- IOTA is one of the worst-perfroming coins, down 8% in the recent 24 hours.

- The critical support is created by psychological $0.2000.

IOTA is the 23th largest digital asset with the current market value of $578 million and an average daily trading volume of $12 million. The coin has lost over 8% in the recent 24 hours and over 6% since the start of Monday to trade at $0.2077 at the time of writing. IOT/USD is moving within a short-term bearish trend in sync with the market.

IOT/USD: Technical picture

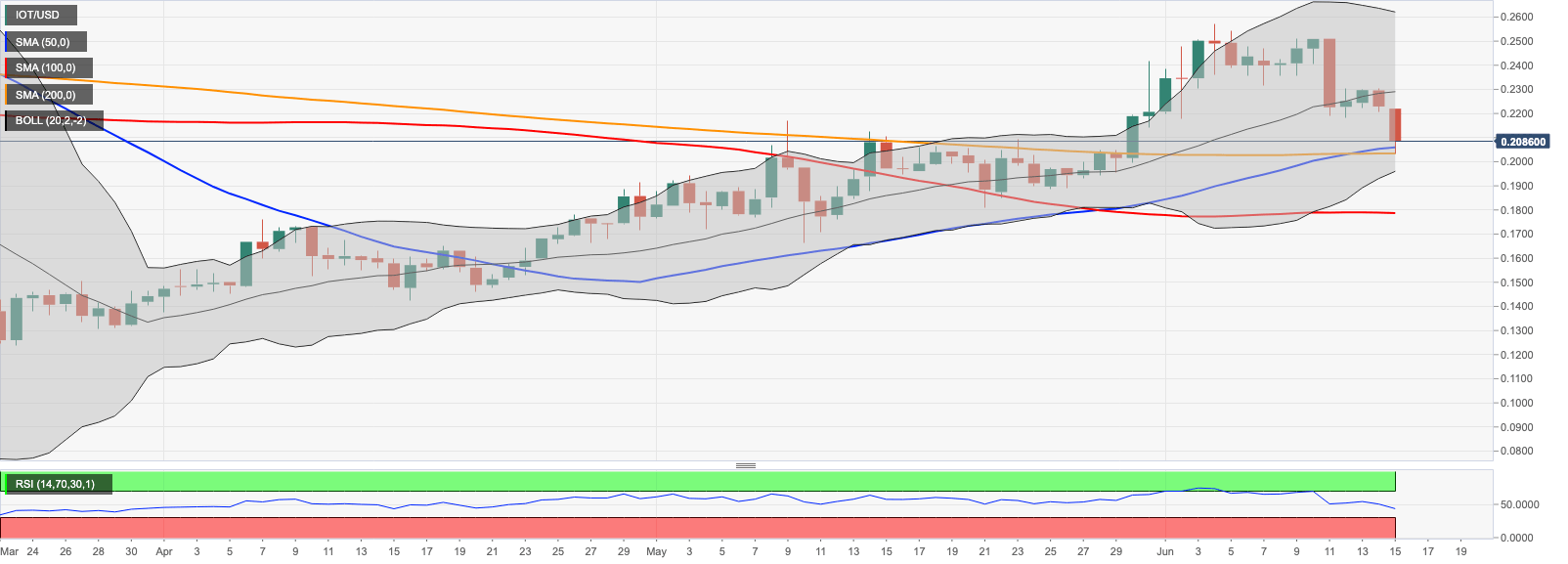

IOT/USD touched the intraday low at $0.2031 and rebounded above a cluster of daily SMA200 and SMA50 at $0.2050. Now this area serves as a local support for the price. Once it is out of the way, the sell-off is likely to gain traction with the next focus on psychological barrier of $0.2000, which is followed by the lower line of the daily Bollinger Band at $0.1958.

The downward-looking RSI on the daily chart implies that the bearish pressure is here to stay with the ultimate downside goal at $0.1800 reinforced by daily SMA100 at $0.1780.

On the upside, we will need to see sustainable move above $0.2200-$0.2220 the upside to gain traction. This area contains the daily opening and a lower boundary of the weekend channel. If it is passed, the upside momentum may gather pace and take the price towards psychological $0.2300 with the middle line of the daily Bollinger Band located right below this barrier.

IOT/USD daily chart

The RSI on an intraday chart attempts a recovery out of the oversold territory; however, there are no clear signals of reversal as yet. The above-mentioned resistance area of $0.2000-$0.2200 is confirmed by 1-hour SMA50 and followed by SMA100 at $0.2260. The upper boundary of the short-term consolidation channel and the upper line of the 1-hour Bollinger Band adds strength to $0.2300.

IOT/USD 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

President Trump's memecoin leads crypto unlock with incoming supply pressure of over $320 million

Official Trump, launched by President Trump, will unlock over $320 million worth of its tokens to team members next week despite the dominant risk-off sentiment across the crypto market.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve, hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin holding steady at $82,584, Ethereum at $1,569, and Ripple maintaining its position above $2.00.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Crypto traders are digesting US President Donald Trump’s Liberation Day announcements last week, the tariff truce declared on Wednesday and the worsening situation with China, as the industry wraps one of its worst weeks in terms of price swings.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637278170549818812.png)