Is Robinhood’s much anticipated IPO an essential buy or avoid at all costs?

-637336005550289133_XtraLarge.jpg)

Robinhood, the investing app that’s rarely strayed from the headlines across the 2021 investment landscape, is set to launch its hotly-anticipated IPO and is targeting a valuation of up to $35 billion. However, whilst arriving off the back of massive fines and a range of controversies, will Robinhood be an essential buying opportunity or an initial public offering to avoid?

It’s fair to say that Robinhood has been the most newsworthy investing app of 2021 so far. The year got off to an explosive start as the platform found itself at the heart of the infamous GameStop short squeeze where retail investors - many of whom were based on Robinhood - coordinated their investments to pump the share value of GameStop where hedge funds had elected to short the stock.

The app has also been at the centre of a war of words between its developers and Wall Street, with key figures like Warren Buffett likening Robinhood to a “casino.”

(Image: CB Insights)

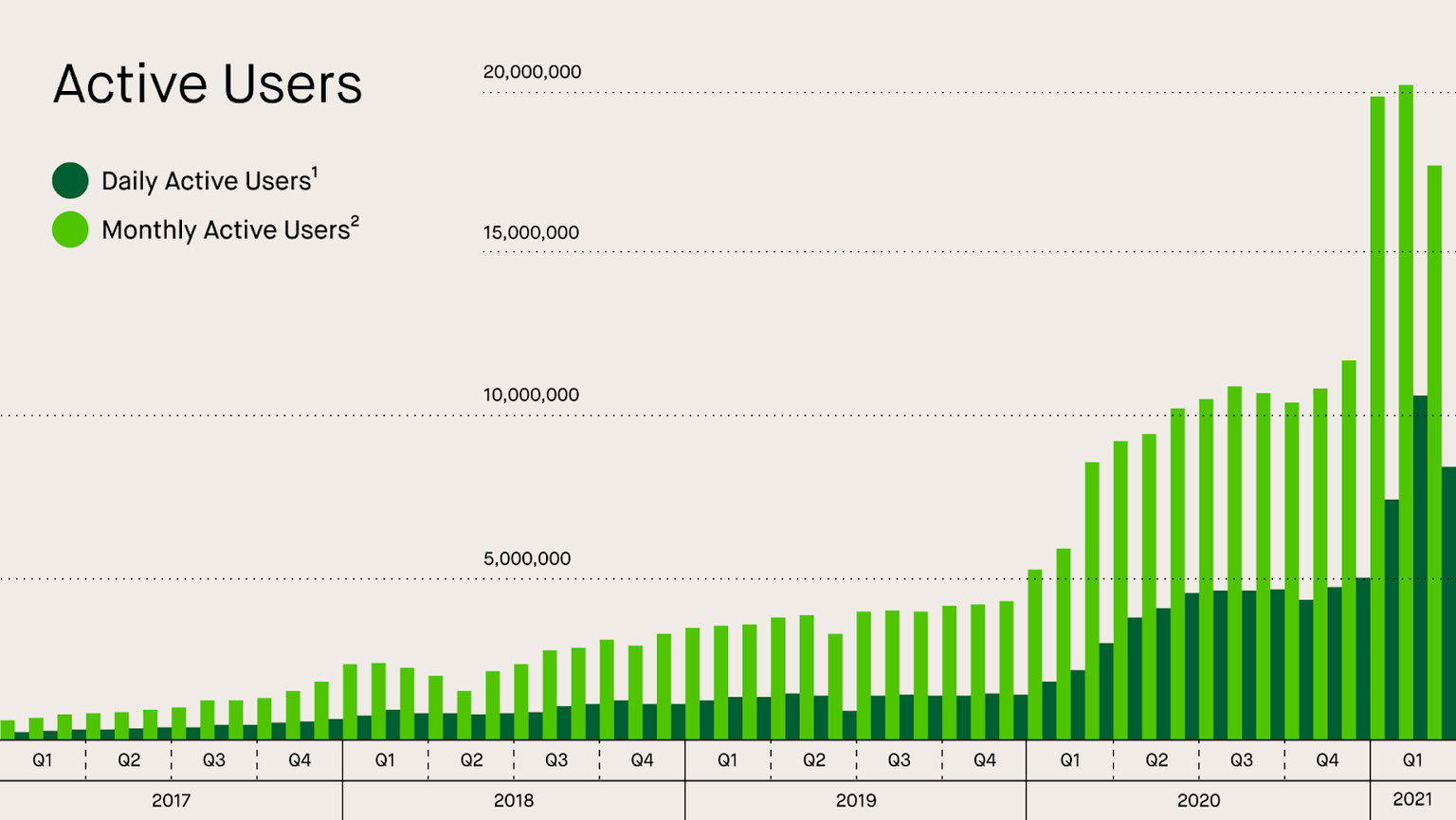

Despite its controversies, Robinhood’s user base has grown significantly in 2021, with as many as 20 million monthly active users being recorded in February.

To supplement its IPO, around 55 million shares are being offered with prices expected to range between $38 and $42 - which would lead to the company raising over $2.3 billion if priced at the top of its range.

