Injective price hits all-time high likely fuelled by rising AI adoption

- AI-focused crypto project Injective’s market capitalization climbed 254% in the past two months amid hype surrounding GPT4 and Artificial Intelligence.

- INJ price yielded over 85% weekly gains and nearly 8% daily gains to holders.

- Injective’s three largest wallets have accumulated 7.1 million INJ tokens in the past three months.

Injective, an AI-focused decentralized finance project, observed a 254% increase in its market capitalization in the past two months. INJ price hit a new all-time high early on Thursday with the token tipping the $32 mark.

The hype surrounding Artificial Intelligence, GPT4 and the AI-focused narrative is likely the catalyst driving Injective price gains.

Also read: XRP price likely primed for recovery as Bitcoin and altcoins rally post FOMC meeting

Daily Digest Market Movers: INJ price hits all-time high, AI hype fuels adoption

- According to data from CoinGecko, the total market capitalization of the AI sector within the cryptocurrency ecosystem is currently $8 billion. Experts predict further increase in the AI sector with the rising demand and popularity of Artificial Intelligence and its enterprise applications.

- An AI-focused project Injective (INJ) observed a massive 254% increase in its market capitalization in the past two months. The developments at American Artificial Intelligence Research Organization, OpenAI and the rising adoption of GPT4 have fueled a bullish outlook among market participants.

- INJ price hit a new all-time high early on Thursday after Injective rallied to a $32.16 peak, before pulling back to $31.73 at the time of writing.

- The AI token’s supply on cryptocurrency exchange platforms has hit its lowest level in the past year, according to Santiment data. Combined with exchange netflows that point to INJ tokens leaving crypto platforms in large numbers, the following chart supports a bullish thesis for Injective.

Injective supply on exchanges, exchange netflow. Source: Santiment

- Traders opening a position in Injective need to be cautious as the Network Realized Profit/Loss metric, used to determine whether INJ holders are booking gains or losses in their transactions, reveals that there is profit-taking by large wallet investors. When combined with the count of whale transactions valued at $100,000 and higher, the spikes in profit-taking coincide with whale address activity.

- Large wallet investors are likely engaging in profit-taking, therefore it remains to be seen whether INJ price gains are sustainable.

INJ whale transactions (>$100,000) and Network Realized Profit/Loss. Source: Santiment

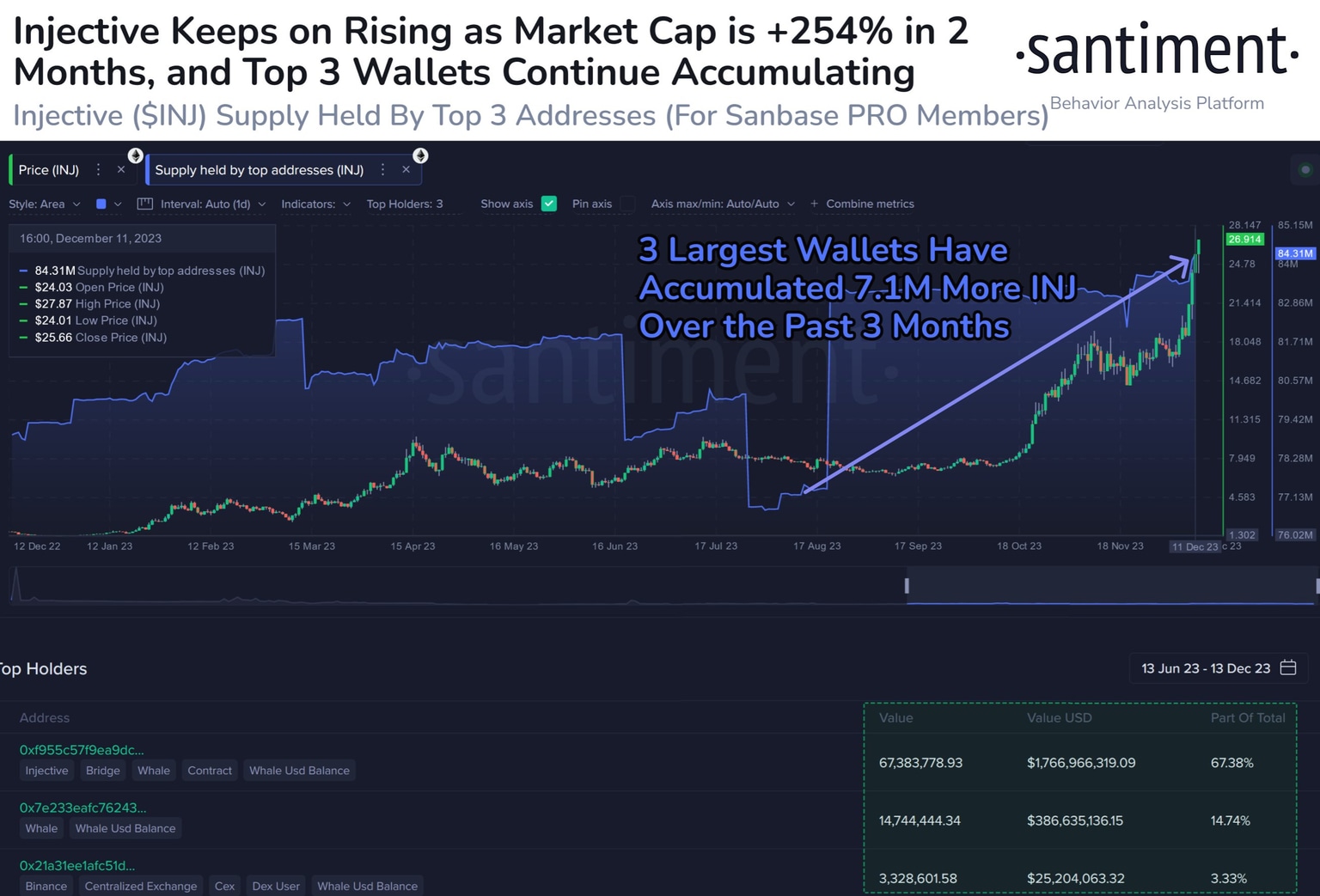

- Santiment analysts noted that the three largest INJ wallets have added 7.1 million tokens to their holdings in the past three months.

Injective wallets add 7.1 million to their INJ token holdings. Source: Santiment

At the time of writing, INJ price is up nearly 8% in the past 24 hours. It remains to be seen whether the DeFi token’s gains are sustainable.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B12.51.16%2C%252014%2520Dec%2C%25202023%5D-638381374040776943.png&w=1536&q=95)

%2520%5B12.52.56%2C%252014%2520Dec%2C%25202023%5D-638381374381444590.png&w=1536&q=95)