Jim Cramer would not do business with Binance, bull news for BNB?

- Jim Cramer has said that he would not do business with Binance, way too sketchy

- Binance CEO and crypto Twitter are elated about the comment

- Could this bolster the uptrend for BNB, given Cramer's inverse reputation?

Jim Cramer, the famous American television personality and host of CNBC's popular show "Mad Money," has said that he would not do business with Binance. The comments came after Cramer listened to former Commodity Futures Trading Commission (CFTC) chairman Tim Massad.

After listening to Tim Massad on last night's show (former head of the CFTC) I would not do business with Binance. Just way too sketchy

— Jim Cramer (@jimcramer) March 31, 2023

Massad led the CFTC for around three years during the administration of former US president Barrack Obama.

Binance is 'way too sketchy' for business deals

Binance and its founder, CEO Changpeng Zhao (CZ), are the subject of a CFTC investigation on allegations of offering unregistered derivatives products and helping US-based customers avoid compliance controls through VPN. Citing Massad:

This complaint basically says that Binance and Zhao himself deliberately and systematically cultivated US business, helped US persons get around those restrictions, and even did things internally to try to hide how much US business they were doing.

As reported, CZ discredited the complaint citing "incomplete recitation of facts." He also noted that Binance did not agree with the characterization of many of the issues featured in the complaint.

Nevertheless, Massad said that it is unlikely that the CFTC's lawsuit against Binance would prompt congressional lawmakers to enact legislation regulating the US crypto industry. He believes it will take some time before the agency's lawsuit against Binance is litigated.

Cramer's mention of "sketchy" could be his controversial way of saying that the CFTC's case is fragmented for the most part, despite Massad's initial suggestion that "there is so much detail to it [the complaint]."

Notably, the latest on Jim Cramer comes days after he called for the market to 'calm down and slow down.'

Nevertheless, Cramer's comments seem to have given direction to many who were sitting on the fence following the lawsuit.

Perfect, now I’m ready to deposit back to #Binance

— Carl From The Moon (@TheMoonCarl) March 31, 2023

Thanks Jim, best confirmation I could have gotten.

Even Binance CEO has noticed CZ’s comment, and reacted with what could be interpreted as “sorry” or “thank you”

— CZ Binance (@cz_binance) March 31, 2023

Trading with the 'Inverse Cramer'

Jim Cramer has built a reputation as the 'Inverse Cramer,' such that when he says to go right, you go left. For instance, in February, the television personality said Silicon Valley Bank (SVB) stock was a buy at $320. As of March 30, however, the stock was going for a penny.

Jim Cramer said Silicon Valley Bank was a buy last month at $320

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 10, 2023

Today it is being closed by California regulators pic.twitter.com/x1xMBTrQTS

Two weeks ago, Cramer told investors to sell their Bitcoin (BTC), but as it would turn out, the king crypto is up almost 20% since the comment.

Now, market players believe the easiest way to win big is to do the opposite of Cramer's recommendation.

How to become a millionaire shorting market.

— Petr Royce (@petrroyce) March 27, 2023

- Short what Jim Cramer recommends

- Sell BTC when Saylor announces he bought

BNB price reacts to Cramer

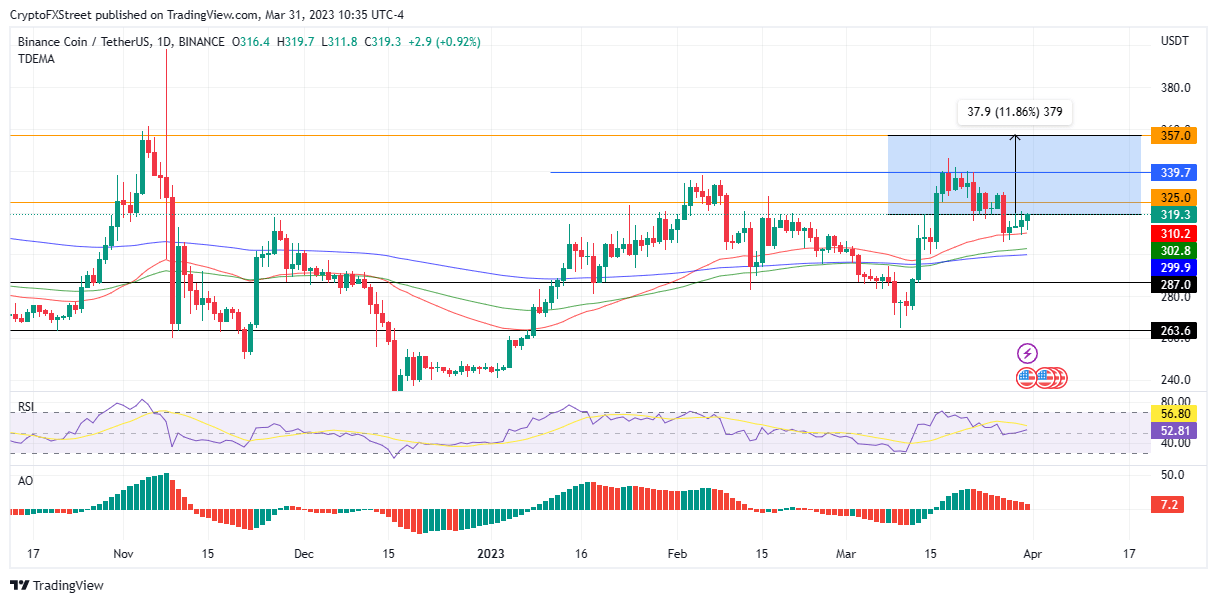

BNB price is up almost 1% in the last 24 hours, outperforming BTC, which is up 0.05% over the same period as of the time of writing.

As Binance Coin has been on a decisive uptrend since March 28, investors should expect a continuation because of Cramer's bullish allusion. This could see the token rise around 12%, as previously predicted, or higher.

BNB/USDT 1-day chart

Conversely, if BNB price loses the support provided by the 50-day Exponential Moving Average (EMA) at $310, the bullish thesis would be invalidated.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.