IOTA Price Analysis: IOTA scored by Crypto Ratings Council, the coin goes into recovery mode

- The Crypto Ratings Council now has scores for the cryptocurrency IOTA.

- IOT/USD is recovering together with the market.

IOTA is the 24th largest digital asset with the current market value of $429 million and an average daily trading volume of $12 million. At the time of writing, IOT/USD is changing hands at $0.1528. The coin has gained over 4% in the recent 24 hours, though it is still lower from Thursday's high at $0.1554.

Crypto Ratings Council lists IOTA

The Crypto Ratings Council issued its rating for the IOTA token, which is considered a significant development for the project. The Council is created by cryptocurrency industry leaders, including Coinbase, to provide the US authorities with a better understanding of the nature cryptocurrency assets.

The scores created by this self-governing body follow case law and SEC guidance to determine whether an asset may be considered as a security. Commenting on the news, IOTA Foundation wrote in its blog post:

The CRC has recommended a score of 2.0 for IOTA. This is a strong score for the IOTA technology, community and ecosystem, as it shows our commitment, since day one, of positioning the IOTA token as a real-world value transfer mechanism between humans and devices in the machine economy.

IOT/USD: Technical picture

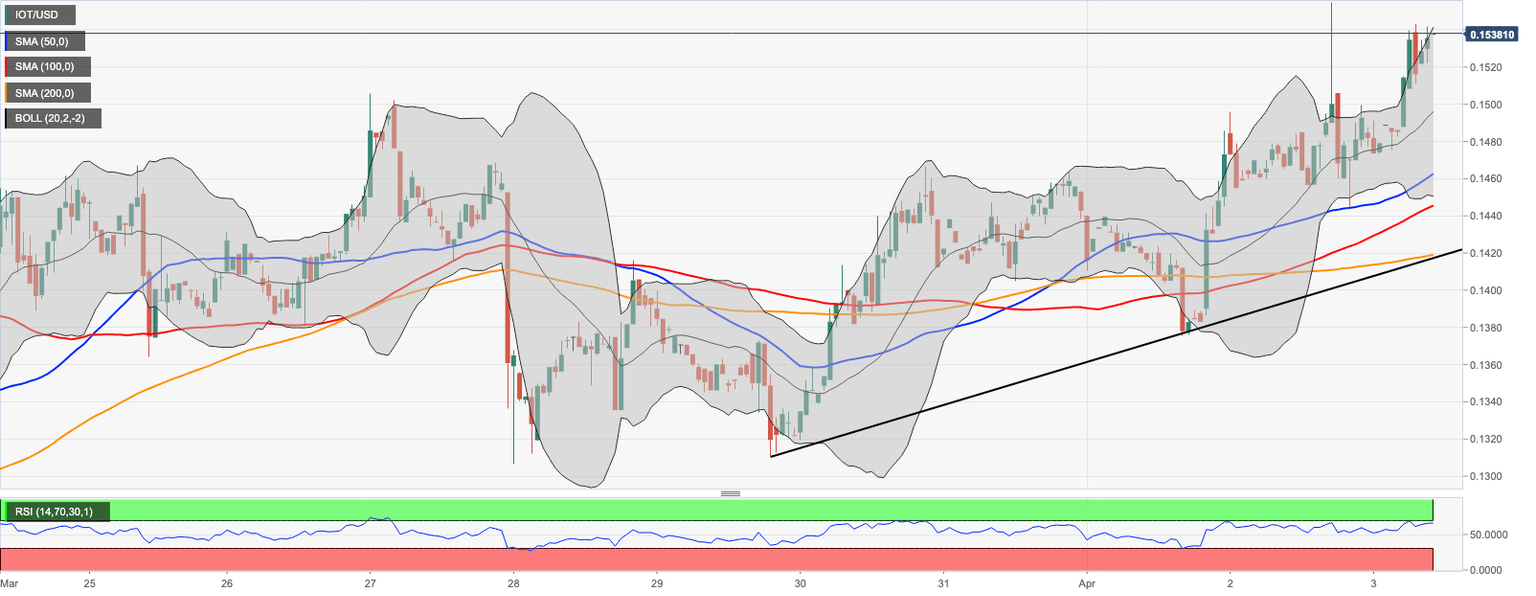

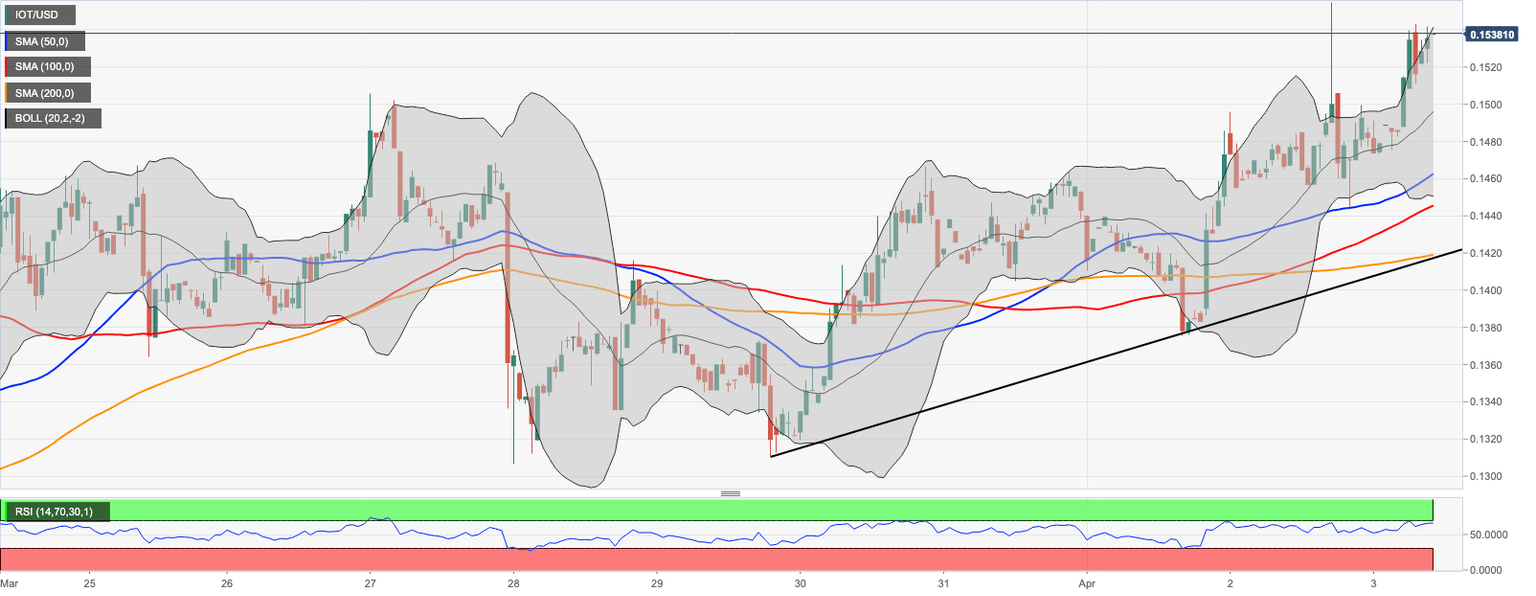

IOT/USD is testing the local resistance created by the upper line of 1-hour Bollinger Band at $0.1540. Once it is out of the way, the upside is likely to gain traction with the next focus on Thursday's high of $0.1554 and psychological $0.1600. This barrier is likely to slow down the recovery and trigger a short-term correction with the initial downside aim at $0.1500, reinforced by the middle line of 1-hour Bollinger Band. This support is followed by SMA50 1-hour at $0.1460 and SMA100 1-hour at $0.1440. The overall trend remains bullish as long as the price stays above $0.1420-$0.1400 area. SMA200 and the upside trend line located in the above-said zone will serve as a strong backstop.

IOT/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst