Is Terra’s LUNA price preparing to double?

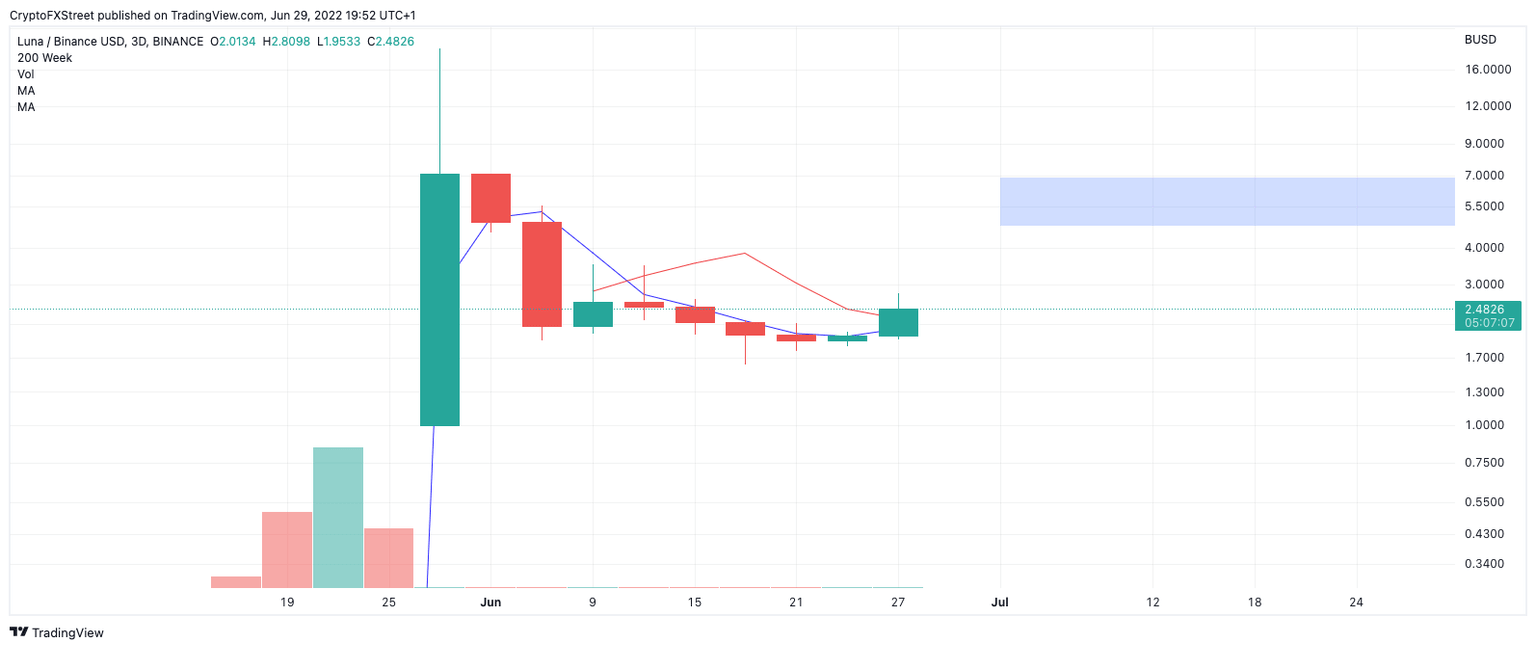

- Terra’s LUNA price sees compression of 8- and 21-day simple moving averages.

- LUNA price volume has tapered out considerably amidst June’s downtrend.

- Invalidation of the uptrend is a breach below $1.60.

Terra’s LUNA price could continue higher. It is not a guarantee, but the probability is valid.

Terra’s LUNA price prepares to rally or detonate

Terra’s LUNA price is experiencing a profit-taking consolidation as the bulls have finally created some momentum. The recent breach of $2.00 created a 35% rally into a high at $2.80 during the final days of June. LUNA price technical indicators do promote the idea that a rise can continue as high as $5.00.

Terra’s LUNA price currently trades at $2.50, a psychological barrier accompanied by optimism as the Terra community has recently organized millions of dollars for further blockchain development. The 3-day chart hints at the possibility of more uptrend as the volume indicator during June was relatively sparse. Secondly, the compression of the 8- and 21-day simple moving averages (SMA) below the current LUNA price could become the catalyst to induce a golden cross. The collision of both moving averages will surely bring a much-needed increase of volatility into the market for intraday traders to engage with.

LUNA/BUSD 3-Day Chart

If market conditions persist, the $3.00 zone will be the final short-term target to breach for less confident bulls speculating on a $5.00 target in the long term. On the contrary, If the bears manage to breach below the $1.60, a sharp plummet to $0.59 could occur, resulting in a 75% decrease from the current LUNA price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.