- JP Morgan, an American banking giant, joined forces with Ripple partner Al Fardan Exchange LLC to offer customers value transfers.

- Proponents say the partnership will enable transactions in leading fiat currencies and same-day transfers in record time.

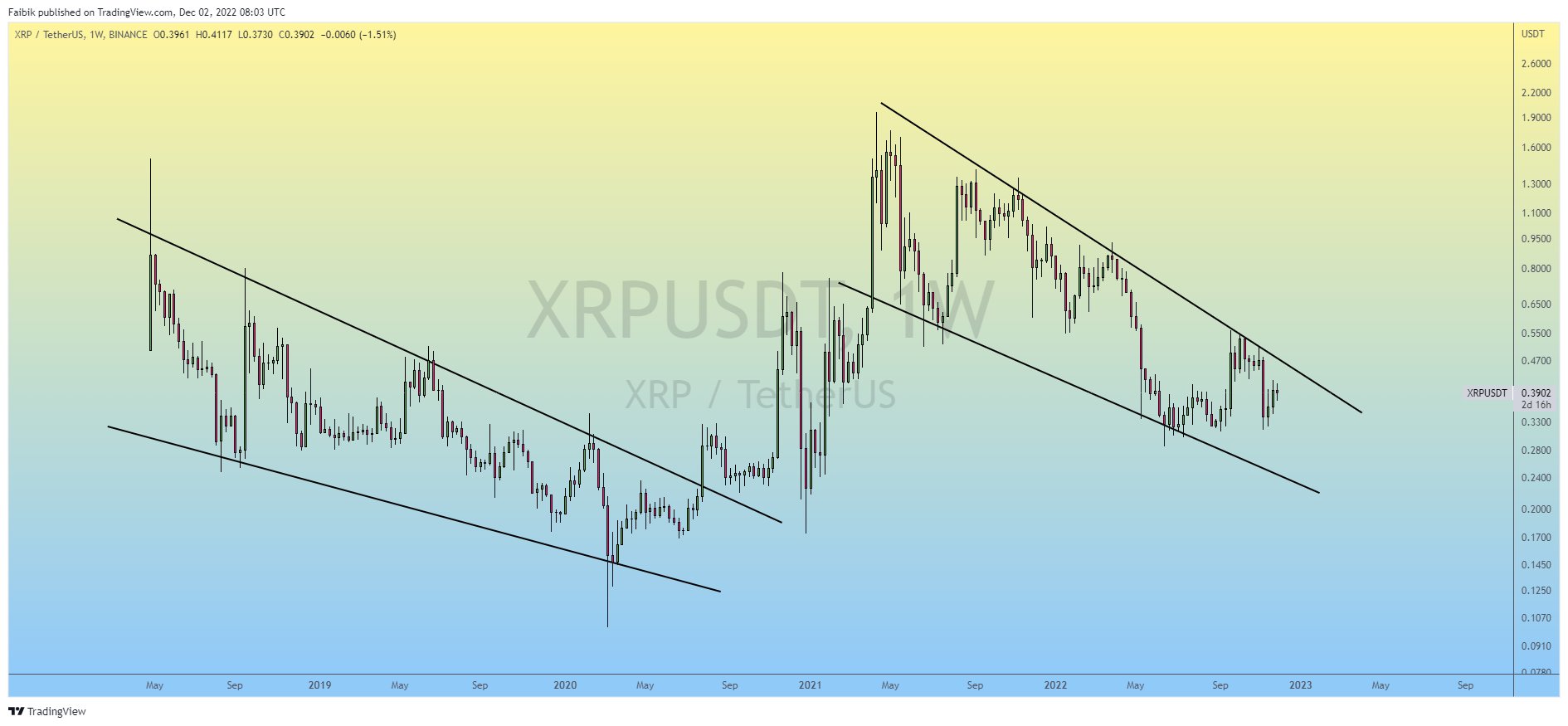

- XRP price chart indicates the altcoin is heading into the buy zone before a breakout that targets $0.40.

JP Morgan, a global leader in financial services, will work alongside Al Fardan Exchange LLC in the United Arab Emirates (UAE) to power faster transaction settlement and transfers in fiat currencies. RippleNet partner Al Fardan Exchange LLC provides money transfer and exchange services in the UAE. The outlook on XRP price remains bullish and the altcoin is headed to the buy zone.

Also read: XRP bulls in spotlight as SEC v. Ripple court filing hints at early closure

JP Morgan joins hands with UAE-based Ripple partner

JP Morgan, investment and retail banking giant, is now partnered with UAE-based Al Fardan Exchange LLC. The money transfer firm’s clients will be able to make transfers in several fiat currencies like the United States Dollar (USD), the British Pound Sterling (GBP), the Euro (EUR) and the South African Rand (ZAR), among others.

Al Fardan Exchange LLC announced its partnership with RippleNet, Ripple’s cross-border payment network in January 2022.

We've taken a leap in leveraging blockchain technology to revolutionize cross-border payments as we've partnered up with RippleNet Cloud Ripple’s cloud-based global financial network.@Ripple https://t.co/UP9dXMjDdm

— Al Fardan Exchange (@alfardanuae) January 26, 2022

Hasan Fardan Al Farhan, CEO of the money transfer firm said that the company's collaboration with global banking giant JP Morgan is attracting major global players from the financial industry, who are returning to the UAE market.

The exchange’s users will access the service through the mobile application AlfaPay, which can be used for making remittances and paying bills.

In making strides with new partnerships and expanding its global presence, Ripple is forging ahead regardless of its ongoing lawsuit with the US Securities and Exchange Commission (SEC), who have alleged Ripple’s XRP cryptocurrency should be classed as a “security” with all the legal and regulatory implications that would entail. Ripple’s team of lawyers, however, are confident they can win the SEC v. Ripple case.

David Gokhstein believes Ripple will win the legal battle

David Gokhstein, former US Congressional candidate and host of the “Crypto-Mamba” podcast believes Ripple’s win in the SEC v. Ripple lawsuit is imminent. Gokhstein shared his views in a recent tweet:

Ripple will win. The #crypto industry will win as well.

— David Gokhshtein (@davidgokhshtein) December 4, 2022

Brad Garlinghouse, the CEO of Ripple congratulated the entire team of its legal counsel for their work so far, and assured the crypto community that the payment giant will fight tenaciously to win the case.

XRP price outlook remains bullish

XRP price remained unchanged following recent developments in the SEC v. Ripple lawsuit. The altcoin is currently trading at $0.38, at its 50-day Exponential Moving Average (EMA).

The $0.41 level has acted as key resistance for XRP on nearly four occasions since November 2022. If XRP price continues its climb the $0.40 and $0.41 levels are the next two resistance points where the altcoin is likely to meet heavy selling. The Relative Strength Index (RSI) a momentum indicator, is at 38, which is below the neutral zone. This implies XRP is close to the buy zone, an optimum spot for traders to scoop up the altcoin before it begins a recovery.

XRP/USDT price chart

Crypto Faibik, a crypto analyst on Twitter believes XRP price is ready for a breakout in Q1 2023. The expert noted similarities in the XRP price trend in Q4 2022 with Q4 2020, confirming his theory of a bullish breakout in the altcoin.

XRP/USDT price chart

In 2020 the price formed a similar bullish falling wedge pattern (see chart above) which led to an upside breakout, and Crypto Faibik expects the same to happen in Q4 2022.

This disclaimer makes it clear that there is no professional relationship or partnership between JP Morgan and RippleNet. JP Morgan is not associated with RippleNet or any Ripple-related services.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.