Injective price could retest $50 as INJ bulls try to overcome critical resistance level

- Injective price looks primed to break from its two-month consolidation.

- Investors could expect a near-20% rally from INJ in the near future.

- A 12-hour candlestick close below $34.15 will invalidate the bullish thesis.

Injective (INJ) price has been coiling up in a tight range for more than two months. But the recent developments suggest INJ is readying for a massive volatile breakout rally in the next two weeks.

Also read: Injective Price Forecast: INJ to provide buy opportunity before skyrocketing 25%

Injective price edges closer to an uptrend

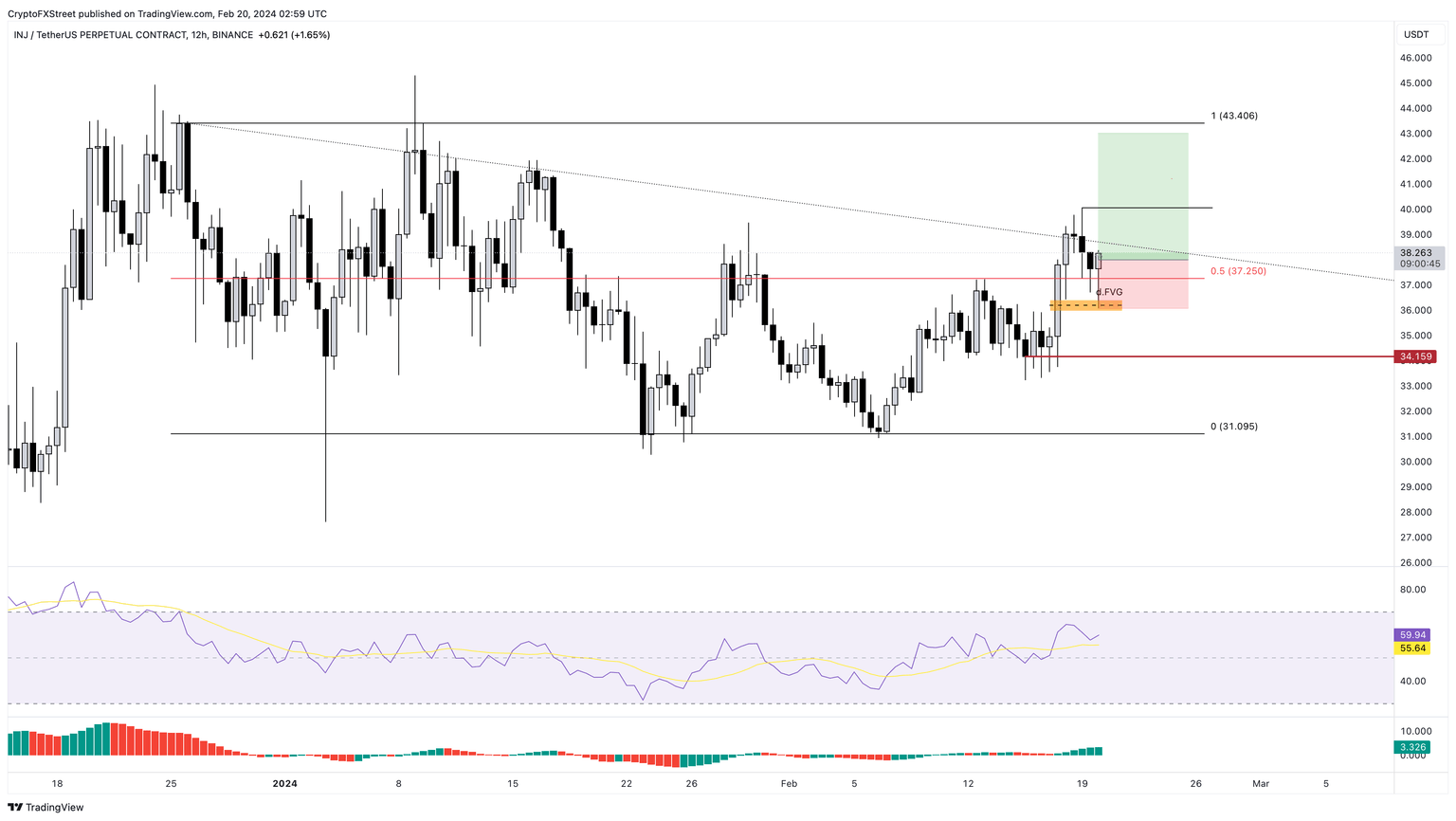

Injective price set up the $31.09 to $43.40 range in early 2024 and has been trading inside it for more than two months. In this tight range, INJ has produced lower highs, which can be connected using a trend line, revealing a declining resistance level. This hurdle was breached on February 27 as INJ rallied 13% to retest the range high at $43.40. This positive development is likely to lead to a breakout int he near future, which could result in handsome gains for investors.

Ideally, a swift breakout and flip of the $43.40 resistance level into a support floor could result in a retest of the 161.8% Fibonacci extension level at $51.01. Such a move would constitute a nearly 19% gain for investors from the current level of $42.75.

The Relative Strength Index has just retested the overbought zone, which should be alarming considering that we're in an uptrend. In bull markets RSI tends to remain in the overbought conditions for longer durations. The Awesome Oscillator has also started producing green histograms above the zero level, suggesting the dominance of bullish momentum. Both the momentum indicators are pointing to a bright future for Injective protocol.

INJ/USDT 12-hour chart

While the optimism for Injective price is logical, investors need to be cautious of Bitcoin-driven sell-off. In case this outlook does come to pass and INJ produces a twelve-hour candlestick close below $34.15, it will invalidate the bullish thesis. Such a development could create a lower low and create a lower low and shift the odds in bears' favors, causing investors to sell. Under these pessimistic circumstances, the Injective price could drop 9% and revisit the range low at $31.09.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.