Justin Sun rushes to Curve’s aid, buys 5 million CRV tokens announcing TRON partnership with CRV

- Curve Finance’s total value of assets locked was slashed by half over the past month after mass withdrawals that followed the $70 million exploit.

- TRON’s founder Justin Sun bought 5 million CRV tokens from Curve CEO Michael Egorov in a likely OTC deal, at an average price of $0.4.

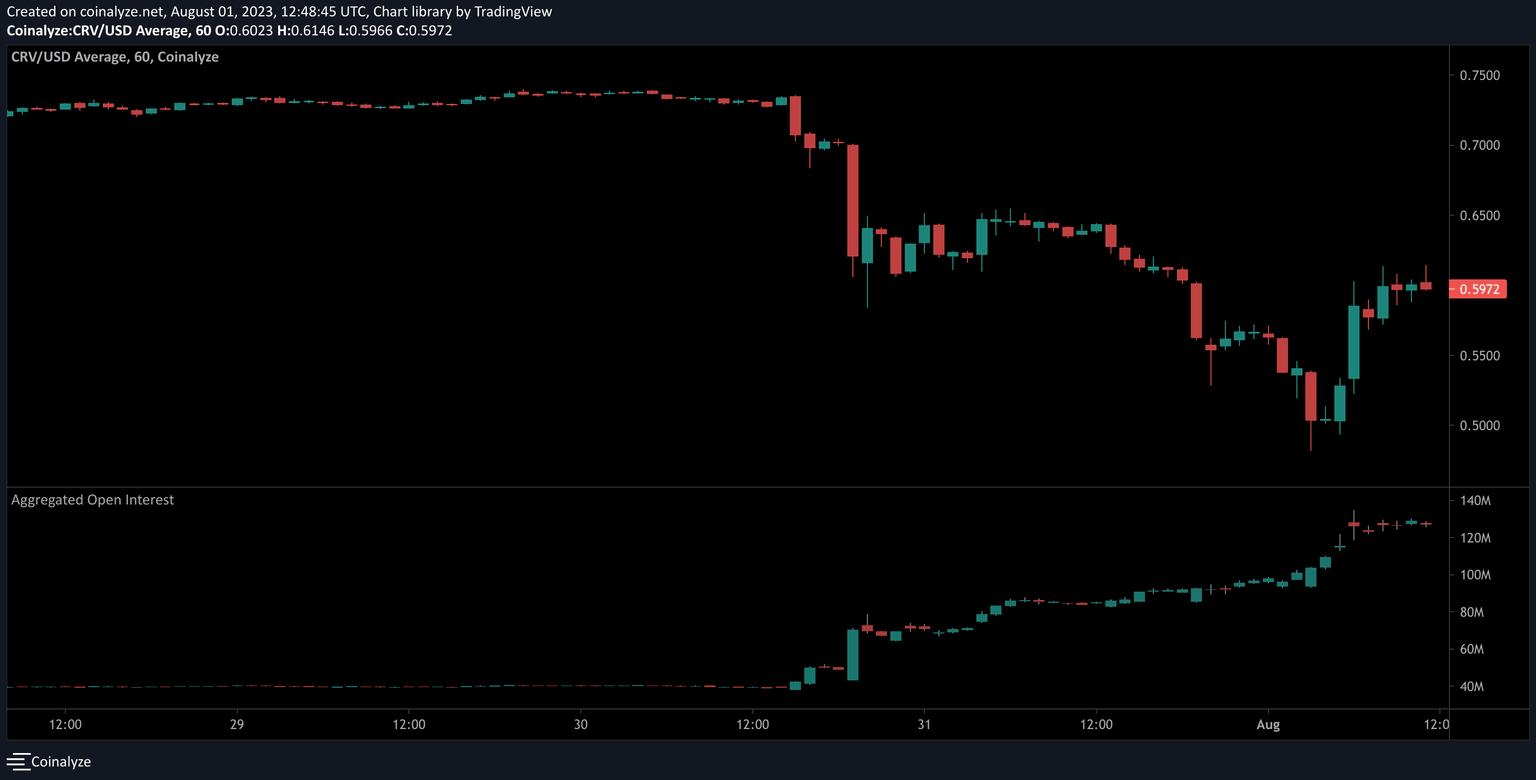

- Sun announced a partnership between TRON and CRV on stUSDT, while Coinalyze data reveals traders are lining up to short Curve tokens.

