Increased utility in DeFi, NFTs back Ethereum’s 3-year high in its ETH/BTC pair

Ethereum price hit a new all-time high in its ETH/BTC pair and a classic technical analysis pattern suggests the altcoin has a lot more upside.

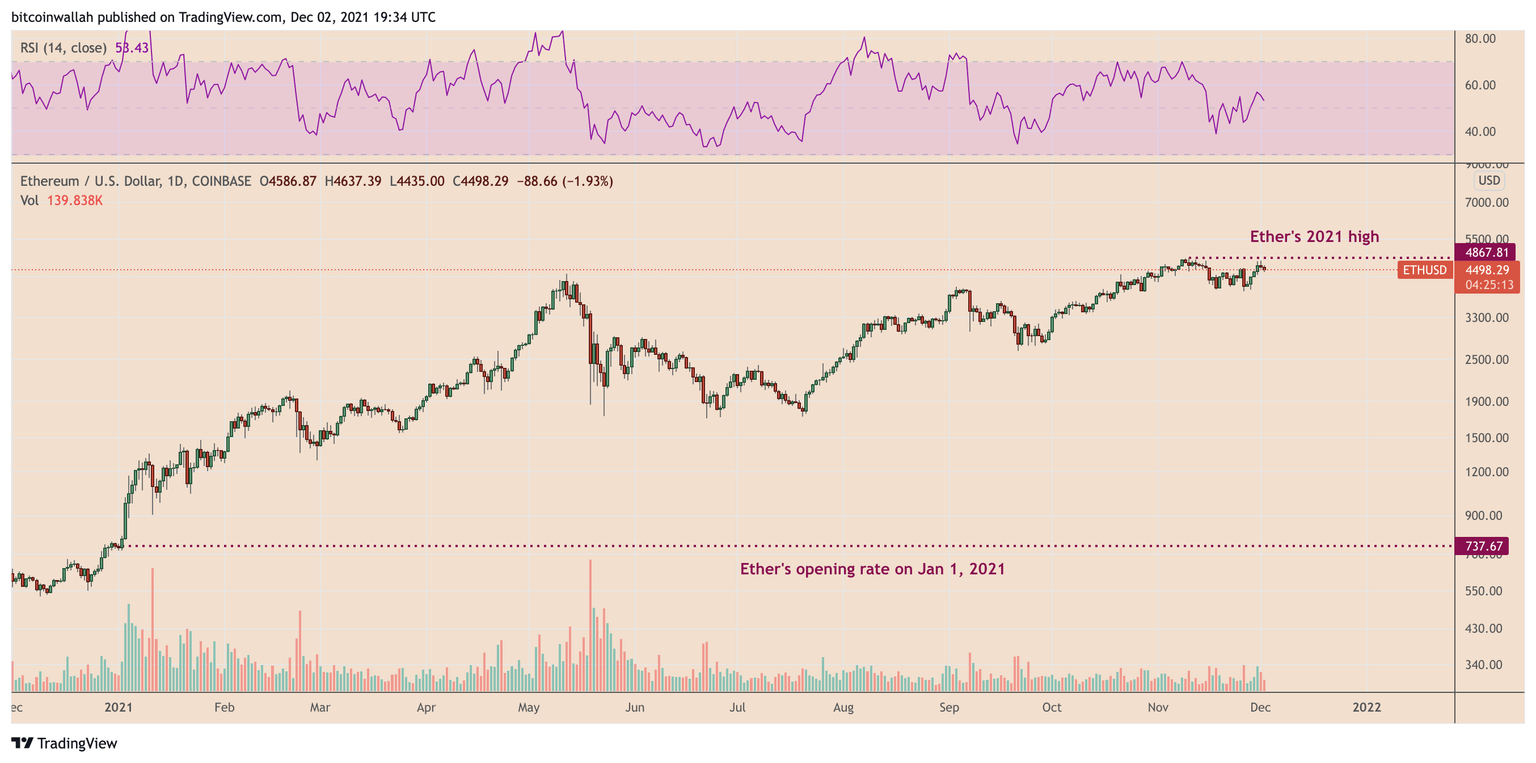

This week, Ether (ETH) price reached a new 2021 high against Bitcoin (BTC), bringing its year-to-date returns slightly above 350% and according to technical analysis, the rally could extend even further.

