Is Enjin Coin price preparing to moonshot?

- Enjin Coin price has rallied 7% in two days after a 21% decline since September 1.

- The downtrend’s back-and-forth nature has formed an Elliott-Wave diagonal pattern.

- Invalidation of the uptrend scenario is a breach below $0.387.

Enjin Coin price could skyrocket toward the September highs. Key levels have been identified.

Enjin price has potential

Enjin Coin (ENJ) price has been underwater most of the fall. Since September 1, the bulls have endured a 21% loss in market value. On October 26, the technicals show subtle signs that the ENJ price is prepping for an explosive retaliation against the bears.

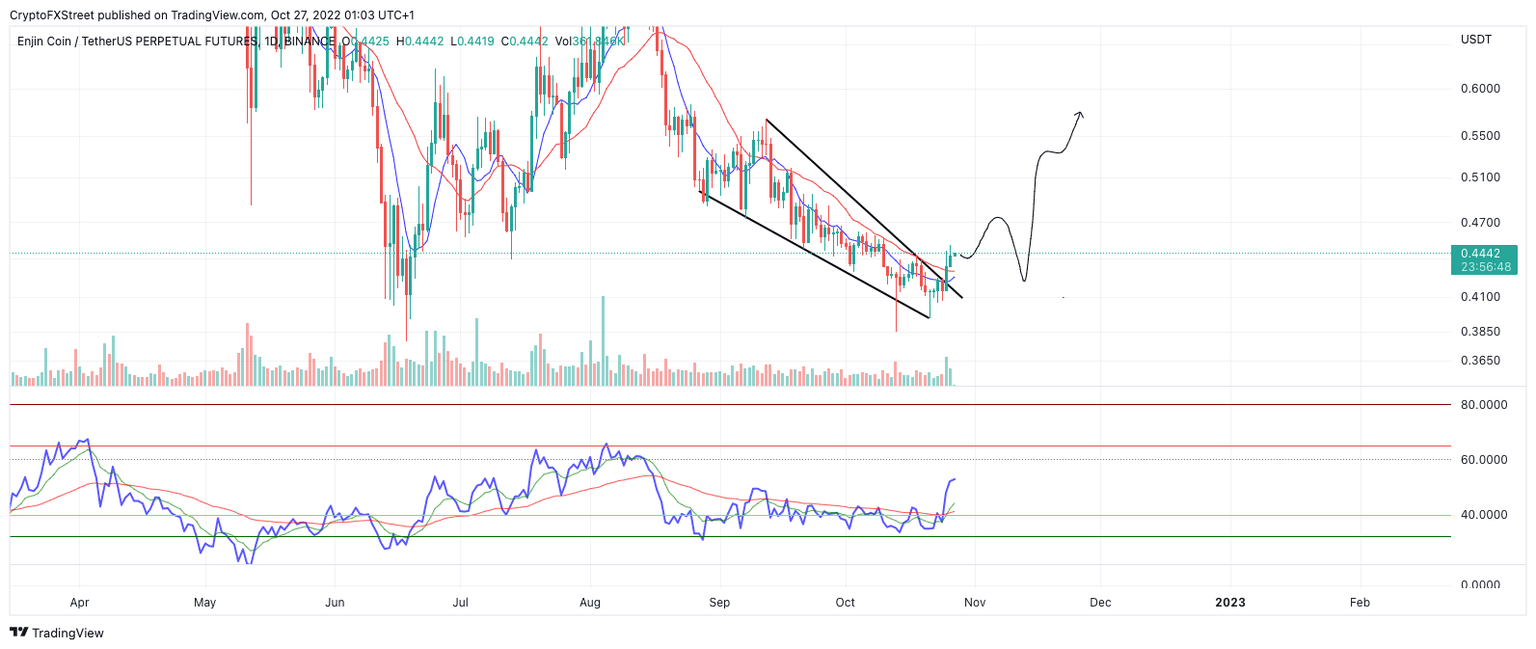

Enjin Coin price currently auctions at $0.440. The persistent decline over the past two months has yet to be easily accomplished. On several occasions, there have been countertrend pullbacks signaling an underlying strength. The turbulent downtrend has created a coiling-looking Elliott Wave Ending Diagonal pattern. Ending Diagonals are considered reversal patterns, known for triggering sharp sky-rocket-like rallies in the opposite direction of the trend towards the origin point of the pattern.

ENJ/USDT 1-Day Chart=

The volume profile index shows a significant uptick in volume near the October 13 swing low and on October 24, which induced this week’s 7% rally. If the technicals are correct, the low for the pattern is already in. A powerful 30% rally targeting $0.560 should commence in the coming days. The Relative Strength Index compounds the bullish notion as it now hovers in the supportive territory after printing bullish divergences between October 14 and 20.

Invalidation of the bullish thesis will be a breach below the October 13 swing low at $0.387. A breach of the low could induce a severe liquidity hunt targeting $0.300, resulting in a 30% decline.

In the following video, our analysts deep dive into the price action of HBAR, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.