- Bitcoin supply in loss reached an eight-month low of 6.1 million BTC, indicating that asset holders could sell their holdings while profitable.

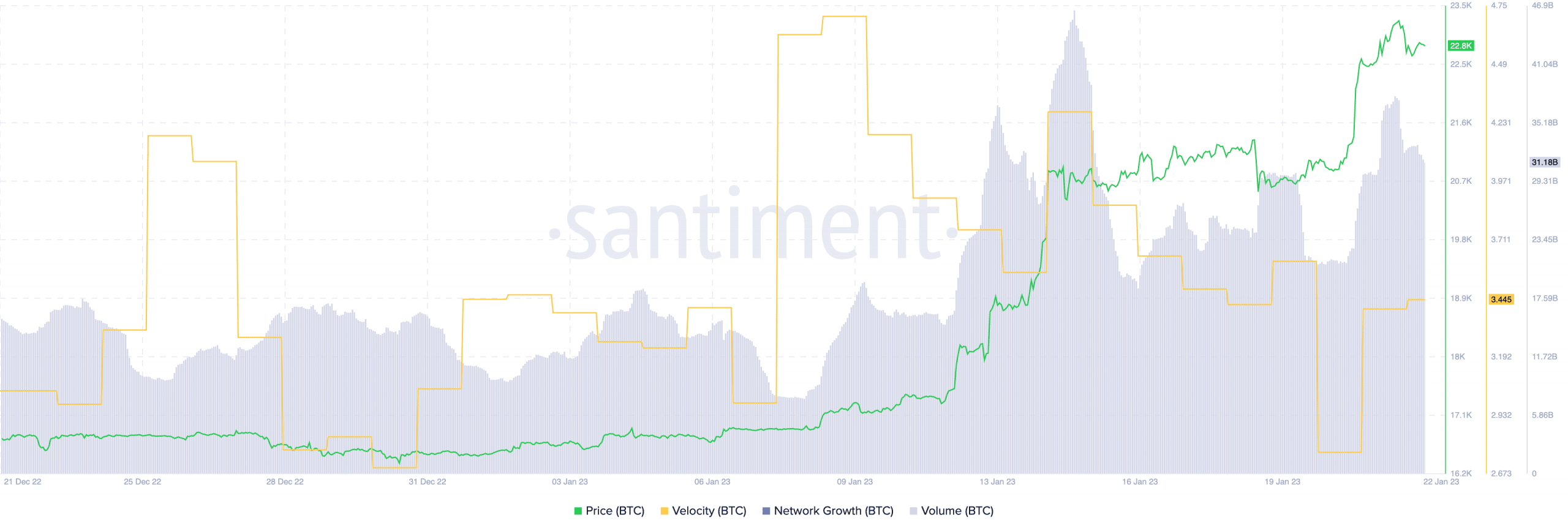

- Bitcoin velocity, a metric that measures how quickly BTC is circulating, declined since January 9; wallet addresses are holding on to their BTC.

- BTC price has been volatile, driven by trader sentiment, and technical indicators MVRV and RPV ratio.

Bitcoin price witnessed increased volatility in the last seven days (since January 16) driven by a mix of factors, including trader sentiment, Bitcoin velocity, and various technical indicators, like the MVRV and RPV ratios.

According to data from technical indicators, the enthusiasm among bulls is on a decline and the asset is currently overvalued. Bitcoin’s bull run is in jeopardy, unless positive sentiment among BTC holders drives the cryptocurrency’s price higher.

Also read: Bitcoin, Ethereum, XRP and Cardano have more meat on the bone, rank in undervalued assets in 2023

Have Bitcoin bulls lost enthusiasm, according to MVRV and RPV ratios?

