Is Bitcoin (BTC) ready to grow faster than altcoins?

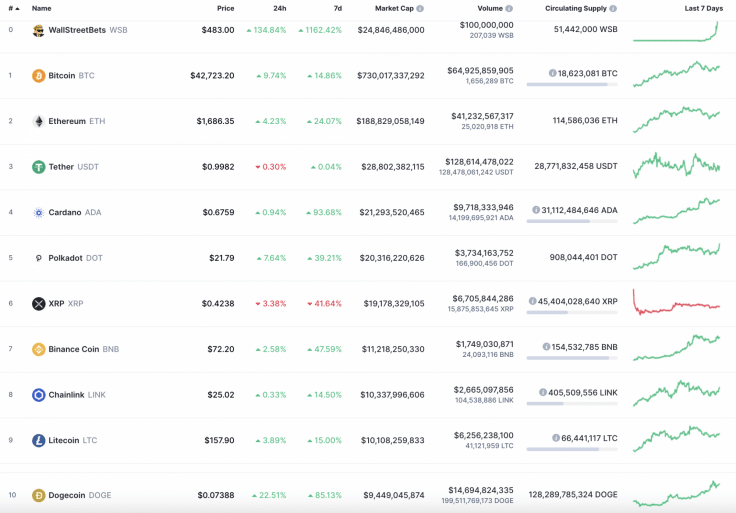

The new week has begun with the continued rise of most digital assets. Only XRP is trading in the red zone, falling by 3.38% over the past 24 hours.

Top 10 coins by CoinMarketCap

BTC/USD

Last weekend, the Bitcoin (BTC) price overcame the resistance of $40,000 and tested the level of $41,000, but bears did not allow the pair to gain a foothold above $40,000.

On Sunday night, sellers rolled back the price to the two-hour EMA55, and yesterday afternoon they pierced the level of average prices, coming close to the support of $37,300. Sales did not exceed the daily average and the decline stopped.

BTC/USD chart by TradingView

Today, Bitcoin (BTC) has set a new peak at $45,000, having confirmed the bulls' power. According to the chart, traders may expect a retest of the $42,000 mark before the growth continues. If that happens, there are chances of seeing the main crypto trading around $50,000 by the end of the month.

Bitcoin is trading at $43,677 at press time.

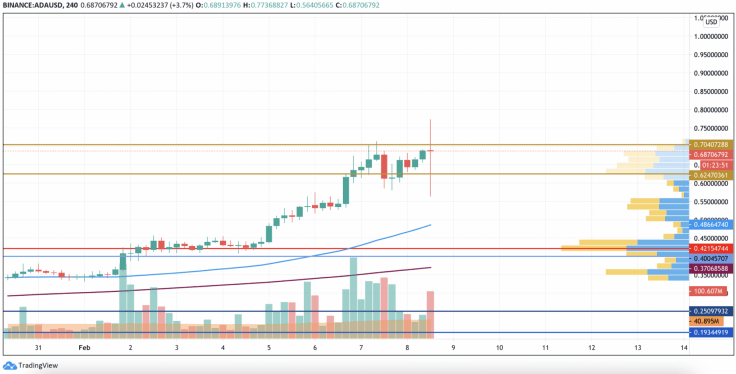

ADA/USD

The rate of Cardano (ADA) has slightly risen since yesterday as the price change has accounted for only 1.19%.

ADA/USD chart by TradingView

On the 4H time frame, Cardano (ADA) needs the energy to keep the rise based on the long wick. In this case, sideways trading in the range of $0.62-$0.70 is the more likely scenario for the next few days.

Cardano is trading at $0.68 at press time.

BNB/USD

Binance Coin (BNB) has shown bigger growth than Cardano (ADA) as the rise has made up almost 5%.

BNB/USD chart by TradingView

From the technical point of view, Binance Coin (BNB) is looking similar to Cardano (ADA) as it also needs power for continued growth. In this regard, the false breakout of the support at $69.70 may occur, followed by a future rise.

Binance Coin is trading at $74.64 at press time.

XLM/USD

Stellar (XLM) is the only coin from our list that is located in the bearish zone. However, its long-term projection is bullish as it is about to break the vital resistance at $0.44.

XLM/USD chart by TradingView

Stellar keeps trading in the rising channel, which means that bulls are not going to seize the initiative. Thus, if buyers break the $0.44 mark, the vital level of $0.50 may be achieved shortly.

Stellar is trading at $0.3968 at press time.

AAVE/USD

AAVE is the biggest gainer today as its rate has rocketed by 14% since yesterday.

AAVE/USD chart by TradingView

Despite today's sharp growth, there is almost no power left for bulls to keep the rise. All in all, trading in a wide range between $400 and $550 is the more likely price action in the upcoming days. This time buyers need to accumulate strength for continued growth.

AAVE is trading at $504.95 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.