Is Ethereum’s correction almost done?

It may feel like ages, and we don’t blame you for feeling like it, but Ethereum (ETH) has not moved since its all-time high (ATH) of $4865 set in November 2021. It dropped to $883 by June 2022 and rallied slowly to $4109 in December 2024. Four months later, it reached as low as $1384. Currently, it is trading at $1600.

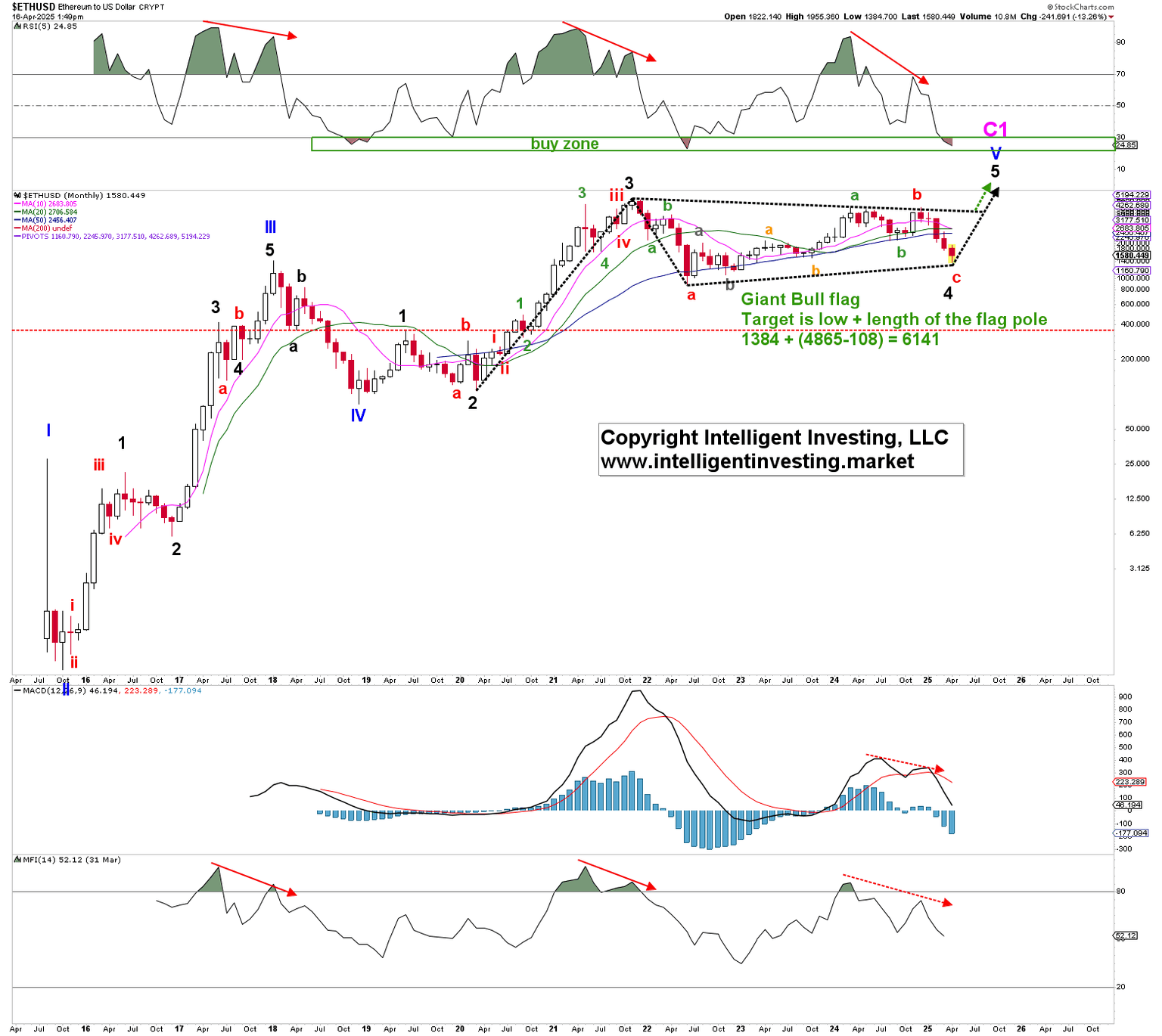

Using the Elliott Wave (EW) Principle, the drop from the ATH to the $883 low counts best as three (green) waves lower (W-a, -b, and -c) to complete a larger (red) W-a. See Figure 1 below. The rally from then to last December’s high overlaps, i.e., lots of ups and downs, and therefore counts best as three subdividing (green) waves as well: red W-b. Now, ETH is completing five waves lower for the red W-c of the black W-4.

Our preferred long-term EW count for Ethereum

In EW terms, a 3-3-5 pattern is called a “flat” correction and occurs primarily as a 4th wave. From a technical pattern perspective, Ethereum is most likely forming a Bull flag pattern (black dotted lines). The flagpole was the rally from the 2020 low to the 2021 ATH. The flag is the aforementioned sideways pattern, and a breakout can then target $6000+, assuming this month’s low holds.

Zooming in on the path since the December 2023 high, we’re tracking the completion of those five waves lower. See Figure 2 below. The ideal target is around $1085, where the green W-5 equals the length of the green W-1, measured from the green W-4 high: green dotted arrow. Moreover, that level is the 2.618x extension of W-1 measured from W-2.

Our detailed, short-term EWP count for Ethereum

ETH is in a strong downtrend, suggesting more downside. It is firmly below its declining 20-day simple moving average (20-d SMA), which is also below the (blue) 50-d SMA and the (red) 200-d SMA. It is also below the declining Ichimoku Cloud and the (red dotted) downtrend (DT) line, which has held all upside in check since the December high.

Thus, Ethereum can still wrap up at least one more set of 4th and 5th waves to the ideal $1085ish target zone to complete the more significant (black) 4th wave. However, if ETH moves above at least the 50-d SMAs, the DT line, and $2093 without making a lower low first, we must consider the four-month-long downtrend complete and look towards the low $6000s over the next several months. As such, there’s an increasingly favorable risk/reward setup in the making for those who would like to have exposure to Ethereum, contingent on holding above its 2019 high at $356.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.