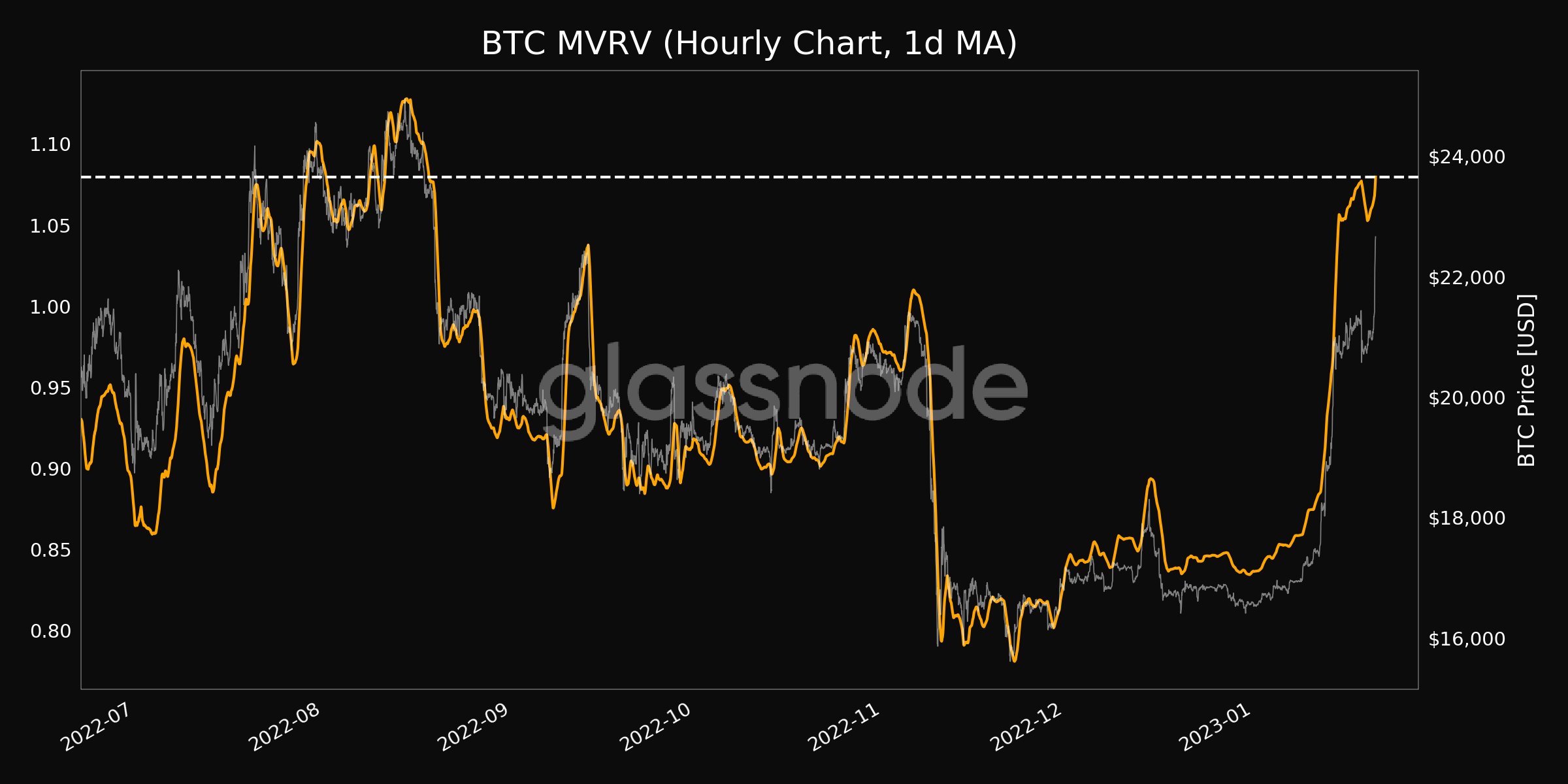

The MVRV ratio, or Market Value to Realised Value ratio, is a useful metric for gauging the current price of Bitcoin relative to its historical value. It takes into account the total market capitalization of Bitcoin, as well as its realized capitalization, which is the price that investors have actually paid for their Bitcoin.

Bitcoin MVRV

When the MVRV ratio is high, it indicates that the price of Bitcoin is overvalued, while a low ratio suggests that the price is undervalued. Currently, the MVRV ratio is higher than it was at the start of the week, indicating that Bitcoin may be overvalued.

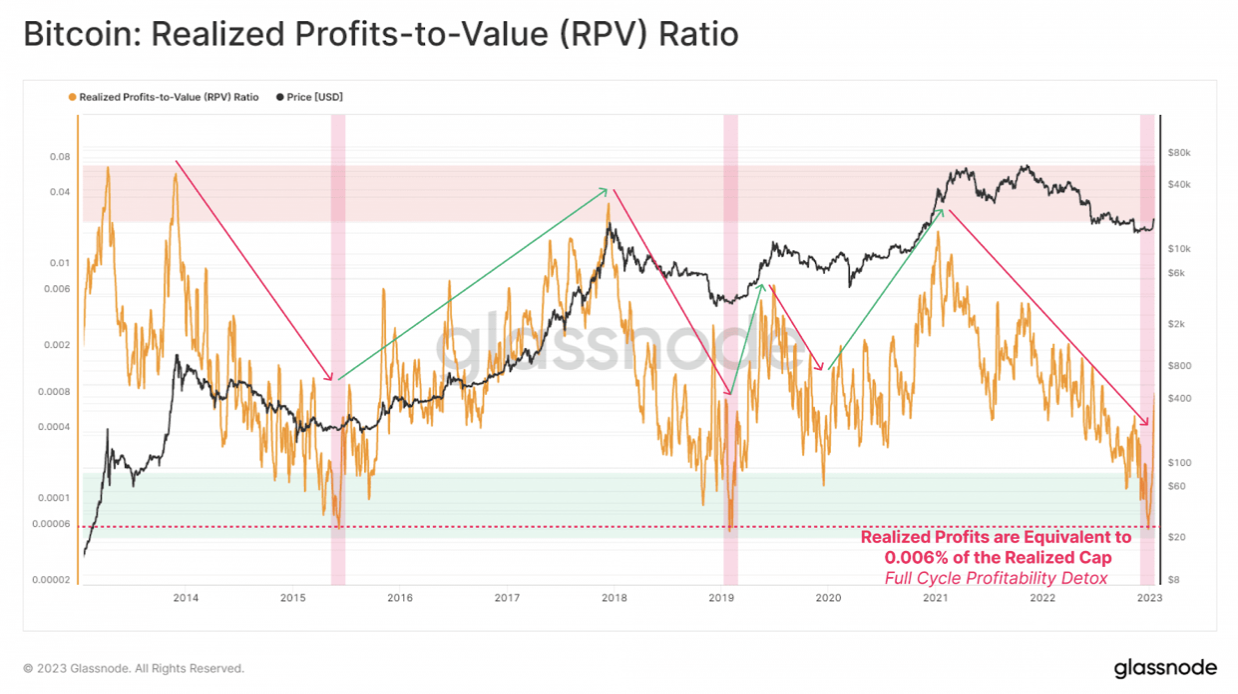

Bitcoin’s Profits-to-Value Ratio (RPV) declined significantly over the last seven days. This ratio compares profit-taking in the market against the valuation of the Bitcoin network and suggests enthusiasm for the BTC bull run has declined.

Bitcoin RPV ratio

The two technical indicators suggest that the BTC bull run is likely in jeopardy. In addition to the MVRV and RPV ratios, Bitcoin velocity is another important indicator of the current market sentiment.

Bitcoin velocity signals sentiment among BTC traders is bullish

Bitcoin velocity measures the rate at which Bitcoin is exchanged between market participants. When Bitcoin velocity is high, it indicates that traders are actively trading Bitcoin and that the market sentiment is bullish. Currently, Bitcoin velocity is higher than it was at the beginning of the week, suggesting that traders are bullish on the cryptocurrency.

Bitcoin velocity

Finally, the overall trader sentiment is also highly influential in determining the current value of Bitcoin. When the sentiment among traders is positive, the narrative is bullish and it is likely to drive demand for the asset. According to data provided by Coinglass, 51.2% of all open positions were long on Bitcoin. This implies that traders are still optimistic about the future of Bitcoin and believe that it will continue to rise in value.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.