- Dimon “suggested governments may move to shut down the currencies [cryptocurrency], because of an inability to control them.”

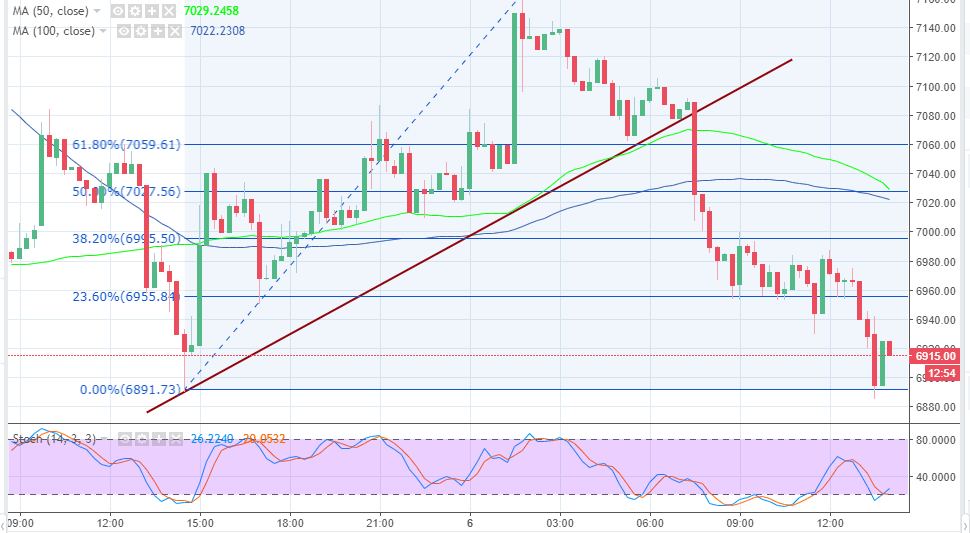

- Bitcoin price has broken intraday support levels, but a recovery is in progress above $6,900.

The CEO of JPMorgan, Jamie Dimon is reported to have bashed cryptocurrencies again referring to them as “scam.” Bloomberg reported on Sunday 5 that Dimon said that he does not have “interest” in the virtual currencies.

He said this while speaking at the Aspen Institute’s 25th Annual Summer Celebration Gala, which was held on Saturday 4. I his speech Dimon shared his opinions on the outlook of the economy of the United States. Mainstream press alongside other respected economic sources redistributed Jamie Dimon’s message online. Bloomberg reported that Dimon “suggested governments may move to shut down the currencies [cryptocurrency], because of an inability to control them.”

Jamie Dimon’s relation with cryptocurrencies and especially Bitcoin has been a shaky one since his statements in September 2017. He referred to Bitcoin as a “fraud” but later said that he “regretted” the terms he used. Since then Dimon has been refusing to comment on Bitcoin and cryptocurrencies.

Bitcoin price extended the declines below the support level at $6,900. Although it is currently trading above this level, it has recovered from a dip supported at $6,880. There is a bullish trend at the time of writing, besides the technical indicators are showing bullish signals for the short-term. The stochastic is making its way out of the oversold region while the moving average gap is closing in on the 15-minutes timeframe chart. Resistance will be encountered at $6,930, moreover, there are a couple of critical supply zones at$6,940 and $6,980.

Read more on Bitcoin price analysis

BTC/USD 15-minutes

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.