Justin Sun informed the TRON community of the latest partnership with CRV. Curve has been struggling since its $70 million exploit. CEO Michael Egorov’s $168 million in CRV holdings, nearly 34% of CRV token’s market cap, was at risk of liquidation before the founder started finalizing Over The Counter (OTC) deals and partnerships in the ecosystem.

A forced liquidation could have stressed CRV price further, at a time when a large volume of traders are looking to short the token, anticipating price declines in the future.

Also read: BALD rug pull wipes out 90% of value, hitting Base DEX LeetSwap: A timeline of events

Justin Sun’s TRON partners with Curve CRV on stUSDT

TRON founder, Justin Sun, informed the community of his partnership with Curve on stUSDT. On July 4, TRON ecosystem launched stUSDT, similar to Ethereum’s stETH on the Lido protocol. The token is a decentralized asset that serves as a proof of investment in real-world assets and holders can generate passive income through the use of stUSDT.

Excited to assist Curve! As steadfast partners, we remain committed to providing support whenever needed. Our joint efforts will introduce an @stusdt pool on Curve, amplifying user benefits. Together, we aim to empower the community and forge a decentralized finance!

— H.E. Justin Sun 孙宇晨 (@justinsuntron) August 1, 2023

Sun told the community that as partners, TRON and CRV will remain committed to amplifying user benefits on the stUSDT pool on Curve. The development comes after on-chain analytics trackers Lookonchain and Peck Shield identified a sale of 5 million CRV tokens to Sun. Sun likely scooped up the CRV tokens in an OTC deal, buying at an average price of $0.40, from founder Michael Egorov.

Curve CEO sells 5 million CRV tokens to TRON’s Justin Sun

Sun’s partnerships came to CRV’s aid and founder Michael Egorov has been spotted putting out fires all day, according to on-chain data.

CRV price faces risk of decline, CEO attempts to fight mass liquidation

CRV price has faced a consistent decline in its price since the $70 million exploit. Find more details about it here. The total value of assets locked in the Curve Finance protocol is slashed in half, from $4.39 billion on July 2 to $2.08 billion on August 1. These statistics are based on DefiLlama data, as seen below.

Curve Finance Total value of assets locked in the protocol

Curve has been stressed since the exploit and CRV price dropped 44.6% from $0.876 on July 14 to $0.485 early on Tuesday. At the time of writing, CRV price has recovered to $0.603 on Binance. Amid the turbulence in CRV, the founder tried to stabilize his DeFi position worth $168 million that is at risk if CRV price drops heavily, specifically to $0.372.

CRV liquidations at $0.372

As seen in the chart above, 303.8 million CRV tokens are likely to suffer liquidation if the DeFi token’s price drops to $0.372. In an effort to fight the liquidation, Egorov made several key transfers recorded on-chain. The CRV founder paid 5.13 million FRAX stablecoin loan and reclaimed 12.5 million CRV tokens as collateral. The founder then moved the 12.5 million reclaimed CRV from Fraxlend to a fresh wallet.

CRV transfers by wallet identified as Egorov

Egorov also received several USDT transfers, these are likely related to the OTC sales of CRV token. Sandra, on-chain analyst at Nansen, identified several CRV transfers, listing them in a recent tweet:

The Curve OTC War updates:

— Sandra (@sandraaleow) August 1, 2023

17.5M CRV to 0xf51

5M CRV to Justin Sun

4.25M CRV to DCFGod

2.5M CRV to Ox4d3

2.5M CRV to DWF Labs

2.5M CRV to Cream: Multisig

1.25M CRV to 0xcb5

3.75M CRV to machibigbrother.eth

250k CRV to 0x9bf

Based on data from Coinalyze, Open Interest (OI) in CRV climbed 50% within the past 24 hours.

CRV/USD price chart and open interest

According to the chart above, OI is currently $127.23 million. The funding rate is negative across all derivatives exchanges, signaling traders are willing to pay to keep short positions open, anticipating further losses in CRV price.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.