Almost 2.63 billion of the shares are being offered out by the company’s founders and chief financial officer, according to the filing. The proceeds of these won’t go back to the company as a result.

Robinhood has sought to position itself as the investment app that aims to ‘democratise finance for all’ and this stance has certainly won the company some big fans in the retail investment landscape. However, in an industry that’s rarely been inclusive in the past, the company’s moves to encourage more individual investors has dropped Robinhood into some hot water.

In seeking a valuation of $35 billion, Robinhood’s IPO may become one of the biggest of the year, but how will it go? Should investors embrace an innovative platform that’s clearly looking to innovate through inclusivity? Or have the company’s many controversies made Robinhood too hot to handle? Let’s take a deeper look at the factors that could impact Robinhood’s floatation:

The Danger of Regulation

Robinhood’s S1 prospectus was released just one day after FINRA hit Robinhood with a $70 million fine owing to “widespread and significant harm” to its customers. Worryingly, the investigation is still ongoing and the company expects to see more penalties arriving over time.

There are many more cases filed against Robinhood, as well as some class action suits relating to the platform restricting access to trading on a range of extremely volatile stocks during the peak of the GameStop short squeeze in January.

Maxim Manturov, Head of Investment Research at Freedom Finance Europe also points to the risk of regulations “such as restricting or banning beginner investor transactions” as a key issue for Robinhood.

“The regulation risks are not that high, though,” Manturov adds. “As such, Ivo Welch, a professor at the University of California (LA), published an article where he studied the behavior of thousands of traders during the bearish trend in March 2020; he came to a conclusion that Robinhood traders tend to make wise moves. During 2018-2020, they earned good profits, which means beginners are not that weak players, after all.”

The Path to Profitability

The timing of Robinhood’s IPO could hardly be better when considering the company’s revenue generated over the past year. Robinhood saw its revenues climb from $277.5 million in 2019 to $985.8 million in 2020.

2021 is set to be an even more impressive year for the company. Over Q1 of this year, Robinhood’s revenues soared to $522.2 million - approximately four-times higher than its Q1 returns in 2020.

Here it’s worth mentioning that Robinhood was already profitable in 2020, with the company generating around $7.4 million over the one year period, however, the company’s most recent period features a significant $1.49 billion cost regarding “change[s] in fair value of convertible notes and warrant liability,” leading to a massive net loss of $1.44 billion in the first quarter of 2021.

For Q1 of 2021, Robinhood posted $463.8 million in operating expenses, inclusive of ‘brokerage and transaction costs.’ So with this in mind, it’s fair to say that Robinhood’s enjoyed a strong start to the year in terms of profitability, in spite of its fair-value charges.

Is Robinhood a Buy?

When considering whether Robinhood’s a buying opportunity for investors or not, it’s important to keep the company’s whole story in perspective. Robinhood is about more than its many controversies, and shouldn’t be defined by the criticisms of Wall Street stalwarts.

The app may have many regulatory issues, but as a fast-growing startup these problems aren’t uncommon.

However, it’s worth remembering that Robinhood exists in a fiercely competitive market. Charles Schwab recently completed a $26 billion acquisition of TD Ameritrade, while Morgan Stanley recently purchased E-Trade.

But Robinhood has constantly sought to set itself apart from the herd by offering the ability to buy and sell cryptocurrencies like Bitcoin and to generally offer retail-friendly features for its users. Recently the app announced that it was launching IPO Access, which offered user participation in a number of initial public offerings where before it wasn’t possible for investors without a significant account balance behind them.

However, David Trainer, Chief Executive of New Constructs, an investment research firm, believes that Robinhood’s target valuation of $35 billion may contribute to its downfall. “Investors may have better odds of making money by trading risky meme stocks using Robinhood’s platform than by purchasing Robinhood’s overpriced stock itself,” Trainer lamented.

“We think the stock is worth no more than $9 billion and that Robinhood will likely not be able to continue the robust growth it saw in 2020 due to looming regulatory risk, increasing competition, and an undifferentiated service,” he added.

Robinhood has spent much of its lifespan as a platform that’s drastically divided opinion. Now, in launching its IPO, it finally has the chance to silence its critics and build a foundation to continue its incredibly innovative work in democratising finance for all. However, with many critics waiting for the next slip up, it’s vital that the app resonates with its investors and enjoys a healthy start to public life. Failure to launch could be especially damaging in such an unforgiving industry.

How to take part in Robinhood IPO?

Robinhood announced that it’s reserving 20% to 35% of its pre-IPO shares for its customers.

The first way to participate in Robinhood's IPO is through their IPO feature - IPO Access. As Robinhood only allows US applications, retail investors from the EU and other countries won't be able to participate. Hence, you'd have to find an alternative.

Luckily, another platform that's offering to participate in Robinhood's IPO is Freedom24, which works on a very similar principle as IPO Access.

On the contrary, Freedom24 isn't available for US applications but is available for European retail investors.

Basically, depending on where you're located, you can still take part in the IPO.

Author

Dmytro Spilka

Solvid

Dmytro is a tech, blockchain and crypto writer based in London. Founder and CEO at Solvid. Founder of Pridicto, an AI-powered web analytics SaaS.