Is Ethereum en route to $10000+?

It has been a few weeks since we last posted a public update on Ethereum (ETHUSD), the second-largest cryptocurrency. Back then, BTC was only 2% away from its ATH, whereas ETH needed to rally 50% to play catch-up, and we concluded that

“…we now have clear parameters in place to tell us if Ether is ready to rally more directly (>$2800) or if it wants to revisit the triple-digits one more time (<$2121) before it can stage its next Bull run.”

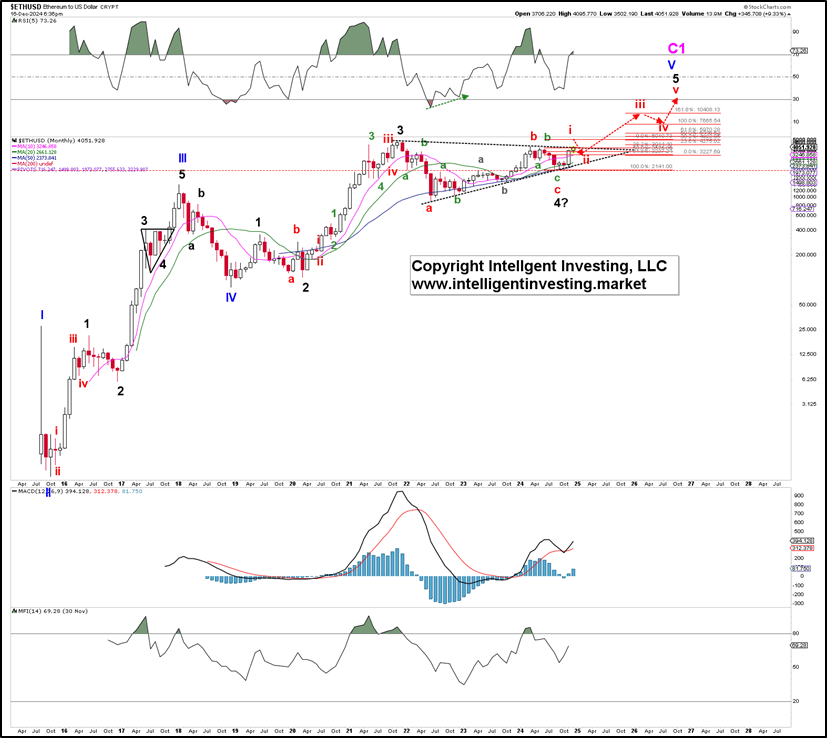

Fast-forward and ETHUSD broke above $2800 on November 7. That told us to don our Bull hat, as Ether had unfinished business to the upside. As such, we’ve kept a Bullish posture for our Premium Members by tracking a potential Elliott Wave impulse path higher. See Figure 1 below.

Figure 1. Our preferred detailed, short-term EWP count for Ethereum

Ethereum has most likely completed grey W-iii and W-iv of the green W-3, which are part of a larger five (green) waves of the red W-i, aka an impulse. We have no confirmation yet, so we labeled the waves with question marks. The impulse is our preferred path as we advance, contingent on holding above at least $3500, with a severe warning below $3000. If we get these five (green) waves up as shown, with an ideal target zone of around $4800+/-200, the next pullback will be an excellent buying opportunity for the red W-iii. See Figure 2 below.

Figure 2. Our preferred detailed, long-term EWP count for Bitcoin

Namely, at that stage, we have confirmation that the black W-4 bottomed in August as a triangle and that the black W-5, to $10000-15000, is getting started. Sounds outlandish? Allow us to explain using round numbers for simplicity. If we assume red W-iii tops at $5100, it would be around $3000 long since it started at the August 5th $2121 low. 2nd waves (red W-ii) tend to retrace 50-76.4% of the prior 1st wave, which projects ~$3200. 5th waves often reach twice the length of the 1st wave: $3200 + 2.0x $3000 =$9200. This excludes the fact that cryptocurrencies often experience extended waves, i.e., W-5 = 3 to 4x W-1. With the latter extension, we’ll be at $15000.

But for now, we will focus on seeing these potential five (green) waves complete. If they do, then the subsequent more significant correction will be a fantastic buying opportunity.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.