Japan crypto exchange DMM Bitcoin is set to liquidate

Japanese cryptocurrency exchange DMM Bitcoin is prepping to liquidate after losing $320 million in Bitcoin from a private key hack in May that the company has failed to recover from.

The crypto exchange is also ceasing efforts to revamp operations and intends to transfer customer assets to SBI VC Trade, an exchange operator under SBI Group, around March, Nikkei Asia first reported on Dec. 2.

According to a translation of a statement released on Dec. 2, a basic agreement between the two companies has been made for SBI to accept the transfer of all accounts and deposit assets.

“Under this agreement, customer deposit assets (in Japanese yen and crypto assets) in accounts opened on DMM Bitcoin will be transferred to us as soon as March 2025,” it read. SBI VC Trade will also handle the transfer of crypto stocks held on DMM Bitcoin, it added.

$320M stolen from May hack

DMM Bitcoin was compromised on May 30 in a server breach and private key hack, which the company referred to as an “unauthorized leak,” resulting in the loss of more than 4,500 Bitcoin (BTC $96,264) from a single wallet.

At the time the firm stated that all user deposits “will be fully guaranteed” as it halted withdrawals, new account openings, and trading.

DMM exchange also promised customers that it would “procure the equivalent amount of BTC” to make sure that all users are compensated, acquiring funds “with support from our group companies.”

DMM’s loss was the second largest in the region, following the $530 million Coincheck hack in 2018.

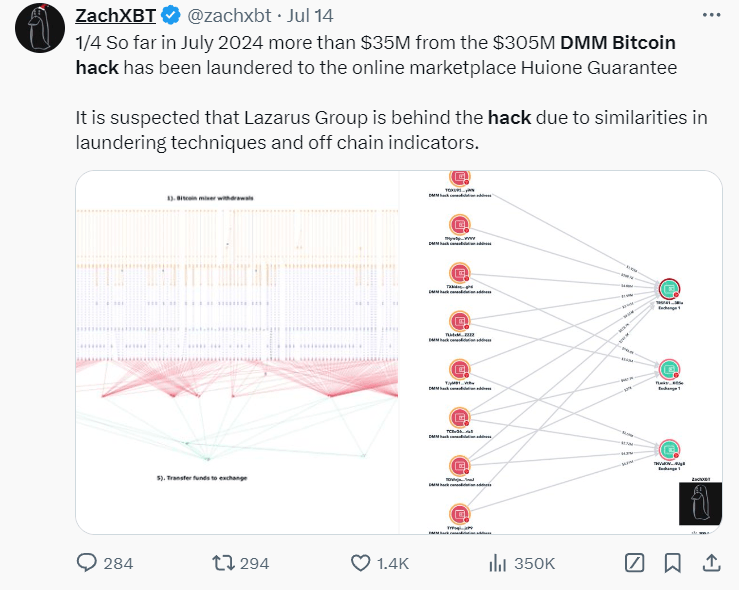

In July, blockchain sleuth ZachXBT reported that around $35 million of the stolen crypto had been laundered to the online marketplace and crypto scam hotbed Huione Guarantee.

Source: ZachXBT

“It is suspected that Lazarus Group is behind the hack due to similarities in laundering techniques and offchain indicators,” he said at the time.

DMM exchange was launched in January 2018 and is owned by the Japanese e-commerce conglomerate DMM Group.

In November, DMM Crypto announced that it was discontinuing its Seamoon Protocol. The Seamoon Portal was a Web3 gaming and content site that featured games and anime produced by the exchange’s parent firm, DMM.com.

DMM Crypto was working with the stablecoin platform Progmat to issue its own stablecoin to enhance the ecosystem. However, according to a translation of a statement at the time, the firm cited “recent rapid changes in the business environment” that have created challenges for the project’s sustainability.

Centralized exchange hacks have been rife in 2024. The Indian WazirX exchange was hacked in July for $235 million, while the Singaporean BingX exchange was hacked for $52 million in September, and an exploit of the Turkish BtcTurk hot wallet resulted in losses of up to $55 million in June.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.