Injective price coils up for a breakout after deep 40% correction

- Injective price has dropped by around 40% after a rejection from $53.

- With the demand zone holding as support, INJ could breakout to a new range high.

- A break and close below $25 would invalidate the bullish thesis.

Injective (INJ) price has recorded two successive breakouts after prolonged consolidations. If history repeats or rhymes and the INJ bulls show up, the AI-powered cryptocurrency token could breakout to a new range high.

Also Read: Injective Price Forecast: Nearing a breakout towards $55

Injective price readies for a strong recovery

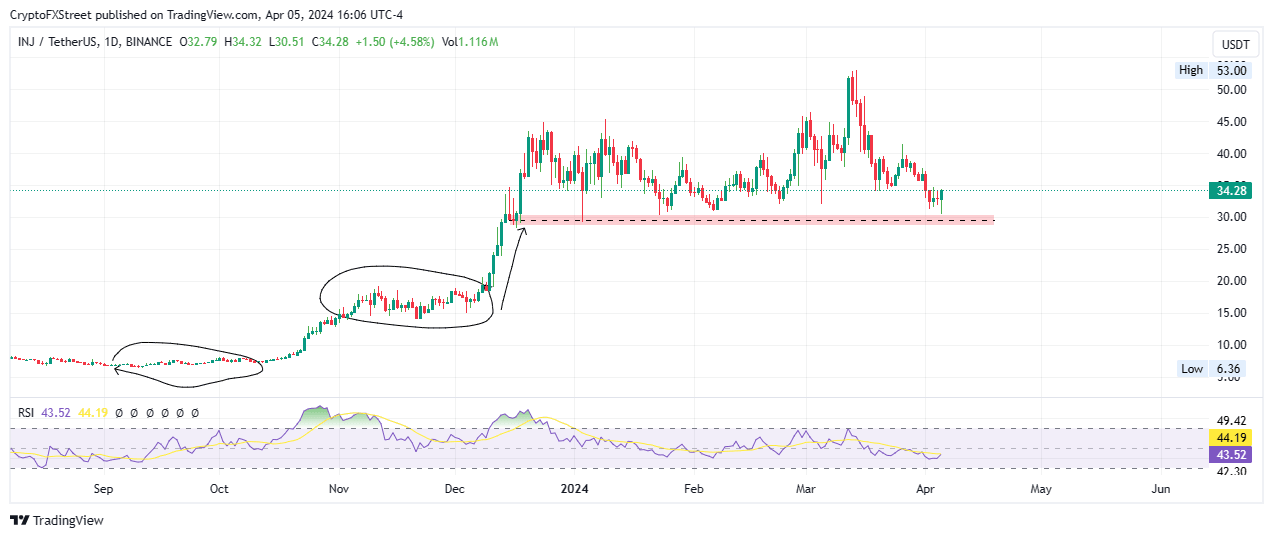

Injective price is down around 40% since the AI crypto coin was rejected at $53. However, INJ price continues to enjoy support due to the demand zone turned bullish breaker between $28.64 and $30.40.

With the Relative Strength Index (RSI) defending against further downside, Injective price could recover. Key levels to beat in a northbound directional bias were the $40 and $45 levels. A strong break above these levels could see Injective price recapture the $53 range high.

In a highly bullish case, INJ price could clear this blockade and record a new local top around the $55 or $60 threshold. Notably, the bullish thesis is contingent on the demand zone holding as support.

INJ/USDT 1-day chart

However, if sellers are able to pull the Injective price to close below the centerline of the supply zone at $29.53, it would confirm the continuation of the downtrend. This could see the AI token extend the fall, potentially as low as the $25 threshold. A candlestick close below this base on the daily time frame would invalidate the bullish thesis.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.