Is Bitcoin's safe haven narrative back as US banks start to go belly-up?

- Following the collapse of Silicon Valley Bank and Signature Bank, depositors are being urged to put their money into Gold.

- Gold and Bitcoin price movement has been pretty in sync despite facing different challenges as BTC rose above $24,000 on Monday.

- Bitcoin price is climbing to year-to-date highs, noting an almost 18% increase in the last 24 hours.

The shutdown of Silicon Valley Bank became one of the biggest bank failures in the history of the United States. But the impact of this event was not limited to just the financial sector as the crypto market took a hit as well. However, looking at the emerging pattern, it seems like Bitcoin price might have made it out unscathed, re-earning a much-talked-about tag.

Bitcoin “safe haven” again?

Bitcoin was once considered a secure investment or a low-risk asset, as it was believed to be unaffected by the fluctuations in the global financial markets before the turbulent movement of the cryptocurrency market.

This tag has also been shared by Gold, an asset class that is considered to be one of the most secure investments. The precious metal has been the same for ages as it has managed to survive the change in times and ends of civilizations and yet maintain its value.

While BTC is a relatively newer asset, it earned this tag soon after its launch but lost it recently following the rise in volatility and rising correlation with the stock markets. As a result, any major economic event resulted in a change in BTC price accordingly.

However, at the moment, it seems like the largest cryptocurrency by market capitalization is following Gold’s lead. Looking at the charts and similar recoveries, it seems like Bitcoin and Gold prices might be moving in tandem.

After recovering nearly 18% of the losses it witnessed in February, Bitcoin price is seen trading at $24,197. Similarly, Gold also took a hit but recovered soon after. So much so that GOLD and BTC’s trajectory is seemingly alike.

BTC-GOLD 1-day chart

Expectations from Bitcoin to continue mirroring the precious metal have been noted by the community, which is a good thing since many analysts have been pushing Gold over fiat. Peter Schiff, analyst and founder of Europac, has the opinion of moving toward Gold. He tweeted,

“Thanks to the Fed's bank bailout now all U.S bank deposits are at risk. That risk comes not from bank failure, but from 5+inflation. The value of all bank deposits will fall as inflation socializes the losses. Anyone with savings in a bank should withdraw it fast and buy gold.”

Another analyst, Michael, stated that Sunday’s gold sales at APMEX were the highest recorded on a Sunday.

Not to be outdone, yesterday's tracked #gold sales at APMEX were *also* the highest I've ever recorded for a Sunday.

— Michael ️ #silversqueeze (@mikesay98) March 13, 2023

Sales were 100% higher than the previous record and 626% above average! pic.twitter.com/Z9s4FMw5Aa

Thus if Gold purchasing picks up, Bitcoin will also experience a positive momentum as investors would attempt to protect their money from bank crises.

Bitcoin price takes a hike

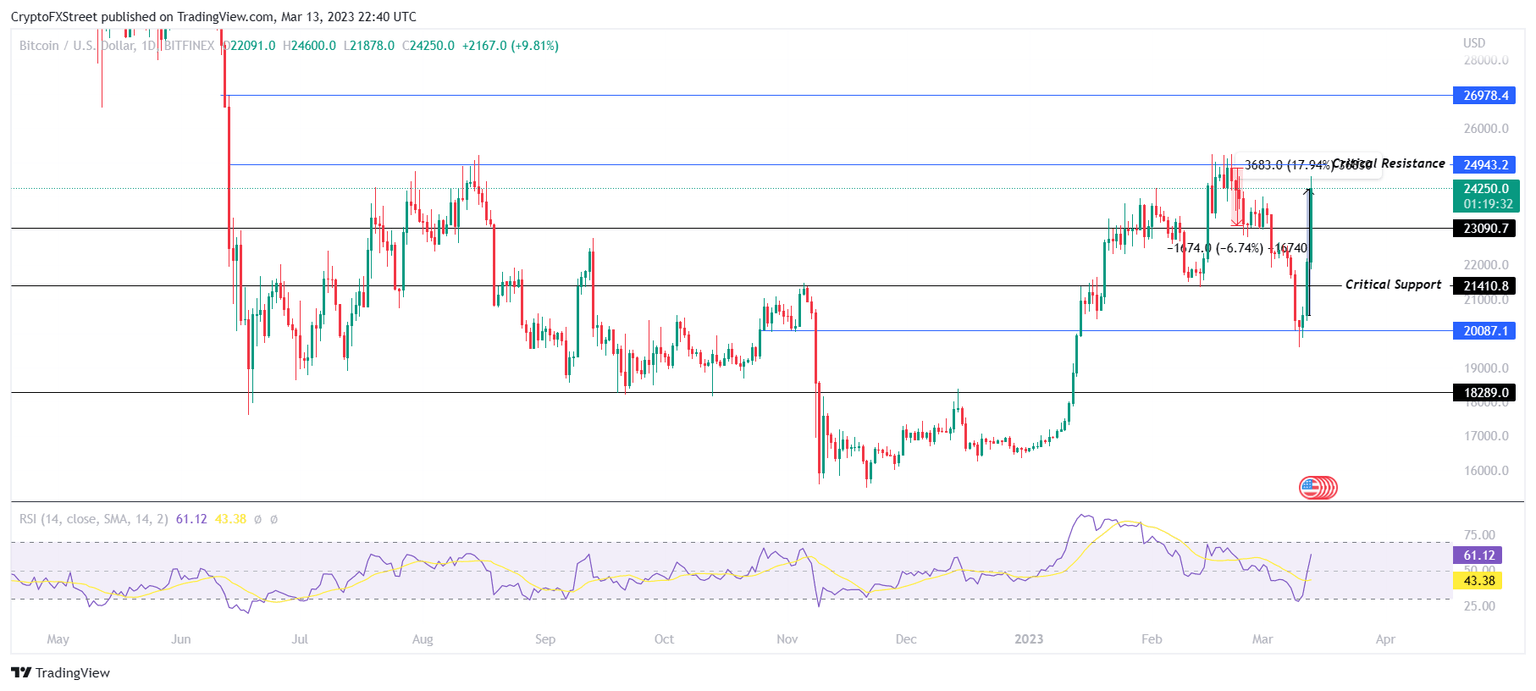

Trading above $24,000 at the time of writing, Bitcoin price managed to climb to the critical resistance at $24,943. The 18% rally in the last 24 hours has brought BTC close to breaching and flipping the resistance into support.

This would also help Bitcoin price mark a new year-to-date high as well as a nine-month high.

BTC/USD 1-day chart

But if the “safe haven” narrative turns out to be a fakeout and Bitcoin price collapses due to excessive external pressure, the cryptocurrency could fall to $21,410. This line acts as the critical support level, and slipping below it would invalidate the bullish thesis, pushing the price to $20,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.