Will Cardano price succumb and head to $0.20

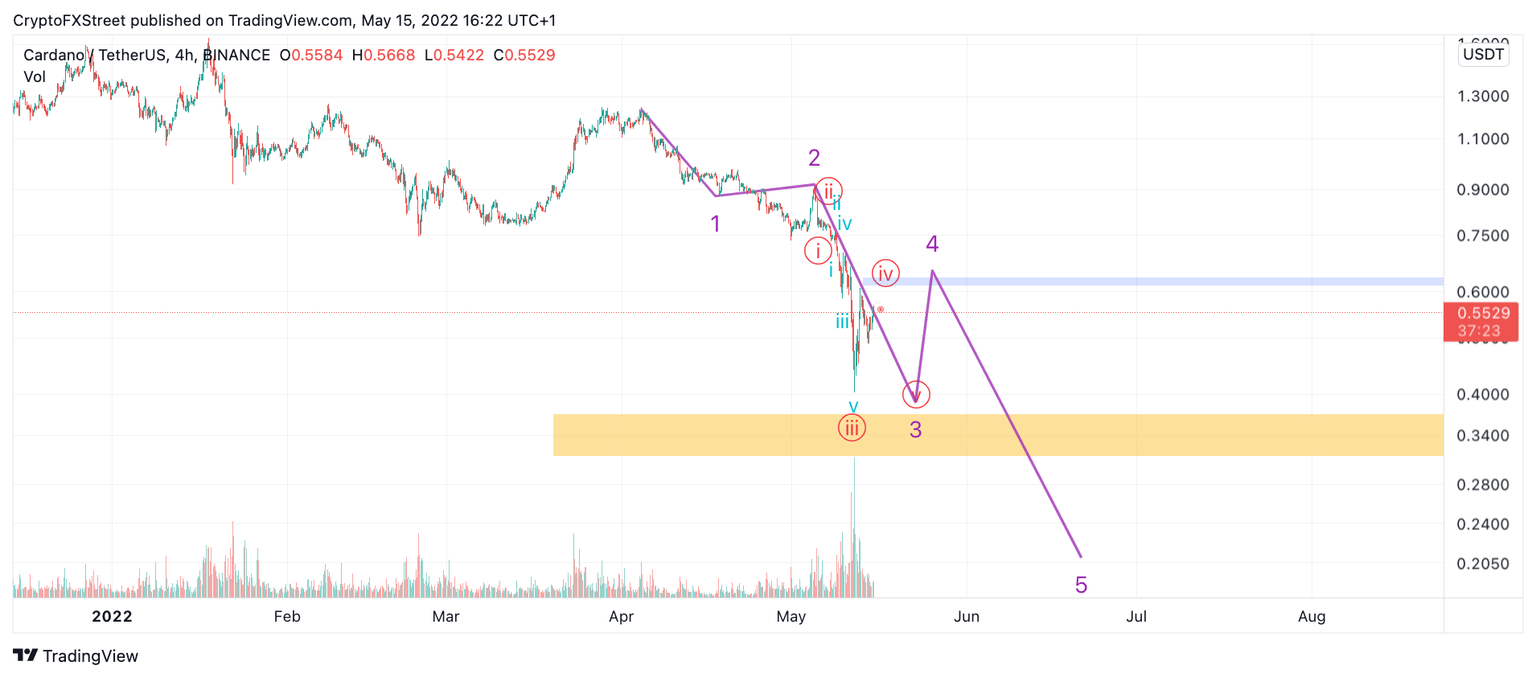

- ADA price is unfolding as an impulsive wave down.

- Cardano price shows bearish divergence on the Relative Strength Index.

- Invalidation of the downtrend is a breach at $0.87.

Cardano price could be prepping for a fatal drop to $0.20.

Cardano price final capitulation low

Cardano price could be prepping for its final capitulation low. The technicals indicate an unfolding zig-zag that can extend as far as $0.20. Traders should be very cautious as the declining wave does hint at a 20% worth of countertrend space to potentially scalp upwards from the current price of $0.55. Still, scalpers in the market should be aware they are casting rods in treacherous waters as the slope of the decline indicates the current price within an extending and unfinished wave 3.

Cardano price can either sweep the lows as early as Monday morning or truncate within the vicinity of last week's low at $0.44 before more uptrend price action occurs. Still, traders should aim to maximize the potential reward while safely managing their risks. Before entering a short position, traders should consider waiting for the final 4th leg to print in the $0.65 zone. It is worth noting that the Relative Strength Index is displaying hidden bearish signals at time of writing which further confounds the idea of additional drops in the days to come.

ADA/USDT 4-Hour Chart

Invalidation for the downtrend is a breach at $0..87. If this level were to get touched, the downtrend would be void, and the bulls could then aim for $1.20, resulting in a 100% increase from the current Cardano price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.