JP Morgan's SEC approved cryptocurrency product could function as a Bitcoin ETF

- JP Morgan's new product contains a basket of unequally weighted stocks directly or indirectly related to cryptocurrency.

- Investors wishing to invest in the high-risk crypto market can do so, especially with an ETF still unapproved.

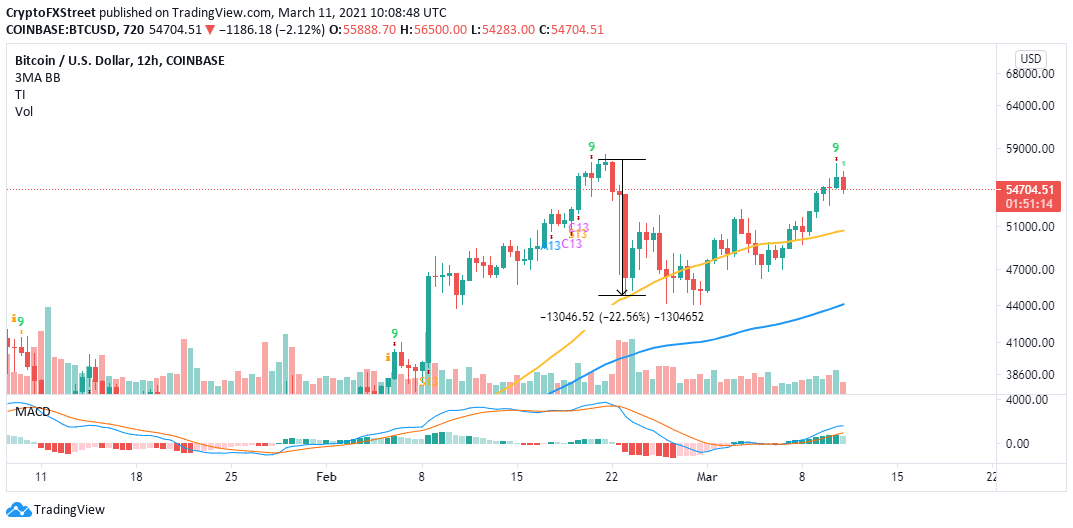

- Bitcoin rejected from highs close to $58,000, culminating in losses toward $54,000.

The Securities and Exchange Commission (SEC) in the United States has given the go-ahead to JP Morgan to launch a Bitcoin exposure basket. The new product will work as a getaway for clients wishing to participate in virtual currency trading indirectly.

JP Morgan's basket of weighted stocks

The new product is a structured note offering tagged to a basket of stocks that, in turn, are related to the digital assets. According to the SEC, the cryptocurrency exposure product has been approved because it does not directly expose investors to Bitcoin or other cryptocurrencies. Still, it is tied to the bank's 11 unequally weighted stocks. The stocks in question may either be directly or indirectly linked to digital assets.

Notably, the bank arrived at the weight of the stocks by measuring the parent company's exposure to Bitcoin as well as liquidity. Since a Bitcoin exchange-traded fund (ETF) is yet to get approval in the US, the JP Morgan basket of weighted stocks will help investors bypass the regulation; thus, investing in a similar product.

Four of the 11 stocks have been classified as Class A, consisting of MicroStrategy, Square, Riot Blockchain, and NVIDIA Corporation's common stocks. These four stocks add up to 68% of the basket. The notes can be bought at a minimum price of $1,000 and mature on May 5, 2022. Investors should be aware that they are charged a basket deduction.

Bitcoin deals with a sell signal as declines linger

Bitcoin is trading marginally under $54,500 after a correction from weekly highs of $57,515. The flagship cryptocurrency almost hit the all-high, but overhead pressure rose, leading to the ongoing breakdown.

The 12-hour chart confirms that the TD Sequential indicator has flashed a sell signal. This call to sell has been printed in a green nine candlestick. Note that the previous sell signal culminated in losses of more than 22%. Therefore, if validated, Bitcoin could drop massively toward the support at $44,000.

On the downside, support is envisioned at $52,000 (former resistance). If Bitcoin's bearish leg stretches further, we can expect massive losses triggered under $50,000.

BTC/USD 12-hour chart

The Moving Average Convergence Divergence (MACD) shows that Bitcoin is still in the hands of the bulls. As long as the MACD line (blue) stays above the signal line, BTC is likely to remain in a generally up-trending market. Besides, holding above $54,000 support signals that bulls are not ready to give up on the mission to assault the all-time high.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren