- “I believe that joining the IOTA Foundation Board of Directors will help me to achieve this dream in good time,” Sergey Ivancheglo.

- IOTA has recovered tremendously above the lows at $0.40, the buyers are focused on $0.50 resistance level.

IOTA is delighted to welcome a new member, Sergey Ivancheglo to the IOTA Foundation Board of Directors. The announcement was made via Twitter on August 14. The detailed announcement on the Medium said that Sergey is a graduate of Bachelor of Science with a major in electronics and artificial intelligence. He has over 20 years of experience working as a software engineer. Significantly, Sergey has been working primarily on Distributed Ledger Technology since 2011.

Sergey is known as the pioneer of various technologies (“next-gen”) specific to the DLT community. He also developed Nxt prior to co-founding IOTA. Nxt was among the initial crypto projects that focused on harnessing the power of blockchain beyond Bitcoin. He is also part of the pioneers of Proof-of-Stake (PoS) consensus algorithm, in addition to implementing (PoS). On joining the Board of Directors Sergey said:

“A long time ago I decided that I would dedicate that decade to achieving my dream of constructing a globally shared illusion in VR. To make that possible, I aim to finish everything I started — that includes Economic Clustering, the technology currently called “NBPoW” and other things. I believe that joining the IOTA Foundation Board of Directors will help me to achieve this dream in good time.”

IOTA price analysis

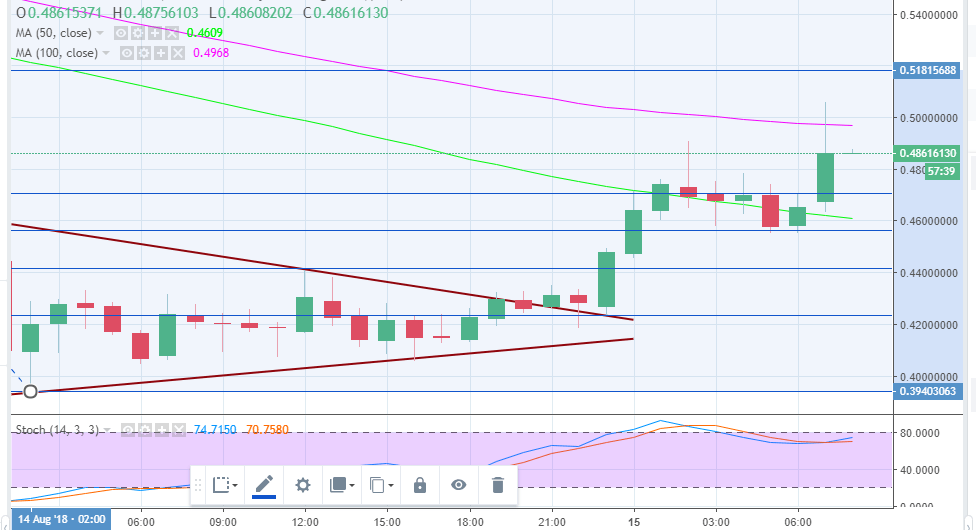

IOTA recently declined below the major support at $0.54 while the next vital support at $0.50 failed to hold. The price traded marginally below $0.40 before regaining balance yesterday. However, the resistance at the 38.2% Fib level of the last drop from $0.518 to $0.3940 at $0.441 capped the gains.

The support at $0.440 held ground during the trading session yesterday and the IOTA broke out of the contracting triangle resistance at $0.4271. IOT/USD spiked toward the close of the session and exchanged hands above $0.46. The upside trend continued during the Asian trading hours today. Moreover, the bullish trend does not seem to be slowing down in the European trading hours. IOTA is up a whopping 12.52% on the day in addition that, it has broken the resistance at the 61.8% Fib level around $0.47.

The price is currently trading at $0.486 while heading toward the broken support resistance at $0.50. The 100 hourly moving average will offer resistance at $0.4968. Therefore, the buyers will have a hard time clearing the resistance between $0.49 and $0.4968 but a break above $0.50 will help the buyers to formulate another upward trajectory.

On the downside, the 50-day moving average on the same chart will work as a support at $0.46 while the former resistance at $0.440 is a stronger support area.

IOT/USD hourly chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.