Bitcoin futures curve was in backwardation for most of 2018, a year when BTC lost 74% of its value, JPMorgan noted.

JPMorgan’s cryptocurrency market analysts have pointed to the difference between Bitcoin’s (BTC) spot prices and BTC futures prices as a potential bearish sign for the market.

In a Thursday note to clients, JPMorgan analysts led by global market strategist Nikolaos Panigirtzoglou wrote that the Bitcoin market has returned to backwardation — a situation when the spot price is above futures prices. The analysts said that the past month's correction in crypto markets saw Bitcoin futures reversing into backwardation for the first time since 2018.

According to the strategists, Bitcoin futures backwardation should be viewed as a negative sign for BTC price despite a major rebound on the market over the past two days, with Bitcoin hitting $37,500 on Thursday. The analysts stressed that the Bitcoin futures curve was in backwardation for most of 2018, a year when Bitcoin dropped 74% after hitting its then-historic high of $20,000 in late 2017:

“We believe that the return to backwardation in recent weeks has been a negative signal pointing to a bear market [...] In our opinion the shift in Bitcoin futures into backwardation is a bearish signal echoing 2018.”

In the latest analysis, JPMorgan specifically looked at a 21-day moving average of the second Bitcoin futures spread over spot prices. The analysts observed an “unusual development and a reflection of how weak Bitcoin demand is at the moment from institutional investors” who trade futures contracts on the Chicago Mercantile Exchange.

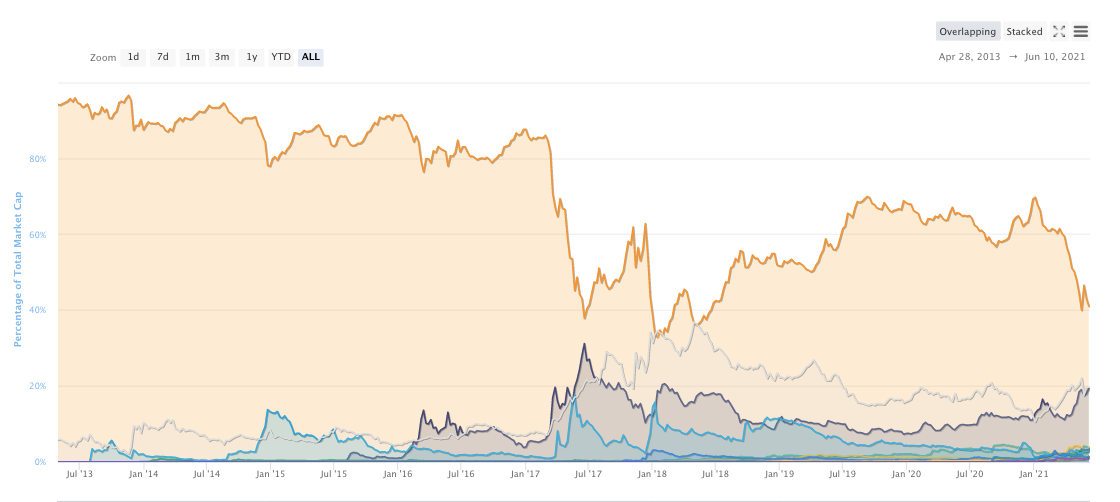

The analysts also noted that Bitcoin’s weakened share in the total crypto market value is another concerning trend. As previously reported by Cointelegraph, Bitcoin dominance on crypto markets tanked to 40% in late May, marking the lowest share over the past three years after surging above 70% this January.

At the time of writing, Bitcoin’s share in the total crypto market capitalization is 43%, accounting for $682 billion out of the total crypto market value of $1.6 trillion, according to data from CoinMarketCap. Some analysts like crypto index provider Stack Funds believe that BTC dominance could retest its previous highs in the short term.

Bitcoin dominance percentage all-time chart. Source: CoinMarketCap

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.