- IOTA partners with Kontakt.io as the price explores new May lows.

- IOT/USD could continue to correct lower toward the weekend trading session.

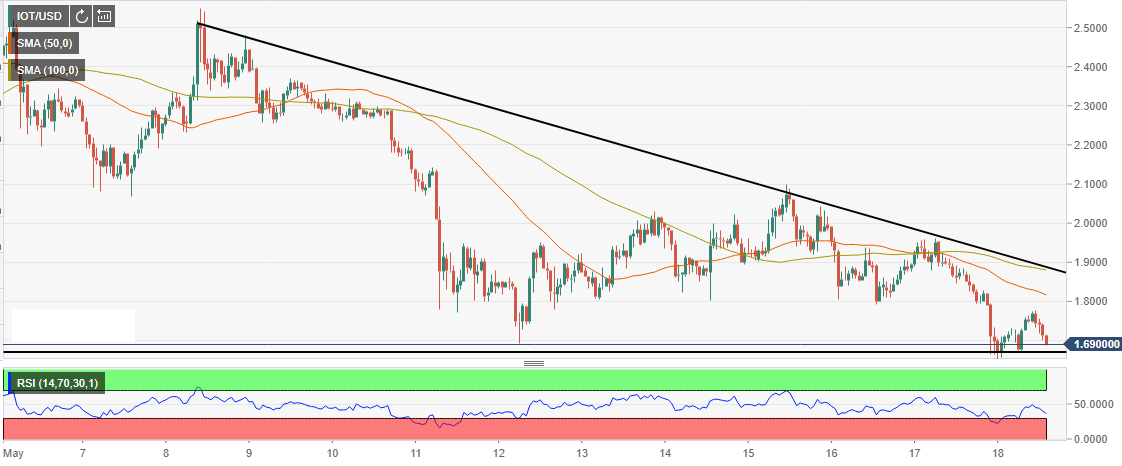

IOTA price is threatening to break below the immediate support level at $1.60. On the other hand, the upside has also been limited within a contracting triangle as seen on the chart. Attempts to correct higher have led to successive minor crashes where IOT/USD is trading lower highs and lower lows.

Although IOTA is drowning in selling pressure like the other major coins, the network has been making strides to ensure that IOTA has a future. The latest partnership is with Kontakt.io according to a Twitter message released on Thursday 17. Kontakt.io is a platform for sharing location that has been built to ensure sales are secured. An official blog post by Kontakt.io comments on the partnership:

“By leveraging mechanisms of Distributed Ledger Technology, the Kontakt.io and IOTA solution is going to ensure that device-to-device and device-to-cloud communication of telemetry streams is encrypted and the data itself is unalterable. Manufacturers, carriers, inspectors, technology providers, and consumers alike will benefit from this technology. It will increase trust and transparency, ease dispute resolution, result in better compliance breach detection, and consequently prevent faulty products from being delivered to consumers.”

This type of partnership is to cement the future for IOTA, besides they help to develop the ecosystem. The price might not react to this partnership with Kontakt.io but it is positioning itself as a go-to platform for the Internet of Things solutions.

IOTA price is exchanging hands at $1.69 but there is a slopping trend in progress on the charts. IOT/USD is immediately supported at $1.60, while on the upside the immediate resistance is at $1.80. The next target is at $2.0 but the selling pressure at $1.9 must be overcome to allow the cryptocurrency to gain momentum. The Relative Strength Index (RSI) is approaching the oversold levels at 30 which could signal buyers to enter the market. However, the simple moving averages on the same 1-hour chart signal the dominance of sellers towards the close of the session.

IOT/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

This week could be explosive for ETH: Ethereum ETFs to debut in the US on Tuesday

Ethereum (ETH) is down nearly 1% on Monday as the Securities & Exchange Commission (SEC) confirmed via its website on Tuesday that it has given the final approval for spot ETH ETFs. Considering the ETH ETF launch and the upcoming Bitcoin Conference, this week could prove crucial for Ethereum.

SEC gives final approval for Ethereum ETFs to begin trading

The Securities and Exchange Commission (SEC) approved the S-1 registration statements of spot Ethereum ETF issuers on Monday, making it the second digital asset ETF to go live in the US, according to the latest filings on its website. The approval is also visible across the websites of the various asset managers that applied for the product.

Could Donald Trump and Elon Musk provide Bitcoin's bullish spark?

Trump could use Justice Department's 200,000 BTC as headstart for potential Bitcoin reserve, says analyst. Elon Musk hints at potential Bitcoin endorsement after US dollar value destruction post and laser eyes profile picture. The bearish crowd has remained silent since Bitcoin's two-week rebound.

Crypto investment products continue positive run after $1.35 billion net inflows

CoinShares' weekly report shows that crypto investment products saw a third consecutive week of inflows. Bitcoin saw inflows of $1.27 billion, with short-bitcoin recording more outflows. Ethereum-based products outperformed Solana on year-to-date inflows.

Bitcoin: Will BTC continue its bullish momentum?

Bitcoin (BTC) price increased by 5.5% this week until Friday after breaking above a descending trendline. Currently, it is trading slightly higher by 0.23% at $64,166.