Is the Bitcoin price bottom here?

- Bitcoin price is currently supported by the 1-day to 1-week UTXO Age Bands.

- On-chain data suggests that crowd FOMO is calming down, signaling a potential BTC price bottom.

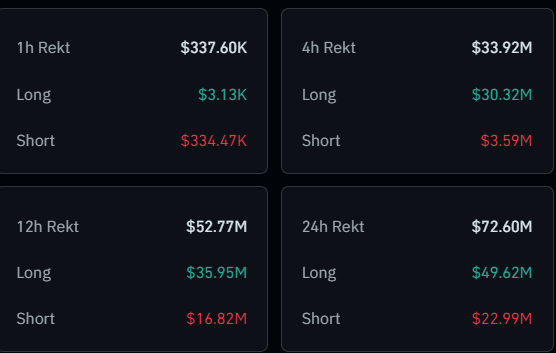

- Over the past 24 hours, $72.60 million worth of BTC has been liquidated, with $49.62 million coming from long positions.

Bitcoin (BTC) price struggles around the $65,000 level on Tuesday. However, BTC seems supported by the 1-day to 1-week UTXO Age Bands, and other on-chain data indicates a significant easing of Fear Of Missing Out (FOMO) and a recent sell-side liquidity sweep, hinting at a possible bottoming out of BTC's price.

On-chain data favours Bitcoin bulls

Data from CryptoQuant's UTXO Realized Price Age Distribution metric includes a set of realized prices along with age bands. Overlaying a set of different realized prices helps us overview each cohort’s holding behavior and can act as a support and resistance level indicator.

Currently, the Bitcoin price is supported by the 1month to 3months line, as shown in the graph below. This area has multiple times acted as support and is assumed to be a place where new purchases are being made.

On the other hand, the 1-day to 1-week line is the break-even point for high prices and acts as an immediate resistance around $67,000.

-638542936874461851.png&w=1536&q=95)

BTC UTXO Realized Price Age Distribution chart

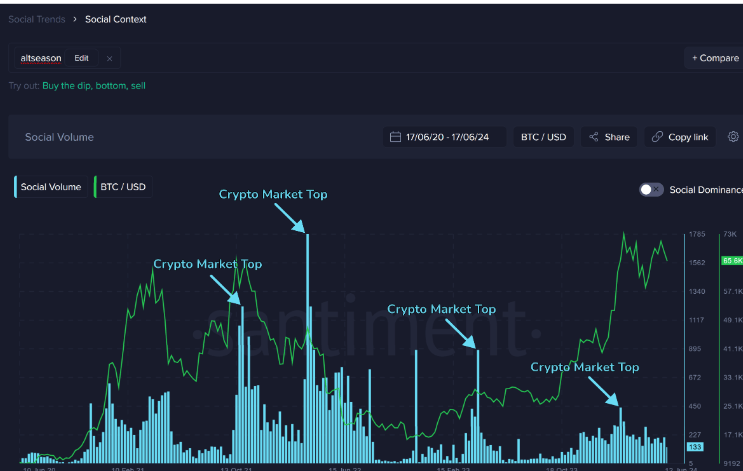

Santiment’s Social Volume data for social content ‘altseason’ shows the number of altseason mentions on crypto social media. A spike in this metric during rallies often signals local tops, as traders become greedy and their interests in altcoins rise.

As in BTC’s case, Social Volume metric is decreasing after the latest top in March. This decline indicates that the Fear Of Missing Out (FOMO) has calmed considerably, and the crowd fear has brought BTC's price to its local bottom.

BTC Social Volume chart

Liquidation data at Coinglass indicates information about traders' liquidated long or short positions. These positions are forced to close because the asset’s price moves against them.

Over the past 24 hours, $72.60 million worth of BTC has been liquidated, with $49.62 million coming from long positions. This indicates that a sell-side liquidity sweep had occurred, removing most of the over-leveraged long positions and activating a cluster of pending buy orders allowing them to enter a huge position with minimum slippage. This event could help BTC to form a local price bottom.

BTC Liquidation chart

As previously noted, data of BTC UTXO Realized Price Age Distribution, Social Volume and Liquidation all indicate that Bitcoin could find a local price bottom. However, if the overall global market sentiment turns negative and Bitcoin spot ETFs show weakness like last week, the bullish thesis will be invalidated, leading to a price decline in BTC.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.