ISIS-affiliated groups raise $2 million in Tron-based USDT: TRM Labs report

- Multiple pro-ISIS groups have been using cryptocurrency to recruit fighters to join ISIS’s affiliate in Afghanistan (ISKP).

- Almost all ISIS networks have been identified to be using Tether (USDT) on the Tron network (TRX) to facilitate these transactions.

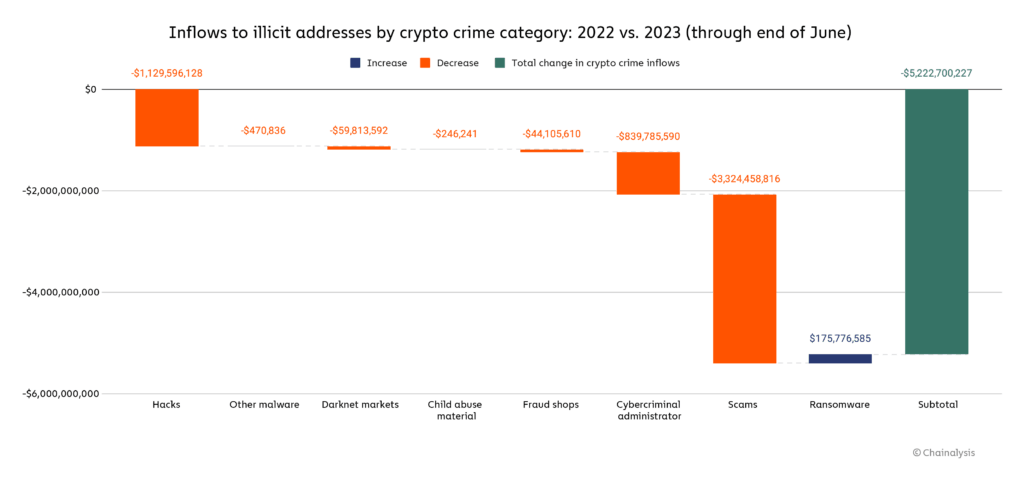

- 2023 has seen a decline in crypto crimes, with illicit inflows falling by 65%, amounting to $5.2 billion in the first half.

One of the advantages of crypto is the anonymity that comes with it which is also a huge disadvantage since it is the prime medium for illicit fund transfer by criminals. Such use cases have expanded in the past few months, and even though crypto-affiliated crime has come down this year, its illicit user base has grown. Particularly using Tether (USDT) on the Tron network.

ISIS uses Tron-based USDT for crime

According to a report from TRM Labs, The terrorist organization ISIS has been using cryptocurrencies to conduct all its financials. The report comes from the recent observations by the US Treasury Department and United Nations. Evidence gathered shows that pro-ISIS networks have been using cryptocurrencies to help conduct their activities in Tajikistan, Indonesia, Pakistan and Afghanistan.

Pretty much the entirety of such transactions have been noted to take place using USDT on the Tron network. A particularly major instance of the same is the fact that an address in Tajikistan received about $2 million in USDT in the last year. These funds are used by the terrorist organization to recruit fighters to attack the Tajik government.

In another instance in Indonesia, more than half a million dollars were sent to pro-ISIS groups in 2022, and over $40,000 worth of crypto assets were handled by similar entities in Pakistan.

While the use of cryptocurrencies in illicit transactions cannot be put to an end, it can be reduced significantly with the help of regulations. Markets in Crypto Assets (MiCA) in the European Union are an example of a step in the right direction.

But with bad news comes good too. 2023, year to date, has noted a drastic decline in the overall crypto-affiliated crimes recorded. In the past six months, the total inflows of crypto assets to illicit entities have reduced by about 65%, amounting to a decline of $5.2 billion.

Crypto crime inflows

Furthermore, scams in 2023 have also generated much less revenue than they did by June 2022 last year. By the end of June this year, the total revenue fell by more than 77%. This is a positive development for another reason beyond a decline in crime, as explained by Chainalysis,

“...this year’s decline is arguably more notable because it comes at a time when crypto asset prices are going up. Usually, positive price movements translate to higher scam revenue, likely because increased market exuberance and FOMO make victims more susceptible to scammers’ pitches. But 2023’s drastic scam decline bucks that long-standing trend.

Thus regulations in place going forward could further bring down both use of crypto in illicit transactions as well as crypto crimes.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.