Injective Price Forecast: INJ offers chance to accumulate before a potential 10% rally

- Injective price offers traders a chance to accumulate before the next breakout.

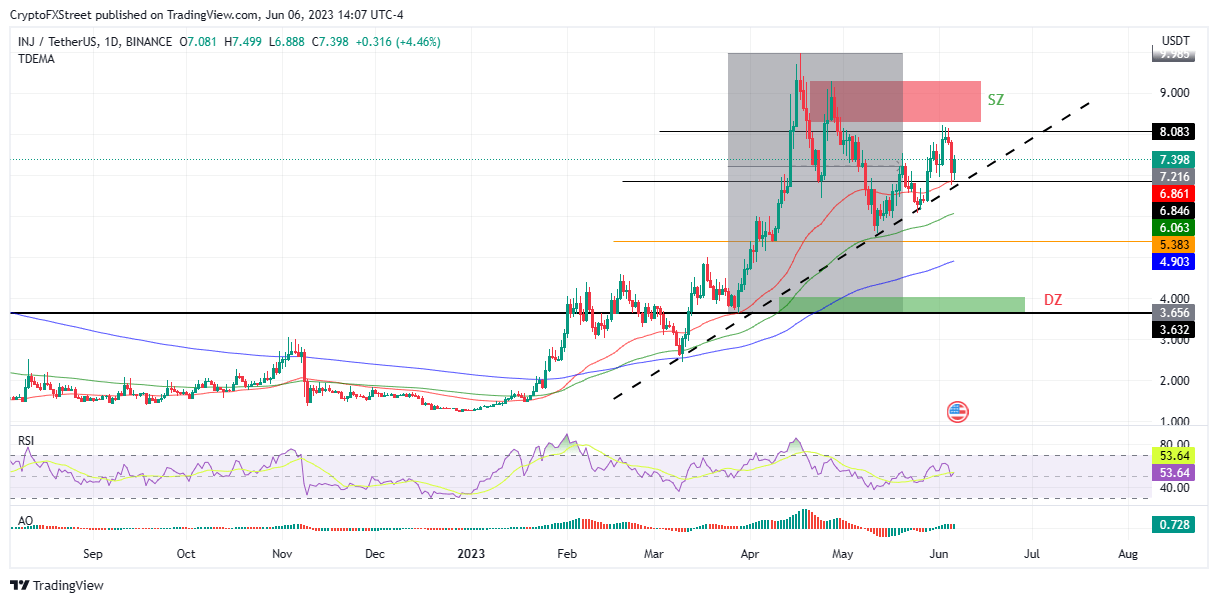

- INJ could rally 15% north to the red zone, where supply overwhelms demand because of seller accumulation.

- A rejection from the supply zone could send INJ down 45% to the market range bottom where the demand zone resides.

Injective (INJ) price is bullish, moving along an uptrend line as investors calculate the outcome that yields the most gains. The price action communicates vision, giving a chance for traders to be part of the next rally.

Also Read: Optimism price could shoot up by 30% after OP whales accumulation spree

Injective price eyes 10% gains, at least

Injective (INJ) price, though stalling at the current $7.44 level, is bullish and presents an opportunity for traders to join the bandwagon before the next breakout happens. The optimism comes as the altcoin continues to sustain above an uptrend line, edging closer to the supply zone (SZ in the daily chart below), where sellers abound.

A supply zone defines the price level where traders typically sell. It is above the current price, with the highest potential or interest to sell. When the price reaches this level, unfilled orders are completed, provoking a decline in the price.

As such, technical analysis indicates that the short-term goal for Injective price lies between the $8.31 and $9.29 range, indicated by the red rectangle. An increase in buyer momentum above this level could see the Injective price rise by at least 10%. Notably, some investors have already identified this buying opportunity.

$INJ / $USD - Update

— Crypto Tony (@CryptoTony__) June 6, 2023

The trigger for the safest entry is simple legends; we enter if the bulls can flip the supply zone at $8.00.

Or you can enter here with a hard stop loss at $6.70, aiming for the supply zone at $8.00. Just keep an eye on any entries you put in pic.twitter.com/SPe1pS4dSj

The Relative Strength Index (RSI), heading north and crossing above the signal line, and the Awesome Oscillators (AO) moving in the positive zone added credence to the optimistic outlook. Both indicators suggested a rising momentum.

INJ/USDT 1-Day Chart

On-chain metrics are optimistic

Santiment data shows a stark growth in daily active addresses, recording a 55% increase between June 1 and 6. Similarly, the volume is up 25% over the same period.

Conversely, early profit-taking could interrupt the rally, akin to what happened between June 2 and 3, leading to a correction. The ensuing selling pressure could see the Injective price fall below the confluence of the 50-day Exponential Moving Average (EMA) and the uptrend line at around $6.84.

Failure to hinge around the 100-EMA at $6.06, like on May 12, could see the Injective price drop further, potentially breaching the 200-day EMA at $4.90 before tagging the demand zone (DZ) marked in green. This would be a possible recovery base for INJ as this is where buyers would swarm.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B21.37.47%2C%252006%2520Jun%2C%25202023%5D-638216750395734500.png&w=1536&q=95)