Is this gaming token ready to plummet after a 56% rally in the last week?

- Gaming tokens witnessed a massive boost in their prices in the week leading up to the Game Developers Conference scheduled for March 20 to 24.

- ImmutableX’s IMX token yielded 56% gains for holders since March 13, ahead of the biggest utility upgrade and announcement of a web3 gaming partnership.

- IMX’s big reveal could turn out to be a sell-the-news event, wiping out gains from the past week with 18 million token unlock on March 25.

With the Game Developers Conference between March 20 and 24, gaming tokens witnessed a massive boost in their prices. IMX token yielded 56% gains since March 13, alongside other blue-chip gaming tokens like Axie Infinity (AXS), The Sandbox (SAND), ApeCoin (APE) and Magic (MAGIC).

ImmutableX is set to unveil a web3 gaming partnership later today and there is a token unlock event scheduled for March 25. It remains to be seen whether the event will turn out to be sell-the-news for IMX.

Also read: Is the US Federal Reserve’s bailout of international banks a bullish signal for Bitcoin?

ImmutableX announces biggest utility upgrade and web3 gaming partnership

Immutable is a platform that provides layer two solutions on the most secure and decentralized layer one, the Ethereum blockchain. APIs and developer tools that make it easy to build on layer two.

The platform announced its biggest utility upgrade on March 20, the first of the three fundamental updates to Immutable. Robbie Ferguson, the co-founder of Immutable tweeted earlier today:

Tomorrow, @immutable is unveiling:

— Robbie Ferguson | Immutable (@0xferg) March 20, 2023

1) The first of 3 fundamental utility upgrades to $IMX.

Overall, this will be one of the biggest token utility upgrades in history.

2) A partner announcement that will fundamentally change @immutable and web3 Gaming.

pic.twitter.com/fqxkDNj9uw

Ferguson assured the crypto community that this will be one of the biggest token utility upgrades in history, the countdown timer on the website is counting down to 6.5 hours.

The layer-2 solution platform will announce its web3 gaming partner in a live event today.

$26.3 million worth of IMX tokens set to unlock on March 25, here’s what it means

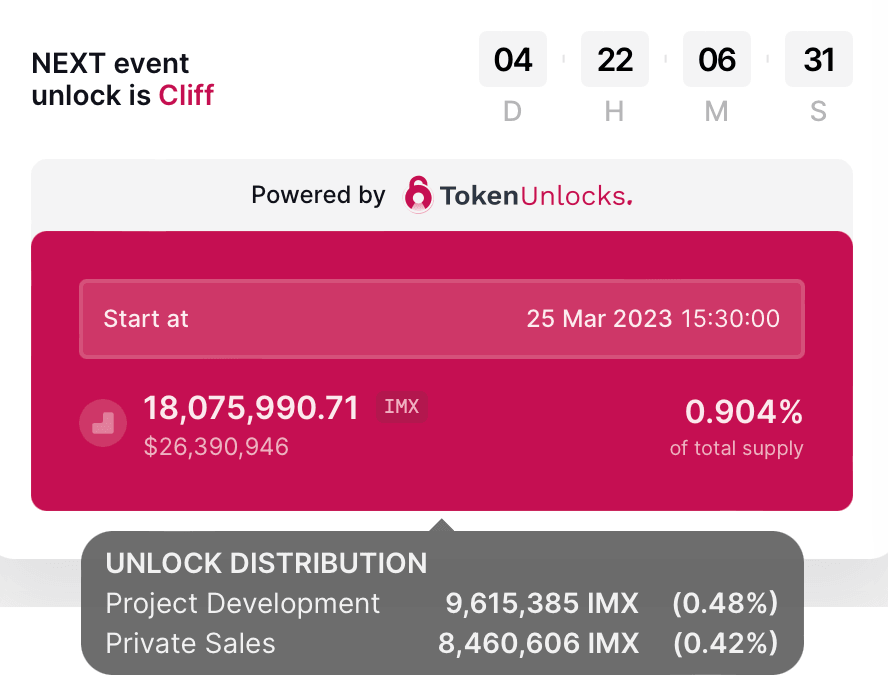

IMX token unlock is scheduled for March 25. 18 million IMX tokens worth $26.3 million are set to be unlocked this week. Based on data from the Token Unlocks portal, 9.6 million IMX will be unlocked for project development and 8.4 million for Private Sales.

The March 25 unlock accounts for 0.90% of IMX’s total supply.

After yielding 56% gains for holders, IMX token is likely to witness a correction. With the upcoming token unlock and the corresponding increase in selling pressure, IMX could wipe out its recent gains.

In the week leading up to the Game Developers Conference, IMX price yielded double-digit gains. As the anticipation surrounding gaming tokens declines, IMX price could note a decline.

Can IMX invalidate the bearish thesis and rally?

Akash Girimath, lead analyst at FXStreet believes the IMX token is primed for a 70% price rally. The expert noted the inverse head-and-shoulders formation. Using the technical formation on the three-day chart, Girimath forecasted a 70% upswing to $2.

IMX/USDT 3D price chart

The analyst identified $1.32 as the breakout point and set $2 as the bullish target for the gaming token.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.