Internet Computer price could move higher as ICP helps build the future of ordinals

- Internet Computer price is trading within the January 3 supply zone between $12.01 and $14.43.

- ICP could rise 10% to clear resistance due to the midline of the order block at $13.25.

- The bullish thesis will be invalidated if the altcoin breaks and closes below the 50-day SMA at $12.13.

- The network is committed to building the future of ordinals after a related discussion on February 5.

Internet Computer (ICP) price remains within the confines of a bearish technical formation since the year started. However, it could record a bold move soon with technicals inching in favor of the bulls.

Also Read: Internet Computer price’s V-shaped recovery rally under threat

Internet Computer helps build the future of ordinals

Internet Computer network is helping build the future of ordinals, powering Bioniq, touted as the fastest and easiest to use BTC ordinals marketplace. Bioniq has no gas fees but delivers fast transactions and secure BTC ordinals wrapping. On February 5, the network held a discussion, with community members given a chance to join the talk about innovation in ordinals with industry experts on ICP.

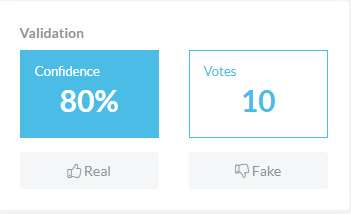

With a confidence vote of 80%, community members demonstrated support for the use of ICP to make Bitcoin and Ordinals better. As part of this endeavor, the team will work closely with those in the Bitcoin and Ordinals ecosystems. They will also build decentralized Bitcoin solutions at the application layer on ICP, and thirdly, work at the protocol layer to support future Bitcoin use cases.

ICP ordinals validation vote

Internet Computer price outlook

The Internet Computer price is down 5% in the last 24 hours, despite a 7% rise in trading volume as of 22:30 GMT. It continues to trade within the January 3 supply zone between $12.01 and $14.43. The 50-day Simple Moving Average (SMA) offers strong support downward at $11.66, moving north, with the same trajectory seen on the 100- and 200-day SMAs at $8.28 and $5.86 levels, respectively. This shows the north is the path with the least resistance.

Similarly, the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the Awesome Oscillator (AO) all remain above their respective mean levels.

Increased buying pressure could see the Internet Computer price overcome the midline of the supply zone at $13.25. A decisive candlestick close above this level would confirm the continuation of the uptrend, with ICP price likely to flip the order block into a bullish breaker above the $14.00 psychological level.

In a highly bullish case, Internet Computer price could extend the climb to the $15.33 blockade, or higher, reclaiming or clearing the range high of $16.30. Such a move would constitute a 30% climb above current levels.

ICP/USDT 1-day chart

On the other hand, if the supply zone holds as a resistance order block, Internet Computer price could lose immediate support due to the 50-day SMA. An extended fall could send it to the $10.00 psychological level, or in a dire case, retest the late December lows around the $8.79 support.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.