- Bitcoin price decline over the past week spooked retail and institutional investors.

- Regardless, ARK Investment and 21Shares are partnering to file for a Bitcoin spot ETF.

- The trembling confidence in the crypto market has increased altcoins' dependence on Bitcoin which would result in the alt season being delayed for a while.

Bitcoin and altcoins price action over the last two weeks has taken a toll on the alt season narrative brewing throughout the latter half of March. But as BTC fell in the past five days, the discourse about alt season is firing up again, although investors might be in for a disappointment.

Institutions signal mixed feelings about Bitcoin

Given the current volatility of the crypto market, no one side can be taken, and institutions are experiencing the same situation. This is evident in the fact that while on the one hand, ARK Investments and 21 shares are partnering to file for a new spot Bitcoin ETF, on the other, institutions are pulling out of BTC.

Cathie Woods' Ark Investment Management announced its partnership with crypto exchange-traded products (ETP) issuer 21Shares. The two companies are coming together to apply for a Bitcoin spot market-based Exchange Traded Fund (ETF).

21Shares has attempted to make such an ETF happen twice in the past, once in 2021 and again last year. However, both bids faced rejection by the Securities and Exchange Commission (SEC).

21Shares is not alone in this, as the regulatory body's stance on such a situation has been witnessed by Grayscale as well. The SEC rejecting Grayscale's bid for converting its Bitcoin Trust (GBTC) into an ETF even led to the investment management company filing a lawsuit against the regulators. The company even stated that the SEC was unfair for rejecting a Bitcoin spot ETF and claimed it treated the same with "special harshness."

Thus another attempt by ARK and 21Shares might bear the same results, but the bullishness visible in this attempt suggests some institutions are pining for Bitcoin price recovery.

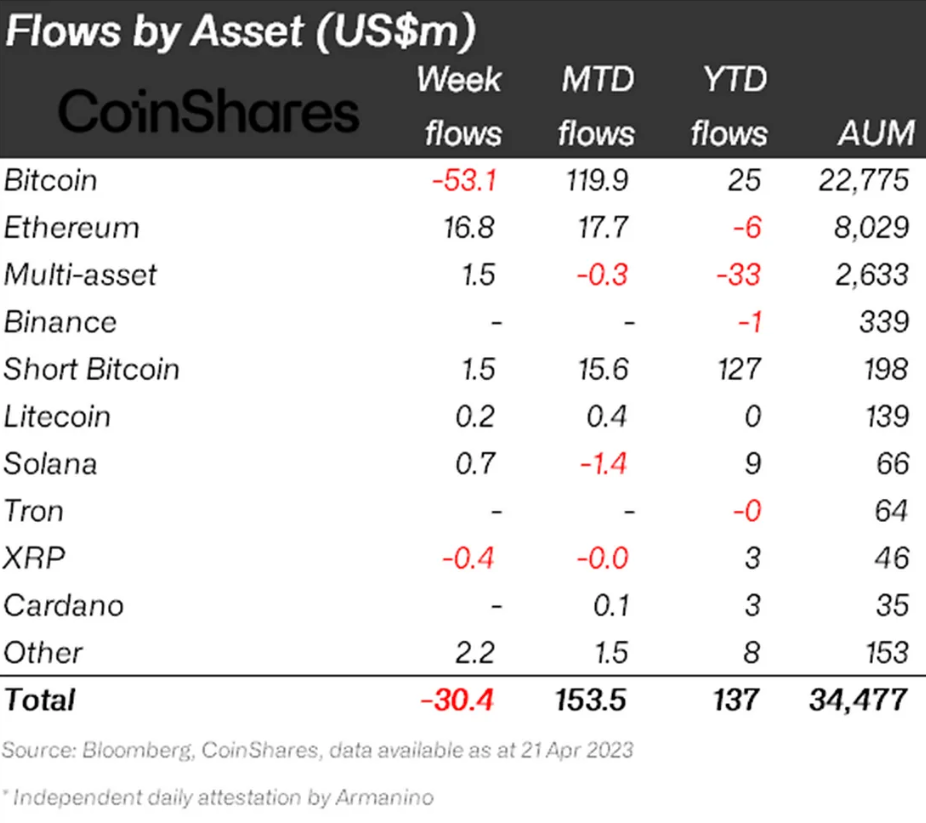

At the same time, institutions pulled out of Bitcoin after being spooked by the recent decline. The cryptocurrency falling to $27,700 resulted in an outflow of $53 million for the week ending April 21. This suggests that the faith in BTC is weak given that altcoins, including Ethereum, Litecoin, Solana, etc., noted inflows in the same duration.

Institutional investment in digital assets

Alt season - On the way or not?

Generally, when Bitcoin marks a market top, money tends to move into altcoins, and the resulting market conditions are known as an alt season. This is precisely what investors have been expecting since the beginning of Q2; Bitcoin's hold over the market is pushing back.

Bitcoin vs Altcoin dominance

Given that altcoins are following the lead of the biggest cryptocurrency in the world, even BTC's decline did not translate into a rise for alts. Thus, instead of Bitcoin's dominance falling, the altcoin's dominance fell. This is pushing traders and analysts to make do with an "inverse altcoin season," which they predict will take place for now.

It’s beginning to look like the start of the alt season they didn’t tell you about

— Johnny (@CryptoGodJohn) April 19, 2023

Inverse alt season

Furthermore, those waiting for Bitcoin prices to fall should also realize that in the near future, if Bitcoin blows straight through the roof, altcoins will lose the potential to rise. The credit for this goes to the resulting Bitcoin season.

The narrative is strong enough to x2 stuff in any case, but that's not an alt season.

— DonAlt (@CryptoDonAlt) April 17, 2023

It's short-term traders' paradise where you can fleece bears that were bearish up and now have FOMO trying to make back missed-out gains.

Not my cup of tea, personally.

On the other hand, if BTC dumps hard, altcoins might still lose since the investors' faith in the crypto market is not strong enough to sustain confidence in just the altcoin market. Investors are waiting for Bitcoin price to find some stability post which there might be a chance for an alt season; otherwise, the likelihood of the altcoin season seems pretty low.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.