Is a crypto market meltdown looming after massive gains in Bitcoin, Ethereum and altcoins in January?

- Bitcoin price rallied 40% in January, amidst several bullish catalysts fueling the asset’s comeback to pre-FTX levels.

- BTC network witnessed a historic amount of profit-taking on January 30, possibly indicating a looming meltdown in the asset.

- The average exchange funding rate reveals a slight increase in long vs. short positions, prior to Wednesday’s FOMC meeting.

Bitcoin, Ethereum and altcoins yielded double-digit gains over the past month, recovering from the FTX-collapse induced meltdown. As cryptocurrency prices rallied, there was a significant increase in the supply of stablecoins in the market. On-chain metrics signaled a revival in Bitcoin after the prolonged bear market of 2022.

However, the recent shift in trader sentiment and data from derivatives exchanges signals the likelihood of a pullback in Bitcoin and altcoins in February.

Bitcoin, Ethereum prices could correct in the short-term according to these indicators

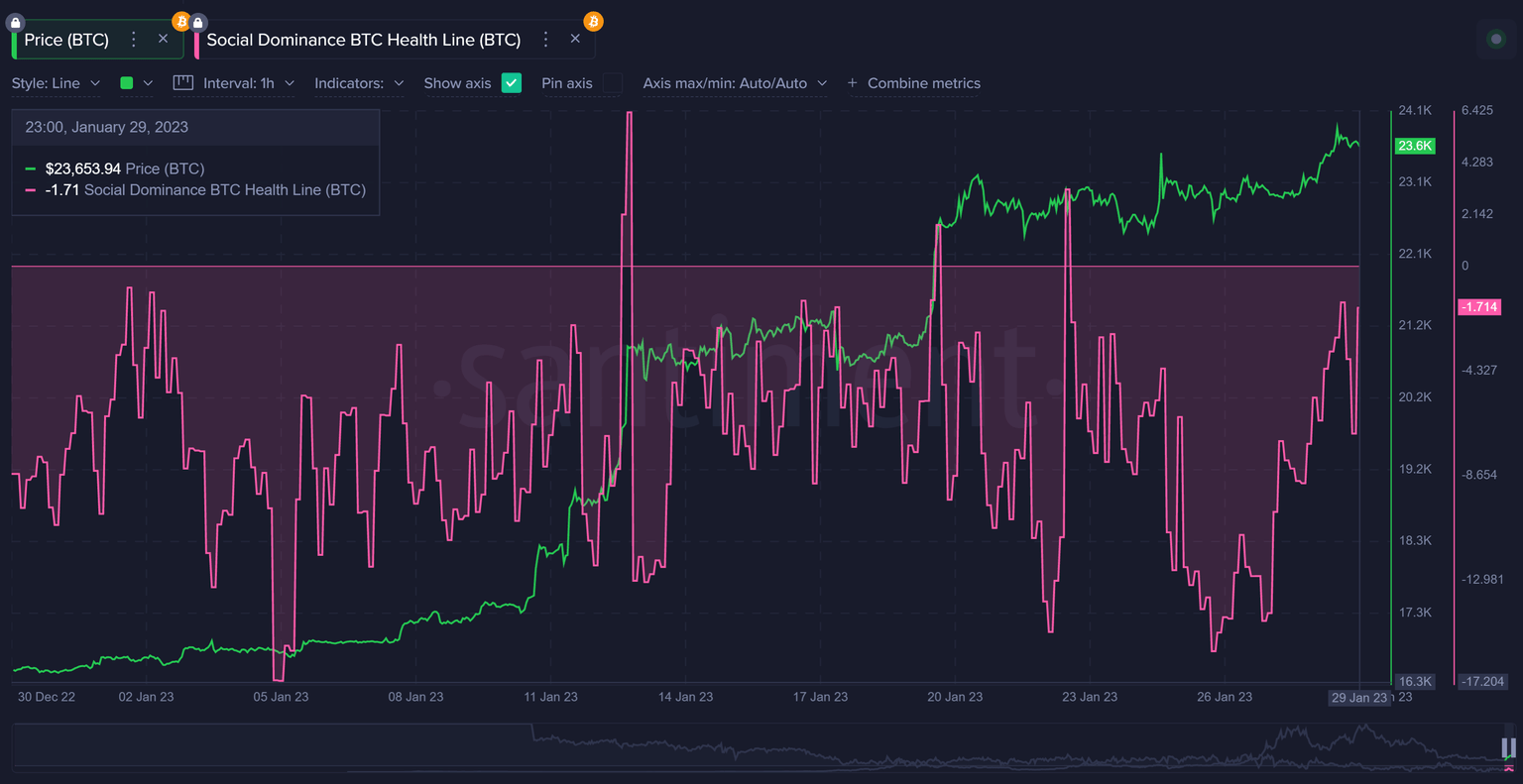

Bitcoin price rallied 40% since December 30, however, despite the massive spike in the asset’s price, social dominance, a key indicator of market health looks shaky, at close to 20% across top social media platforms.

BTC Social Dominance

The spike in Bitcoin price back to the $23,000 level occurred despite a lack of social discourse about the asset among market participants. Typically, this is considered an indicator of greed among traders who believe price can still go higher even if there isn’t much of a buzz around the asset.

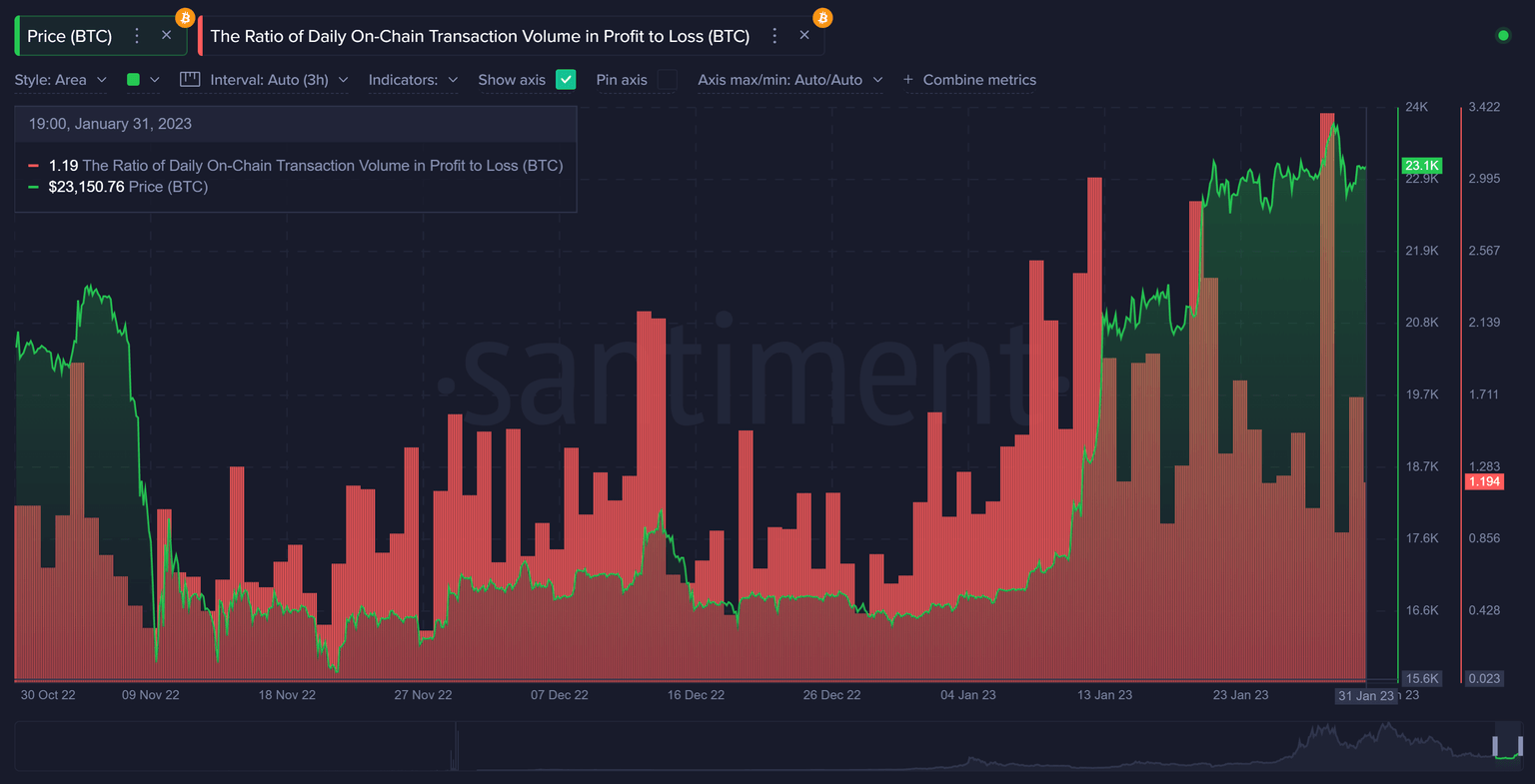

The Bitcoin network noted a historic amount of profit taking on January 30, in line with the lack of social dominance and greed among market participants.

Ratio of On-Chain Transactions in Profit to Loss (BTC)

The spike in profit taking ended up in an immediate correction in Bitcoin price and the $23,000 level seems like a key resistance level for the asset on its journey to the $30,000 target. It remains to be seen where Bitcoin price will head when enough profit takers have shed their holdings above $23,000.

A sustained rally would require an influx of new capital into Bitcoin across exchanges and a reduction in profit-taking by large wallet investors. Currently the average trading returns for traders who acquired BTC 30-days ago is 10.6%.

Historically, pullbacks have typically occurred when 30-day profits for traders climbed above 15%. Thus, while this number remains below 15%, there is room for Bitcoin to continue its climb.

