- Bitcoin has shaved 6% of its value since Iran's missile attacks on Israel.

- Gold has surged amid Bitcoin's plunge in the midst of geopolitical tensions.

- Bitcoin has shown better performance over a longer period than the precious metal.

Following Bitcoin's 6% decline since Iran's missile attack on Israel, several investors are questioning whether the cryptocurrency's alleged "safe haven" status still holds.

Bitcoin has declined while gold holds steady

Bitcoin has been on a decline since Tuesday following heightened war tensions between Israel, Hamas, Hezbollah and Iran. The top cryptocurrency, often dubbed digital gold, shaved off over $4,000 from its value within the past 24 hours, and it now trades around the $60,000 psychological level.

Notably, Bitcoin has recorded over $192 million in liquidation since the attack.

While Bitcoin declined in the face of geopolitical tension, gold surged briefly before seeing a correction on Wednesday.

Though its supporters call it "digital gold," Bitcoin keeps proving that it is not a true safe-haven asset like real gold.

— Jesse Colombo (@TheBubbleBubble) October 1, 2024

One example is how it plunged today on reports about Iran preparing to launch ballistic missiles. At the same time, gold surged. pic.twitter.com/yiwSpArcbK

According to precious metals analyst Jesse Colombo, both assets posted similar diverging moves when Iran attacked Israel in April 2024 and another October 7, 2023 attack on the latter. While gold saw a price rise, Bitcoin plunged.

This shows that investors trust more in gold's potential to serve as a safe haven.

Bitcoin's correlation to Nasdaq 100 and S&P 500

A possible reason for Bitcoin's shift in performance during geopolitical events is its rising correlation with the Nasdaq-100 and S&P 500 in recent times. This is evidenced by how BTC rose in tandem with the index after the Federal Reserve (Fed) decided to cut rates by 50 basis points on September 18. Another key move was their sharp decline following the "yen carry trade" unwinding on August 5.

"I have long maintained that Bitcoin behaves more like a speculative risk asset, similar to hot tech stocks, rather than a safe-haven asset," said Colombo.

I have long maintained that Bitcoin behaves more like a speculative risk asset, similar to hot tech stocks, rather than a safe-haven asset.

— Jesse Colombo (@TheBubbleBubble) October 1, 2024

This is evident in how closely Bitcoin's price movement tracks the tech-heavy Nasdaq 100 Index: pic.twitter.com/WuzOiZ6VVA

Bitcoin has performed better than gold in the longer term

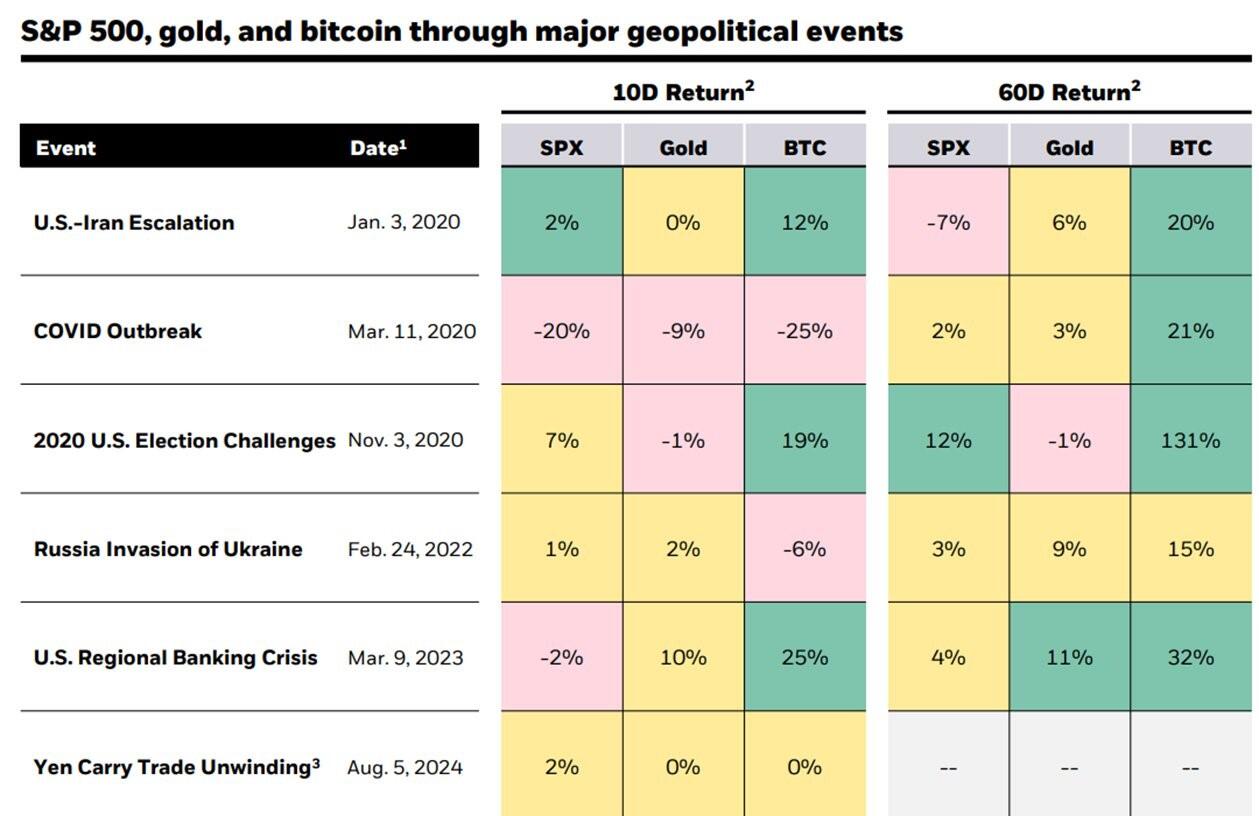

While Bitcoin may behave like traditional risk assets in the short term, a BlackRock report last month showed that it has shown more resilience than gold in the longer term during these geopolitical tensions.

Bitcoin vs S&P 500 vs Gold

Additionally, crypto community members noted that the argument for Bitcoin being a safe haven is also related to inflation. Unlike gold, Bitcoin is deflationary by design, with a predictable supply growth rate capped at 21 million BTC.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.