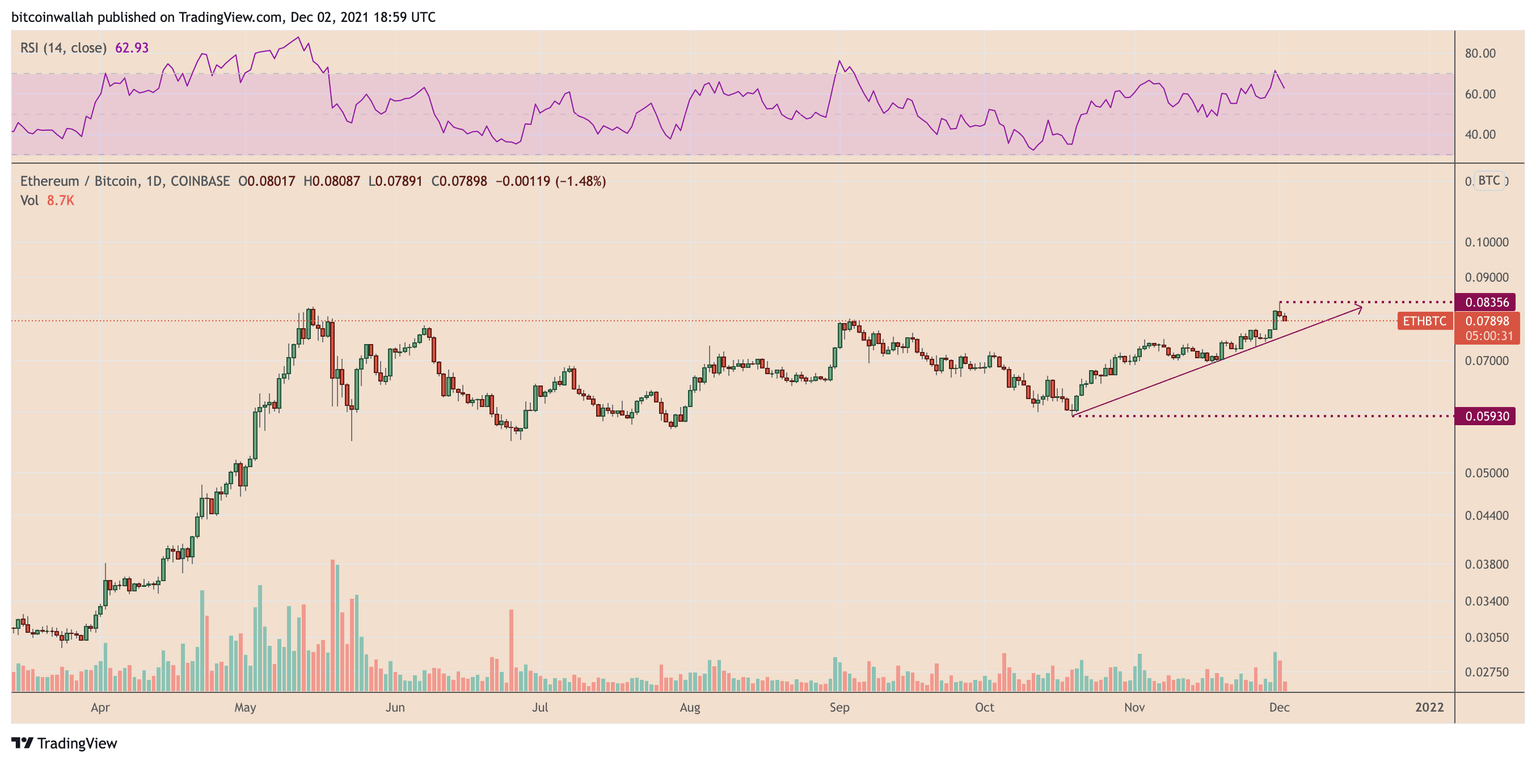

On Dec. 1, bids for the ETH/BTC pair hit 0.0835 BTC on Coinbase for the first time this year. The upside move came as a part of an uptrend that started mid-October after Ether bottomed out against Bitcoin at 0.0630 BTC to carve out almost 41% price retracement.

ETH/BTC daily price chart. Source: TradingView

Growing adoption propels Ether's boom

The ETH/BTC price rally reflect deep interest in Ethereum, which is currently the world's leading smart contract platform by users and market capitalization. This is slightly different than the scenario for Bitcoin, which typically functions as a speculative hedge against inflation across global economies.

As of late, Ethereum has been become a core asset within crypto growth sectors like nonfungible tokens (NFT), decentralized finance (DeFi) and the Metaverse. The firms operating in this space require Ether to run their smart contracts, which in turn, has increased demand for the altcoin and supported a steady uptrend in its price.

Total valued locked inside ETH-based DeFi platforms (including staking). Source: Defi Llama

Demand for Eth is expected to remain robust in the coming year and this simple fact has many analysts projecting prices within the $6,000 to $10,000 range.

ETH/USD daily price chart. Source: TradingView

Matt Maley, the chief market strategist for Miller Tabak + Co., anticipated additional gains for Ether should it break above its mid-November high around $4,900. According to Maley, Bitcoin bulls remain under pressure near the cryptocurrency's mid-November and mid-April highs of $69,000 to $65,000.

If Ether manages to hit and hold a new all-time high while BTC trades in a downtrend, Maley said:

"It will show that Ether has become the new crypto of choice for most investors."

The technical outlook for Ether against Bitcoin has also been suggesting stronger bull runs for the former in the future.

Matt Maley, the chief market strategist for Miller Tabak + Co., anticipated additional gains for Ether should it break above its mid-November high around $4,900. According to Maley, Bitcoin bulls remain under pressure near the cryptocurrency's mid-November and mid-April highs of $69,000 to $65,000.

If Ether manages to hit and hold a new all-time high while BTC trades in a downtrend, Maley said:

"It will show that Ether has become the new crypto of choice for most investors."

The technical outlook for Ether against Bitcoin has also been suggesting stronger bull runs for the former in the future.

A prolonged bullish breakout could be in play

The latest bout of buying has had ETH/BTC break above a multi-month resistance trendline that constitutes an ascending triangle pattern and now the pair eyes an extended bull run towards 0.1 BTC, as shown in the chart below.

ETH/BTC weekly price chart featuring Ascending Triangle setup. Source: TradingView

Typically, ascending triangles are continuation patterns, meaning, they tend to send the price in the direction of its previous trend by as much as the maximum height between the upper and lower trendline when measured from the breakout point.

ETH/BTC's breakout point comes out to be near 0.077 BTC while its triangle's maximum height is 0.022 BTC. In a "perfect" world, this would place the ETH/BTC pair on path to 0.1 BTC, but given the volatile nature of the cryptocurrency sector, anything is possible.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.