million ETH tokens have been selling off their holdings. The redistribution trend started shortly after the Merge, Ethereum’s transition from proof-of-work to proof-of-stake. However, analysts were bullish on ETH despite its sharp decline post Merge and the altcoin has made a comeback above the $1,200 level.

Ethereum’s price has remained largely unchanged over the past thirty days. Redistribution trends and accumulation by whales is typically considered a bullish signal for an asset. Another key indicator, the network’s performance in fee-generation has hit a one month high. These factors are likely to drive the asset’s price higher.

Analysts believe Ethereum is in the accumulation phase

Analysts evaluated the Ethereum price trend and predicted that the asset is in the accumulation phase close to the $1,300 level. Ethereum is in the “buy zone” while recovering from its downtrend and BitQueen, a pseudonymous crypto analyst believes this is the ideal time to scoop up ETH tokens.

ETH-USD price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.