- Coordicide will remove the Coordinator from IOTA’s system.

- IOT/USD jumped up by 11.4% following the news.

IOTA announced that they are going to execute their groundbreaking Coordicide solution to achieve true decentralization. Before the announcement, IOTA used a Coordinator within their system to maintain network security. The Coordinator was initially designed to prevent double-spends and provide transaction finality.

The Coordicide solution will remove the Coordinator and address the following three issues:

- High transaction costs.

- Scalability challenges.

- The tendency towards centralization.

David Sønstebø, the co-founder of the IOTA Foundation, said about the solution:

“We have been working towards the removal of the Coordinator since IOTA’s inception. Now with the maturity and growth of the protocol, and the quality of our research team, we are bringing that promise to fruition.”

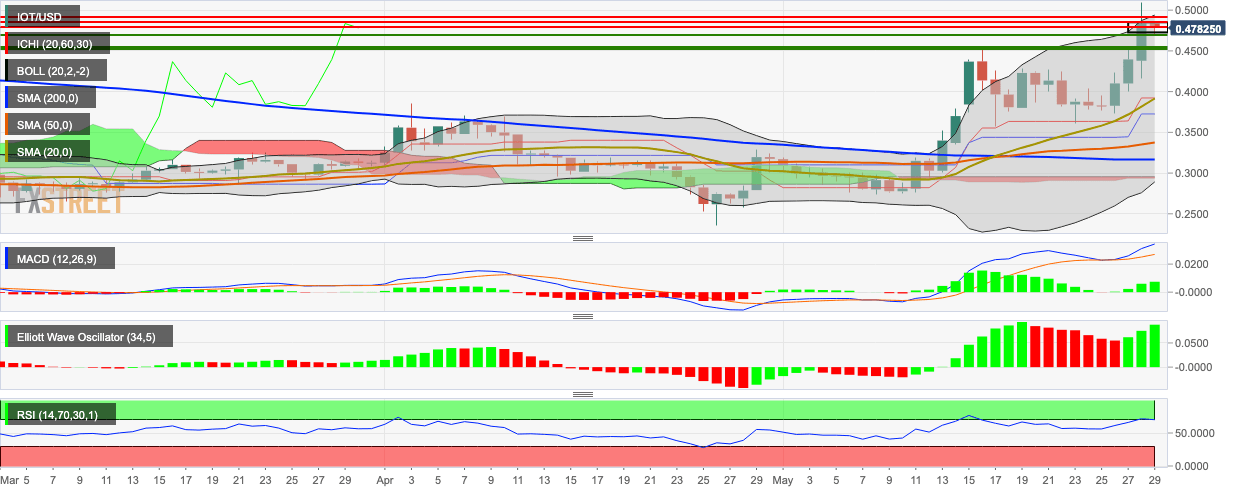

IOT/USD daily chart

- Following the news, IOT/USD bulls took hold of the market and pushed the price up from $0.438 to $0.488, charting an 11.4% increase in price.

- The spike took the price above the 20-day Bollinger band and the bears have taken over in the early hours of Wednesday to keep the price in check. IOT/USD is currently priced at $0.48.

- The signal line has diverged from the moving average convergence/divergence line to show increased bullish momentum.

- The Elliot oscillator has had three bullish sessions in a row with increasing intensity.

- The relative strength index (RSI) indicator has crept to the edge of the overbought zone.

- The nearest support level lies at $0.469 and the closest resistance level is at $0.478.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.