IMF cautions against crypto as legal tender, Coinbase disagrees

- In a recent announcement, the IMF opposed conferring the "official currency or legal tender status" to cryptocurrencies.

- According to the financial authority, such a tag could threaten the superiority of legal currencies as we know it.

- Nevertheless, Coinbase thinks otherwise, lauding crypto for driving money forward.

Coinbase has rebutted a statement by the International Monetary Authority (IMF), taking the side of crypto as a necessary driver for the evolution of money. While Coinbase agrees that policies are necessary in the crypto sphere for investor protection, the largest exchange by trading volume is all in on all things pro-crypto.

Also Read: Elon Musk rebranding Twitter as "X" could trigger a 110% rally in Dogecoin price

Coinbase challenges IMF stance on crypto

Coinbase has defended cryptocurrencies in a Twitter post, lauding the digital asset's position as a driver for money. Acknowledging that money is always changing, the exchange says that crypto moves money forward.

Money is always changing.

— Coinbase ️ (@coinbase) July 24, 2023

And crypto moves money forward.

If you’re in DC this month, stop by Capitol South Station to see where money has been in the past, and where it’s all going in the future. pic.twitter.com/ITkhDKasnP

The comments paint a completely different picture from a recent statement by the IMF, which opposed conferring operational freedom to cryptocurrencies. According to the international financial institution, such a move would threaten the superiority of money.

Accordingly, the agency calls for more thorough policies in the crypto arena, backing the argument with instances of crypto exchange collapses that have prompted both the US Securities and Exchange Commission (SEC) and Commodities Futures Exchange Commission (CFTC) to prioritize policy enforcement. An excerpt from the announcement reads:

By embracing a comprehensive approach and implementing these recommendations, policymakers can safeguard monetary sovereignty, protect investor interests, and promote financial stability in the digital age.

Further into recommendations, the IMF cautions against granting cryptocurrencies the official currency or legal tender status. Based on this interpretation, such a conferment would advertise crypto for paying taxes, fines, and settling debts. Moreover, it could threaten the budget of government finances and affect financial stability across the concerned jurisdiction. With these, the IMF says crypto having the official currency or legal tender status threatens the sovereignty of money both locally and globally.

JUST NOW:

— The Highlight (@thehighlight0) July 24, 2023

According to the IMF, it's crucial to avoid giving cryptocurrency "official currency or legal tender status."#CryptoNews #IMF $BTC #Crypto $ETH #Legaltender $XRP #Cryptocurency pic.twitter.com/9GqaOslmtc

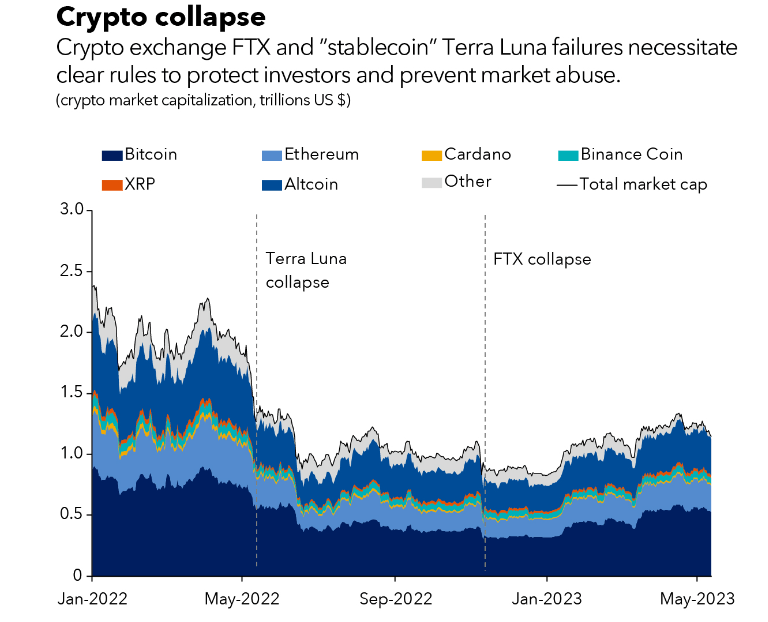

According to the IMF, two implosions echo the need for crypto regulation - the collapse of Terra and FTX ecosystems- events that triggered a cascade of price drops whose effects continue to torture the market.

Market impact of crypto exchanges collapse

Other recommendations include defending against the substitution of sovereign currencies as an enabler to maintaining "robust, trusted, and credible domestic institutions."

Crypto as a threat to money

The IMF's bias against crypto comes as the digital asset continues to gain ground over traditional money in terms of use, with economies such as El Salvador steadily edging towards reliance on digital assets. For this reason, the IMF wants better protection for investors, calling for stricter policies and regulations.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.