Is Bitcoin really headed to $100,000?

Bloomberg Intelligence had a recent report on Bitcoin where they projected Bitcoin could rise to $100,000 in the next 5 years. That’s right, $100,000. This was not a ‘crypto nut’ website but a very serious financial publication making a case for significantly higher Bitcoin prices. The Bloomberg intelligence piece had a number of key points. Here are a few key ones:

-

There is limited Bitcoin supply on very favourable macroeconomic environment (low rates, QE etc).

-

The lowest volatility ever vs the Nasdaq 100 index indicates that Bitcoin is ripe to rise from the one-to-one price to index ratio entrenched for three years. The chart below shows the ratio of Bitcoin’s 260 day volatility to that of the Nasdaq reaching a new low. Bitcoin’s price first matched the Nasdaq index value in 2017 at about $6,200. It revised the level in March and has nearly doubled since then with volatility declining for Bitcoin vs it rising for the stock market. Risk is improving for Bitcoin.

-

Bitcoin supply is limited and declining on an annual percentage. The market cap is $190 billion, so too small for large investors. However, if that cap increases then it can become more like a ‘digital gold’, Gold capitalisation is around $9 trillion.

-

As stocks underperform that encourages even more QE and rising debt to GDP ratios. These are tailwinds for gold and bitcoin (via a weaker USD).

-

The rapid rise in the market capitulation of stable crypto coins indicates that central bank digital currencies are just a matter of time. In this ‘digital currency’ market who is the kingpin? Bitcoin. The digital version of gold.

-

There are favourable trends in decentralised finance (DeFi) and exchanges (DEXs).

-

About 90% of the 21 million Bitcoins that will ever be mined have been.

-

Bitcoin is correlating more closely with gold. On a 52 week basis, Bitcoin is the most correlated to the metal in the Bloomberg Intelligence’s database since 2010. When futures were launched in 2017 the Bitcoin to gold relationship was closer to zero vs about 0.44 now.

-

Bitcoin looks to be the leader in a paradigm shift towards digital money and stores of value. It may fail, but the Intelligence piece sees this as unlikely as On-Chain indicators show a solidifying foundation. Read here to understand On-Chain metrics. The Bitcoin has rate continued to increase and has reached new highs.

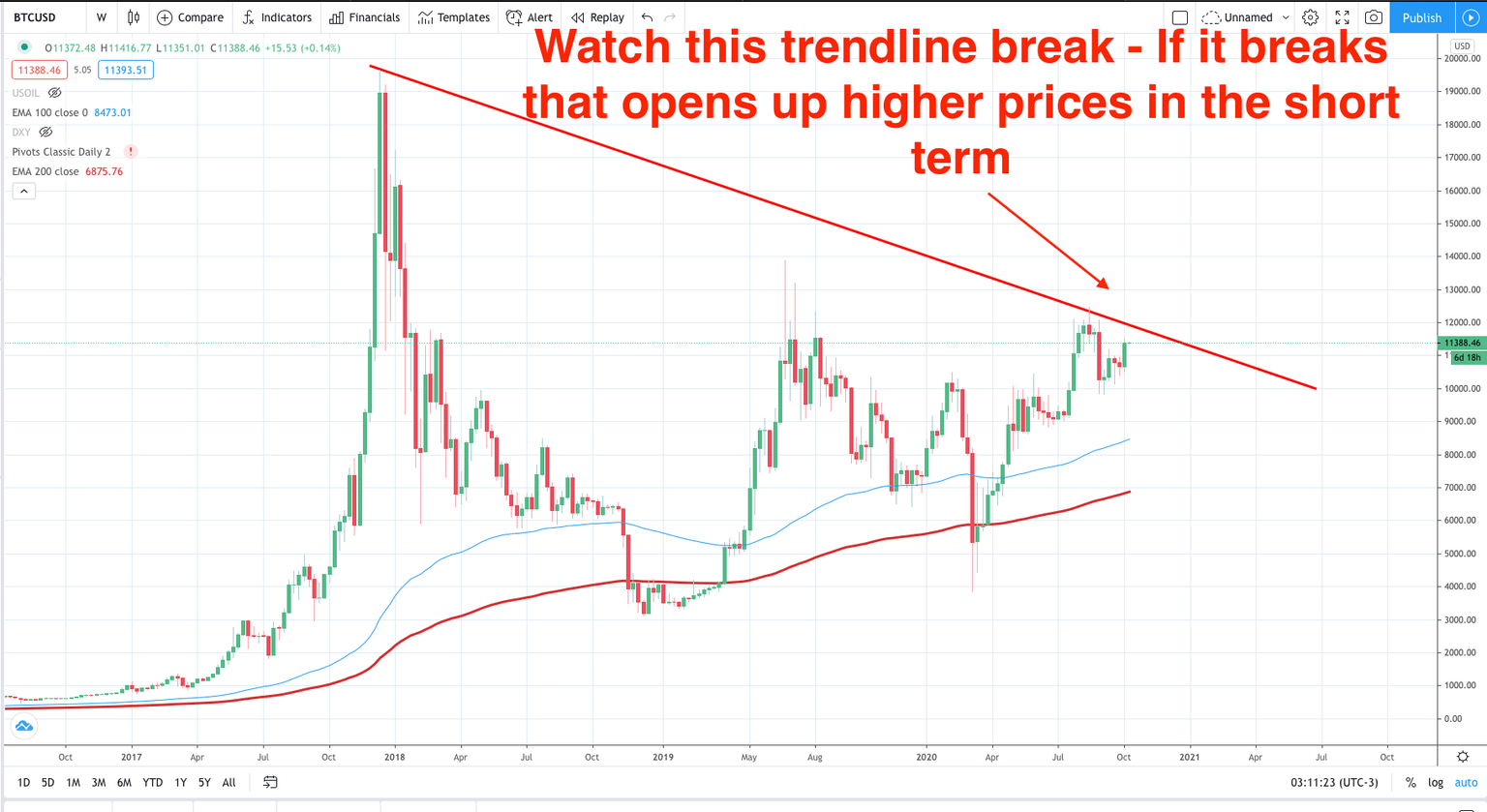

Looking at the technicals there are a few key points ahead. Check out this break of the daily trend line highlighted last week. The break of the monthly trend line would be a great sign for Bitcoin bulls and necessary for any hopes of Bitcoin reaching $100,000.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.