Injective price braces for volatility ahead of nearly $150 million worth of INJ token unlocks

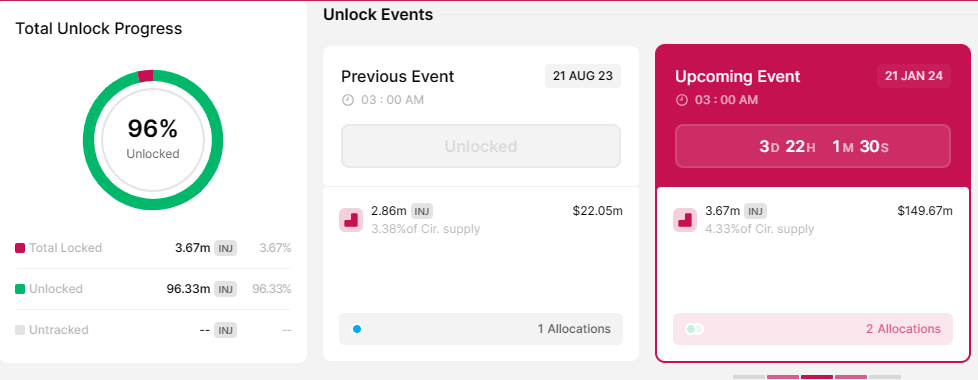

- Injective price could record volatility soon as 3.67 million INJ tokens worth 148.72 million are due to flood markets in a cliff unlock.

- Token allocation to the team and investors may not inspire immediate profit booking, but increased supply will definitely impact markets.

- A similar event on August 21 influenced the AI crypto coin’s price with significant fluctuations before and after the unlocks.

Injective (INJ) price has been trading within a range over the past several days, consolidating within the confines of two levels with profit taking and investors buying the correction keeping INJ within range. The AI crypto coin, which is built atop the Cosmos blockchain cold register increasing volatility soon with a token unlocks event due on January 21.

Also Read: Injective price hits new all-time high at $39.97, INJ sustains uptrend despite profit-taking

Injective price prepares for massive token unlocks

Token unlocks are generally considered to be a bearish event since the market witnesses a surge in the supply of an asset. With the increase in supply and static demand, the value of the asset decreases, and this generally results in the price dropping.

On January 21, the Injective network will unleash 3.67 million INJ tokens to the market, worth $148.72 million at current rates. The volume of unlocks constitutes 4.33% of the network’s entire supply with allocations going to advisors and the team, with the latter expected to receive the lion’s share of the allocation. While these recipients may not be quick to cash in, some selling pressure is expected nonetheless.

INJ token unlocks

Injective price outlook with millions’ worth INJ tokens due to flood markets soon

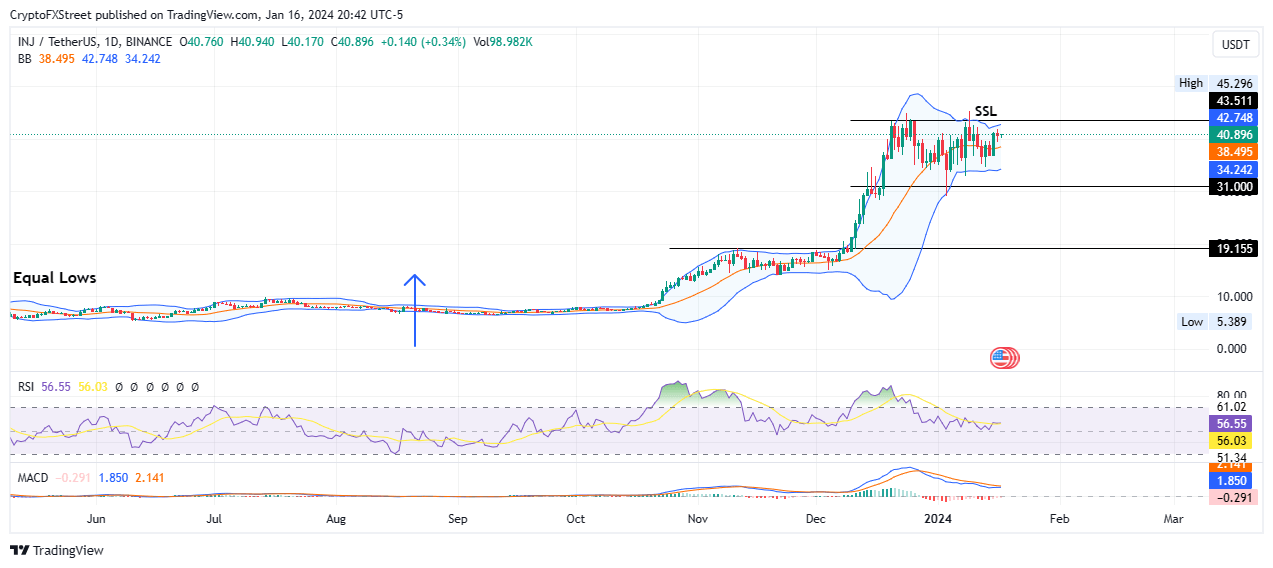

Injective price has been consolidating between the $31.00 and $43.51 levels since December 20, a wide range that could soon narrow with expected increasing volatility. The token’s price is moving within the confines of the Bollinger indicator, sitting atop the support offered by the centerline of the indicator at $38.49 while confronting its upper band at $42.74.

The Relative Strength Index (RSI) is southbound, showing falling momentum, and could soon cross below its signal line (yellow band), marking a bearish crossover if the trajectory sustains. The Moving Average Convergence Divergence (MACD) is also moving below the signal line (orange band) after crossing below it on December 27. These show that the odds favor the downside.

If the bears have their say, Injective price could lose the support due to the centerline of the Bollinger indicator, potentially tagging its lower band at $34.24. In the dire case, the slump could see INJ test the $31.00 support level.

INJ/USDT 1-day chart

On the flip side, increased buying pressure could send Injective price north, likely clearing the upper Bollinger band at $42.78 before tagging the $43.51 resistance level. A break and close above this level, which would start as a liquidity collection exercise, could see INJ record a higher high and potentially reach the $45.296 range high, standing 25% above current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.