Is this the bullish signal that Ethereum holders are waiting for?

- Ethereum staked on the ETH2 deposit contract has hit a new all-time high of 15.9 million, accounting for more than 13% of the total supply.

- Following the mid-September Merge when ETH transitioned from proof-of-work to proof-of-stake blockchain, the number of small Ethereum holders has climbed.

- Ethereum price yielded nearly 31.8% gains for holders over the past month, following Bitcoin’s massive rally.

Ethereum, the second-largest blockchain, hit a new milestone on January 27, nearly four months after its transition to a new consensus mechanism. Over 15.9 million ETH tokens have been staked on the Beacon Chain.

The massive spike in ETH staked on the blockchain could act as a “bullish catalyst” for the altcoin.

Also read: Here’s why Ethereum-killer Cardano whales are shedding their ADA holdings

Ethereum staked on Beacon Chain hits key milestone

Ethereum tokens staked on the deposit contract have climbed to 15.9 million tokens. This is a new all-time high. Within nearly four months of Ethereum’s Merge, where the smart contract network transitioned from proof-of-work to proof-of-stake, ETH has hit an important milestone.

A large amount of ETH staked is due to a rise in the number of deposits and staking.

— CryptoQuant.com (@cryptoquant_com) January 27, 2023

Chart https://t.co/Xiq7lwgVQ6 pic.twitter.com/agE4IIB5MY

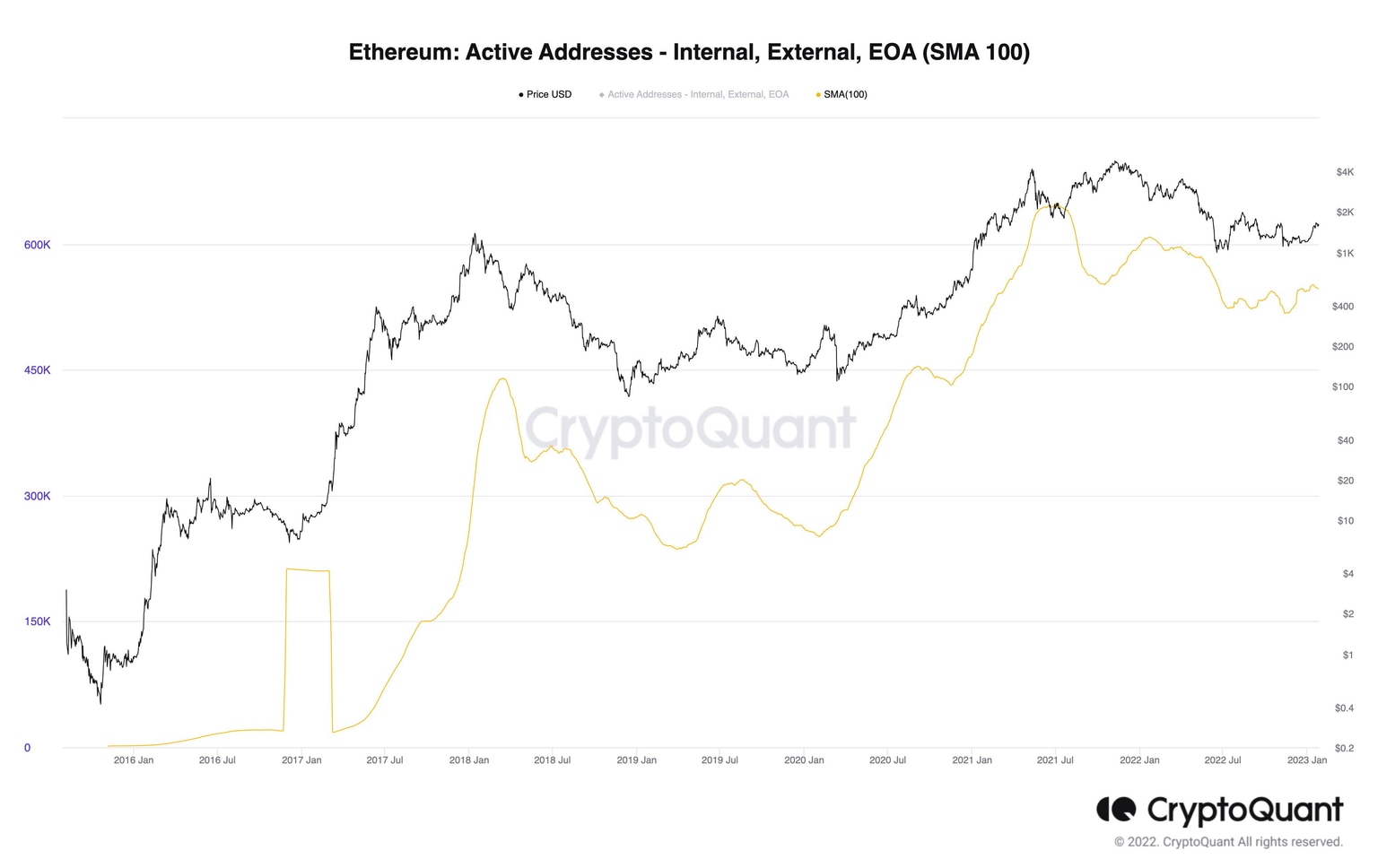

Alongside a spike in ETH deposits on the staking contract, network activity climbed consistently. Based on data from crypto intelligence tracker CryptoQuant, there is a spike in active addresses on the demand side for Ethereum.

Ethereum Active Addresses on CryptoQuant

Interestingly, the count of small-sized Ethereum holders has climbed from 1.57 million to 1.73 million, a 10.4% QoQ increase. Following the Merge update, this is a bullish development for ETH holders.

Nearly 13% of Ethereum’s supply is staked, locked in the ETH2 deposit contract. This reduces the altcoin’s supply in circulation and keeps these tokens off exchanges, easing the selling pressure on the second-largest cryptocurrency.

The native token of the smart-contract blockchain network has yielded 31.8% gains for holders since December 31. Despite the recent decline in ETH’s price, a 3% week-on-week drop in the altcoin, the latest developments could fuel a recovery.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.