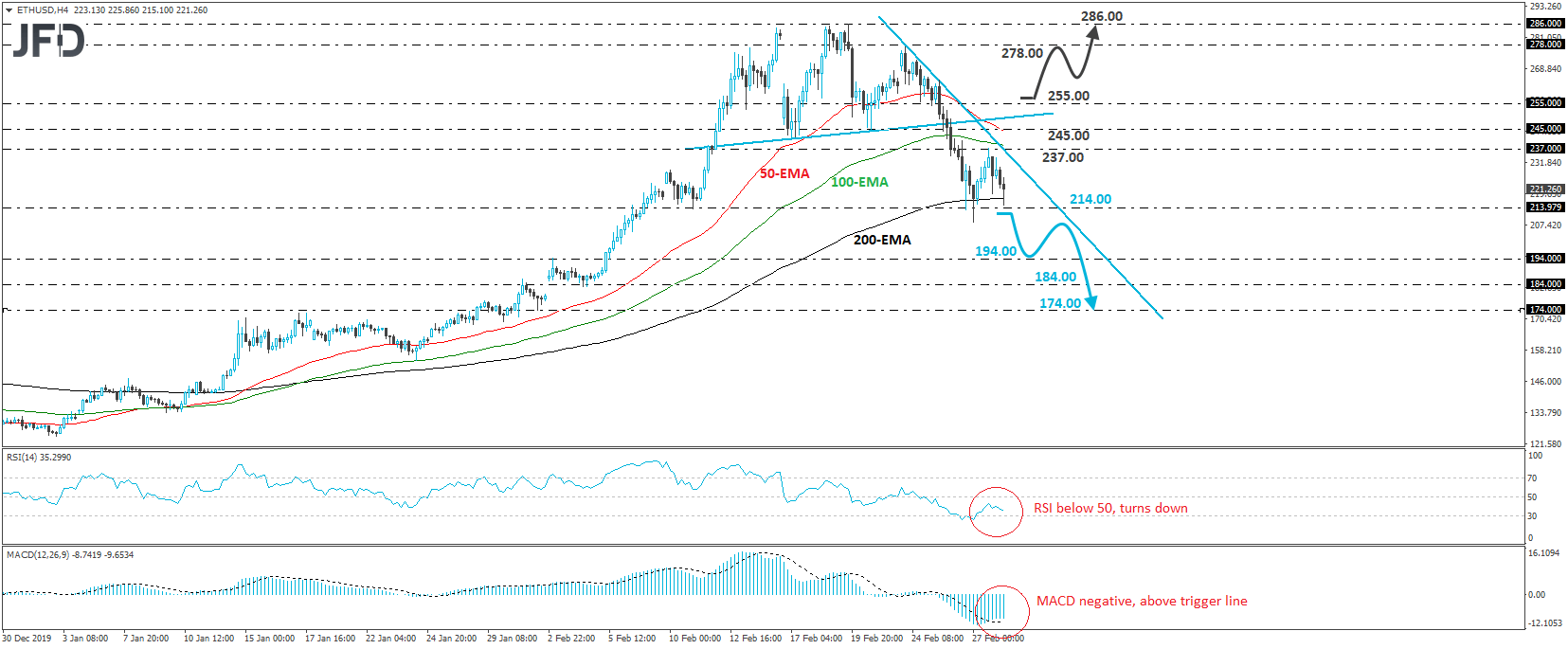

After completing a “Head and Shoulders” formation on February 25th, Ethereum slid and on the 27th of the month, it hit support slightly below 214.00, a level marked by the low of February 11th. Then, it rebounded, but the recovery stayed limited near the 237.00 zone, slightly below the downside resistance line taken from the peak of February 24th. The fact that the price continues to trade below that line, as well as below the neckline of the H&S, suggests that the short-term outlook is negative.

At the time of writing, the crypto is trading slightly above the 214.00 zone. If the bears are willing to overcome that zone this time around, they may decide to push for the 194.00 territory, defined as a support by the inside swing peak of February 3rd. They may decide to take a break after hitting that hurdle, thereby allowing a small recovery. However, as long as such a potential recovery stays limited below the pre-mentioned downside line, we would see decent chances for the bears to take charge again and perhaps drive the battle below the 194.00 area. Such a dip may pave the way towards the 184.00 barrier, or the low of January 31st, at around 174.00.

Our short-term oscillators detect negative momentum and support the notion for some further near-term declines. The RSI, already below 50, has turned down again, while the MACD, even though above its trigger line, lies within its negative territory and shows signs that it could turn south as well.

In order to abandon the bearish case, we would like to see a strong move above the 255.00 zone. This way, the crypto will be, not only above the short-term downside line, but also above the H&S’s neckline. The bulls may then get encouraged to target the high of the right shoulder, at around 278.00, the break of which may lead to the peak of the head, at around 286.00. That said, in order to start examining whether the prior uptrend is back in force, we would like to see a decisive close above 286.00, as such a move would confirm a forthcoming higher high on the daily chart.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

Crypto Today: ADA, AVAX, TON in profit as BTC stalls at $100K

Altcoin market updates: ADA, AVAX, TON emerge as top gainers While BTC has stagnated on Monday, traders are redirecting capital toward mid-cap assets, driving the likes of Cardano (ADA), Avalanche (AVAX) and Toncoin (TON) above key resistance levels.

Ripple's XRP aims for $1.96 as WisdomTree registers for an XRP ETF in the US

Toncoin Price Forecast: Crypto whales spotted buying $30M TON in 4 days, amid Gensler’s exit

Toncoin price opened trading at $6.2 on Monday, up 27% since Gary Gensler's exit confirmation on November 21. On-chain data trends suggest a $7 breakout could follow as whale investors have scaled up demand for TON considerably over the last 5 days.

MicroStrategy set to push Bitcoin to new highs after 55,500 BTC acquisition, should investors be concerned?

MicroStrategy revealed on Monday that it made another heavy Bitcoin purchase, acquiring 55,500 BTC for $5.4 billion at an average rate of $97,862 per coin.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.