- The team announced the release of the first of IOTA 1.5 upgrades.

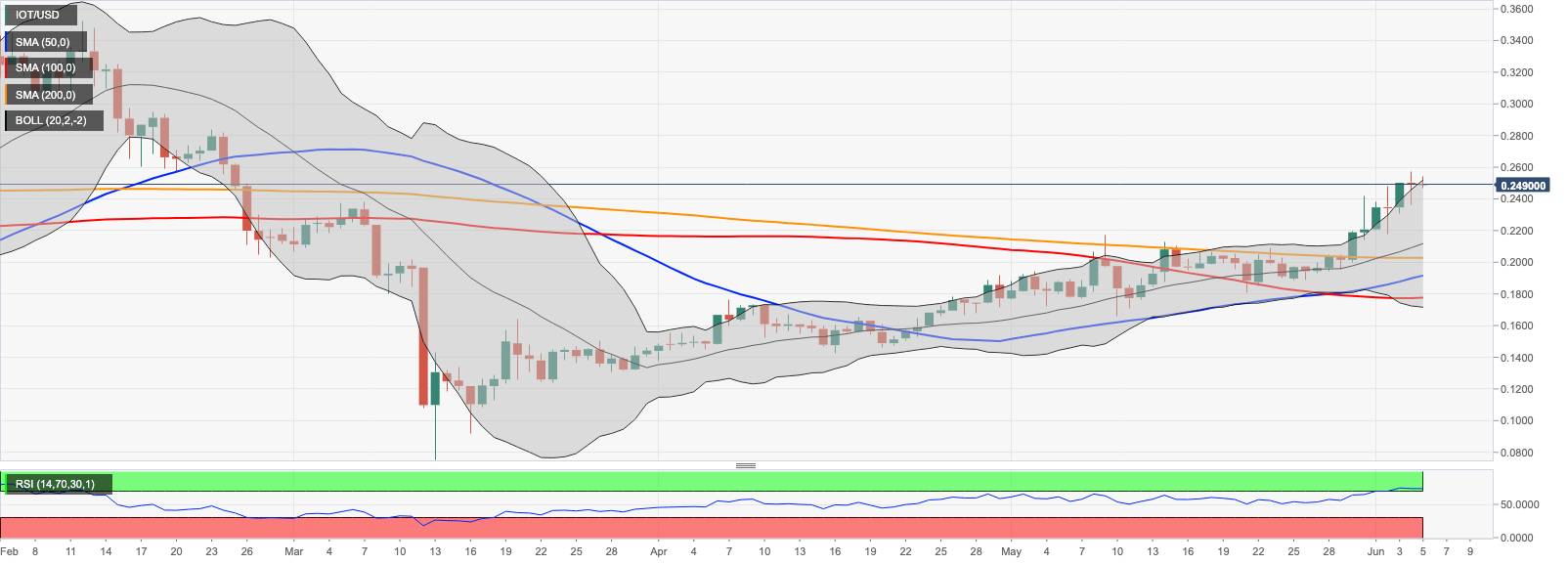

- IOT/USD has printed an Evening Star on a daily chart.

IOTA has announced a major upgrade to its Hornet node software, which is the first performance upgrade in IOTA 1.5. the first in a series of planned protocol upgrades. According to the developers, the new version will lead to an increased adoption, improve decentralization and enhance network performance for IOTA stakeholders.

Hornet consumes 10 times less memory under normal operation, which means that developers do not need to purchase costly equipment and can start running a node on the network in a matter of minutes.

Later this year, the team plans to launch a major protocol update IOTA 2.0 also known as “Coordicide”. Hornet release is regarded as the first step on the way to the critical upgrade that will remove the coordinator node from the network.

Luca Moser, Software Engineer, IOTA Foundation, commented:

Due to IOTA’s parallel architecture and feeless transaction model, developers can build real-world applications without the constraints imposed by traditional blockchain technology. IOTA’s focus on regulatory compliance, standardization, and industry collaboration are key pillars of its adoption strategy. Many of the upcoming protocol upgrades were developed in partnership with our community and network of partners in industry and academia.

IOT/USD: Technical picture

At the time of writing, IOT/USD is changing hands at $0.2465. The coin touched the recent high at $0.2570 on Thursday and returned inside the upside-looking range, created by daily Bollinger Band. A Doji on a daily chart may be a part of an Evening Start candlestick formation. Typically, it is a bearish setup, however, we will need to see a confirmation in the form of another bearish candle.

If the downside momentum gains traction, IOT/USD may retreat to $0.2150 that served as a resistance at the beginning of May. Also, this area is reinforced by the middle line of the daily Bollinger Band.

IOT/USD daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Tether mints another $1,000,000,000 USDT on Justin Sun’s Tron blockchain: TRX traders could profit

Tether, the world’s largest stablecoin issuer, has minted another $1 billion worth of USDT on the Tron blockchain according to Whale Alert data published Friday.

XRP Price Prediction: XRP back above $2 liquidating $18M in short positions, will the rally continue?

Ripple (XRP) seeks support above $2.0020 on Thursday after gaining 14% in the past 24 hours. The token trades at $2.0007 at the time of writing, reflecting growing bullish sentiment across global markets.

Avalanche Octane update goes live on mainnet, slashes transaction fees significantly

Avalanche (AVAX) Octane update, live on mainnet on Thursday, introduces a dynamic fee mechanism to the C-Chain. This mechanism reduces transaction costs during high network activity by adjusting real-time fees, as per ACP-176.

Dogecoin soars as 21Shares files S-1 for DOGE ETF

Dogecoin (DOGE) rallied nearly 12% on Wednesday after asset manager 21Shares filed an S-1 application with the Securities & Exchange Commission (SEC) to launch the 21Shares Dogecoin exchange-traded fund (ETF).

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.