Is Matic price setting up a bear trap? Subtle cues hint at a $2.10 target

- Matic price signals a desire for a countertrend rally.

- Polygon price prints a bullish hammer candle on the weekly chart.

- Invalidation of the bullish idea is a breach of $0.34.

Matic price could surprise the crypto market as the Polygon ecosystem could be prepping for a massive rebound to $2.10.

Matic price displays subtle bullish cues.

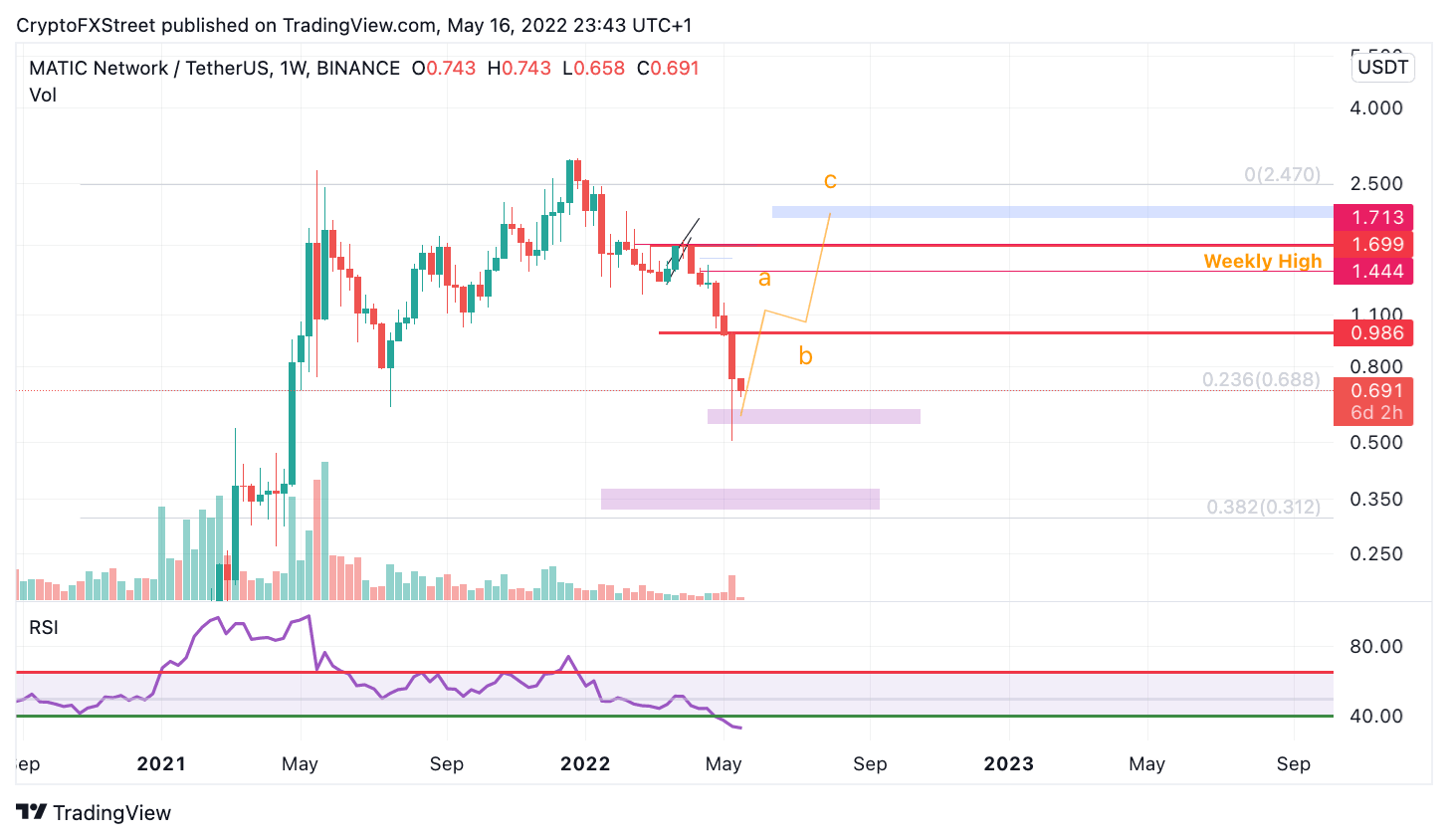

MATIC price could be the "sleeper" coin within the crypto market as the price action displays distinct differences from most other coins in the space. The weekly close has printed a bullish hammer candle with a bearish color. The anomaly presented by the weekly candlestick could suggest smart money involvement in the Polygon price.

MATIC price displays an increase in volume for the current bullish hammer. If the technicals are correct, the Matic price could be trying to establish a countertrend rally into the $2.10 zone as a b wave rally. On smaller time frames, traders should look for a bullish breach of a previous 4th wave degree to provide an appropriate entry signal while placing safety stops at this year's swing low, currently marked at $0.51. The swing low is subject to change if any market fakeouts occur.

MATIC/USDT 1-Week Chart

The safer invalidation for swing traders uninterested in intraday trading is a breach below the large bullish engulfing candle from May 2021 at $0.34. If the bears breach this level, consider the entire thesis void. The bears could continue heading south towards $0.20, resulting in a 75% decrease from the current MATIC price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.