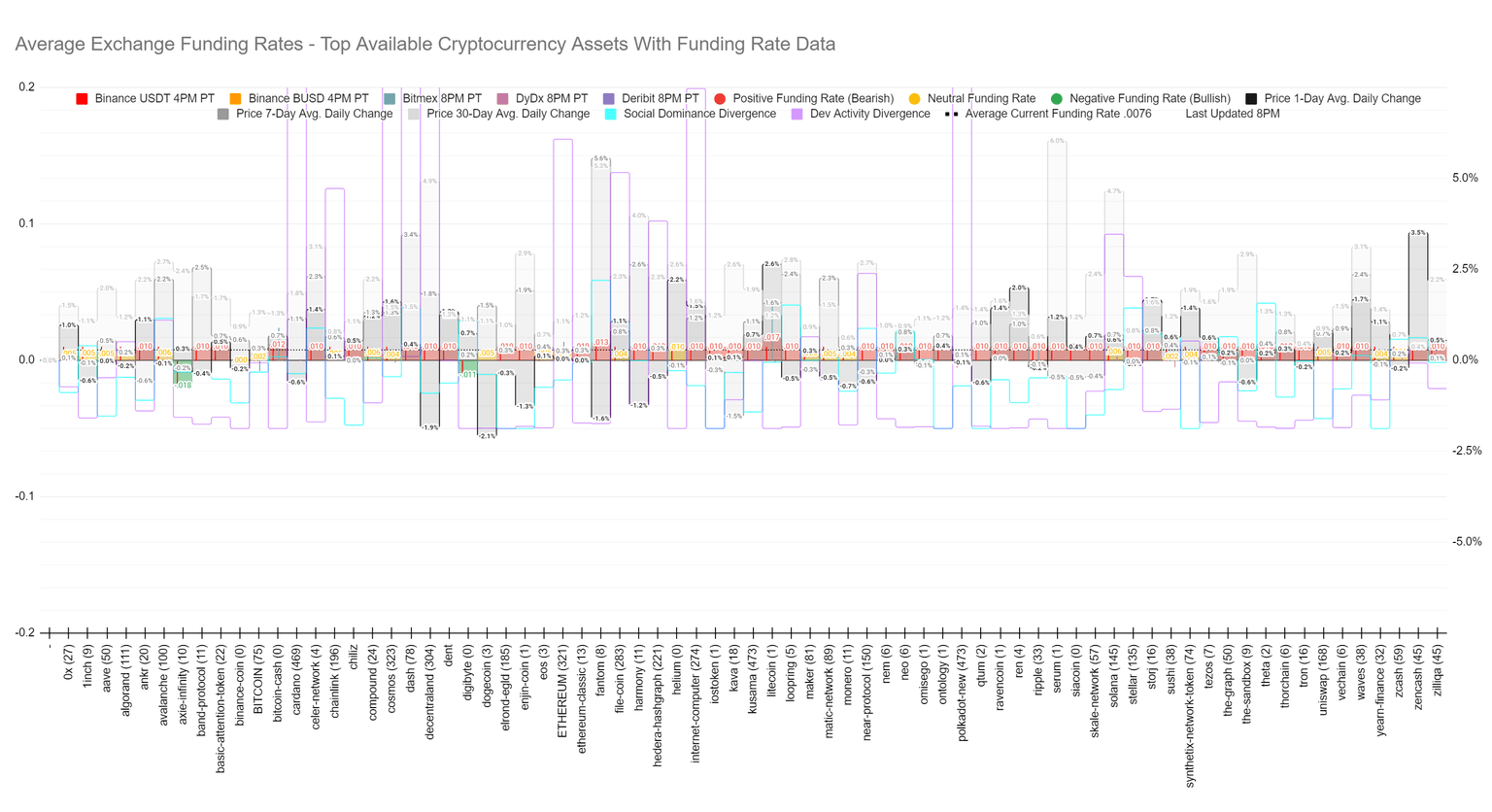

Derivatives traders show slight bullish bias, will this last in February?

The metric used to read whether traders are putting their money where their mouths are is the Average Exchange Funding Rate. After nearly 40% increase in Bitcoin market capitalization since the beginning of 2023, there is a mild long bias among derivatives traders.

Average Exchange Funding Rates

For most assets in the chart above, there are red bars (more long positions than short), however the difference remains slight. This means markets can move either way, and suggests Bitcoin and Ethereum prices could be shaped by the outcome of the Federal Open Market Committee (FOMC) meeting concluded on Wednesday.

Crypto traders are closely watching Jerome Powell’s speech to ascertain whether the US Federal Reserve will resume its hawkish bias after the January rally in equities and risk assets (cryptocurrencies). If the Fed’s stance is hawkish, market participants might shed their Bitcoin, Ethereum and altcoin holdings in a knee-jerk reaction, pulling capital out of risk assets.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.