Jito price confirms 55% breakout rally after recent JTO dip

- Jito price action over the past four months has set up a cup-and-handle pattern.

- This setup forecasts a 55% rise to $6.05, and the recent move confirmed the breakout.

- A breakdown of the $3.86 support level would invalidate JTO’s bullish outlook.

Jito (JTO) price has shown resilience despite Bitcoin’s (BTC) recent drawdown. This development shows buyers are flocking toward JTO and that the altcoin is ready to fly.

Also read: Jito price could hit $6 as JTO coils up inside this bullish pattern

Jito price eyes a lift-off

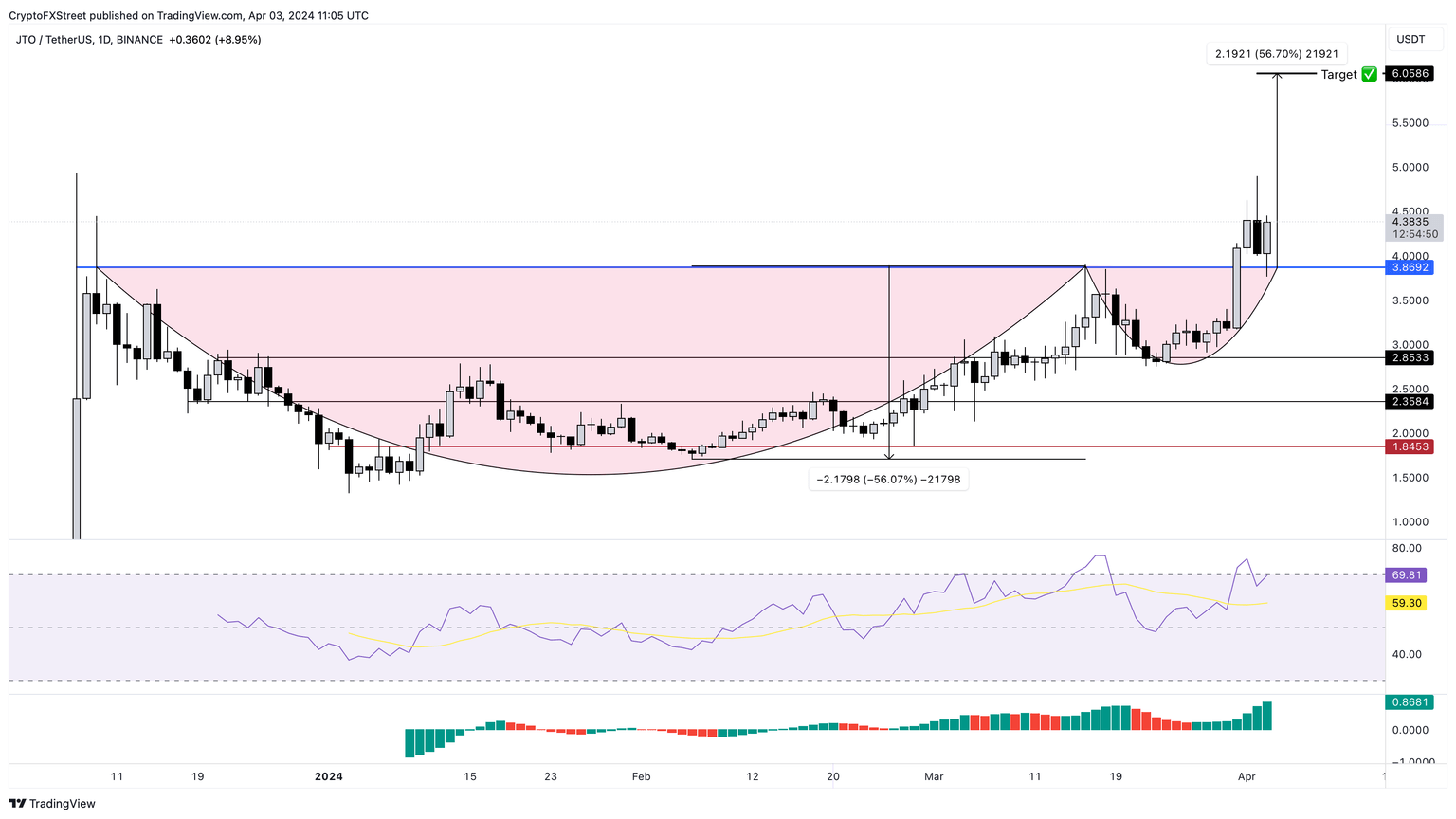

Jito price action between December 9 and March 31 created a bullish pattern known as cup-and-handle. This technical setup contains a rounded bottom known as the cup and is often followed by a small retracement or consolidation termed the handle. JTO formed the cup between December 9 and March 16 and the consolidation that ensued for the following two weeks created the handle.

A trend line drawn connecting the cup and the handle’s peaks forms a resistance level and is key for tracking a breakout. For JTO, this horizontal level at $3.86 was breached on March 31. Due to Bitcoin’s recent correction, Jito price retested the neckline as a support floor, confirming the breakout.

From a technical perspective, Jito price is set to rally higher.

The target for the cup-and-handle pattern is obtained by measuring the 55% distance between the cup’s right peak and its bottom. Adding this distance to the breakout point or neckline reveals a target of $6.05.

The Relative Strength Index (RSI) is recovering from under the overbought zone. While this would be alarming in a normal scenario, in bull runs, RSI tends to stay overbought for prolonged time.

JTO/USDT 1-day chart

While Jito price shows clear bullish signs, the outlook could change quickly if Bitcoin price continues its descent. In such a case, if JTO produces a decisive daily close below $3.86 it would invalidate the cup-and-handle forecasts. This development could see JTO crash 26% to $2.85.

Also read: US Dollar strength could be one of the reasons why Bitcoin could crash more

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.